Hello MarketClub members everywhere!

Once again Janet Yellen, the chairwoman of the Federal Reserve, gave the market yet another easy money "fix". Easy money is the drug of choice for this market and has been for the past six years. Can the insanity of printing more and more money keep going on and on, or will the market have to go into rehab and kick its easy money dependency? Only time will tell. Eventually someone, and that means all of us, will have to pay the piper.

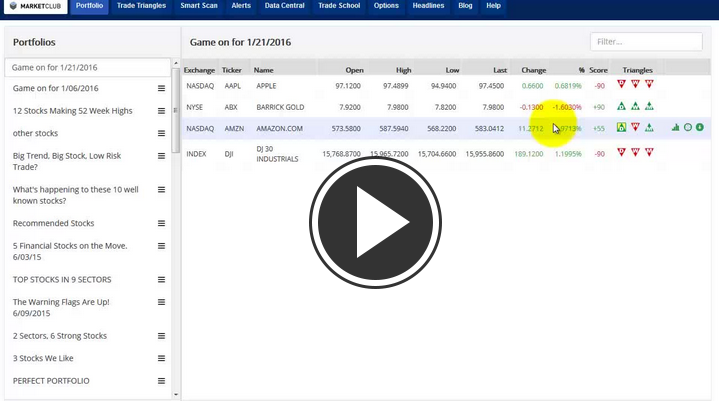

As of today, many stocks, including the major indices, remain locked in broad trading ranges. This could all change as we come to the end the first quarter and move into April. Continue reading "Apple's Secret Weapon"