The Walt Disney Company (DIS) expects its Disney+ streaming platform will have up to 260 million subscribers by 2040. The company continues to exceed all expectations in the streaming space accelerated by the stay-at-home COVID-19 environment. The company has been posting phenomenal streaming numbers that have thus far negated the COVID-19 impact on its other business segments, specifically its theme parks. Disney has had to shutter all its worldwide Parks and Resorts, and ESPN has been hit with the cancellation of virtually all sports worldwide. There have been ebbs and flows with reopening efforts across the globe with mixed results followed by rolling lockdown measures. Despite the COVID-19 headwinds, Disney’s streaming initiatives have been major growth catalysts for the company. Disney+’ growth in its subscriber base has shifted the conversation from COVID-19 impact on its theme parks to a durable and sustainable recurring revenue model. This streaming bright spot, in conjunction with the optimism of its Park and Resorts coming back online, has been a perfect combination as of late, especially with the vaccine rollout picking up steam.

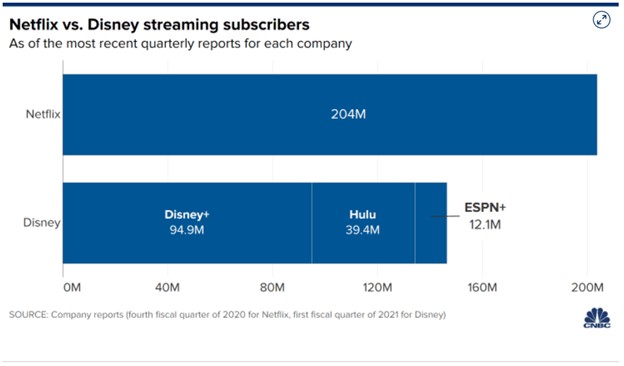

Disney+ has racked up 94.9 million paid subscribers, Hulu has 39.4 million paid subscribers, and ESPN+ has 12.1 million paid subscribers. Collectively, Disney now has over 146 million paid streaming subscribers across its platforms (Figure 1). Disney+ has been wildly successful via unleashing all of its Marvel, Star Wars, Disney, and Pixar libraries in what has become a formidable competitor in the ever-expanding streaming wars domestically and internationally. Hence the tug-of-war on Wall Street between COVID-19 impacts versus the success of its streaming initiatives, with the latter winning out. Thus far, its streaming success has changed the narrative as its stock has broken through all-time highs and nearly breaking through $200 per share. Disney is a compelling buy for long-term investors as its legacy business segments get back on track in the latter part of 2021 in conjunction with these successful streaming initiatives.

Figure 1 – Streaming initiatives across its platforms with over 146 million paid subscribers in total

Post Pandemic

Disney’s business segments will inevitably recover as the pandemic Continue reading "Disney - 146 Million Streaming Juggernaut"