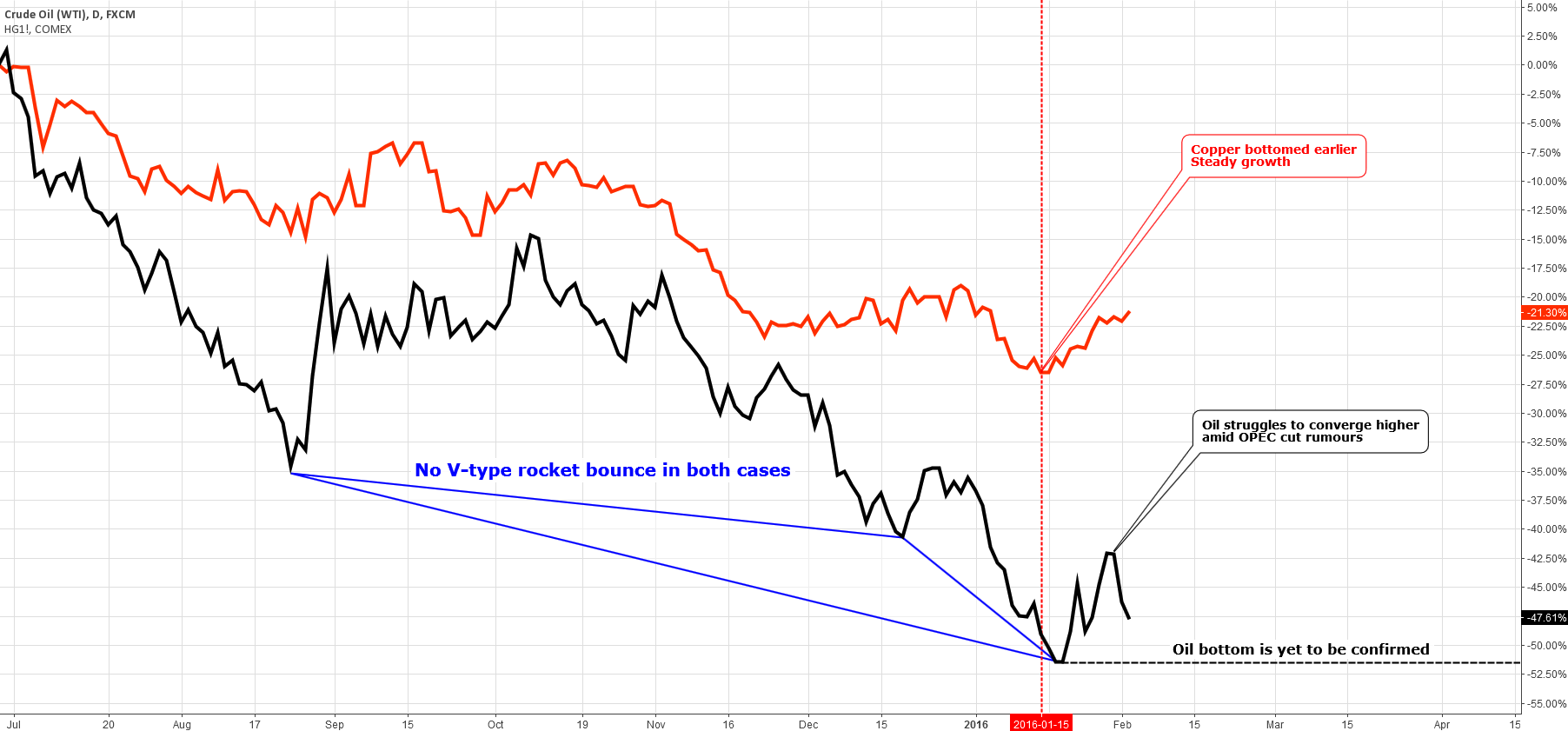

If you have read my last update on this metal, you should be aware of a recent miscorrelation between the two core assets. You will see in the chart below that my bold expectations for a rapid recovery of oil didn't come true.

Chart 1 Copper-Oil Comparative Illustration: Investors Choose Metal Over Oil

Chart courtesy of tradingview.com

Neither the first interim low in the middle of December nor the second low in the middle of January could make the much anticipated V-shape rocket reversal. The main reason for that is the oversupply of the oil market. There are rumors that OPEC will soon reach a deal with Russia to cut production for their mutual benefit. This, of course, will cause the price of oil to rise. I think this is a temporary measure and after the short-term rise we will see the price of oil drop again, but it could take some time happen. Continue reading "Copper Update: Bottomed?"

We’ve asked Michael Seery of

We’ve asked Michael Seery of