Our Stock of the Week was released this morning. Did you get the email?

If you're not yet subscribed to INO's Stock of the Week, you can get this week's pick right now and you'll receive a new pick each and every Tuesday before the opening bell.

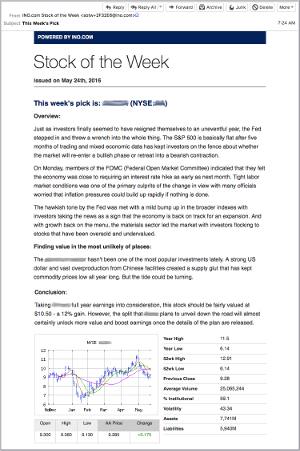

This week's stock comes from a sector that hasn't seen great recent popularity. However, investors are flocking back to this sector as many stocks are oversold and undervalued.

Send me this week's stock. It's absoulutely free.

Our analyst, Daniel Cross, has hand-selected a stock that although has been on a roller-coaster ride this year, it may be setup for a breakout performance in the tail end of 2016.

Furthermore, earnings data and price movement suggest that this stock is in undersold territory and big news in the company's structure could send this stock soaring. Cross estimates that the fair value for this stock is 12% over the current stock price

Request the Stock of the Week and get a new pick, with an amazing analysis, every Tuesday.

Enjoy,

INO.com

[email protected]