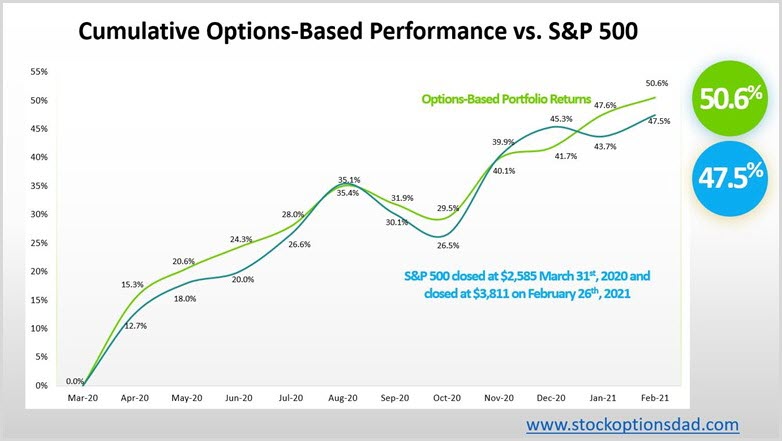

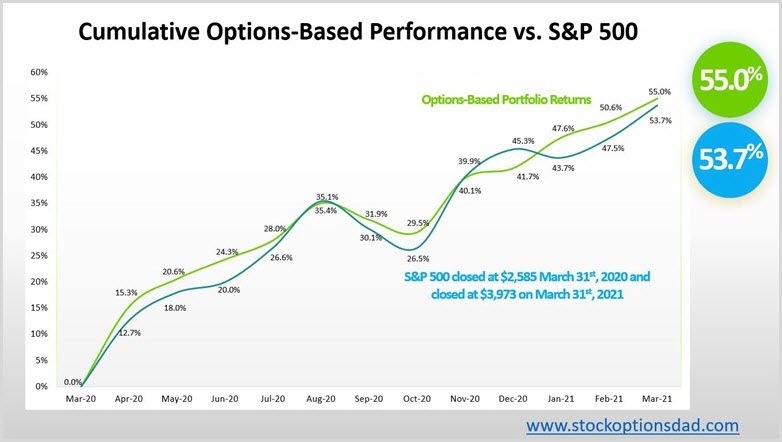

Annualizing the pandemic with an agile options-based approach has demonstrated superior returns while mitigating risk. Over the past 12 months, generating consistent monthly income while defining risk, leveraging a minimal amount of capital, and maximizing return on capital has been the core of this options-based strategy. Options enable smooth and consistent portfolio appreciation without guessing which way the market will move. Options allow one to generate consistent monthly income in a high probability manner in all market scenarios. Over the past 12 months (April 2020 – March 2021), 249 trades were placed and closed. A win rate of 98% was achieved with an average ROI per winning trade of 8.0% and an overall premium capture of 85% while outperforming the S&P 500. An options-based portfolio's performance demonstrates the durability and resiliency of options trading to drive portfolio results with substantially less risk. The options-based approach circumvented September 2020, October 2020, and January 2021 sell-offs while outperforming the S&P 500 over the post-pandemic bull run, posting returns of 55.0% and 53.7%, respectively (Figures 1, 2, and 3).

Figure 1 – Overall options-based performance compared to the S&P 500 from April 2020 – March 2021

Continue reading "Options: Annualizing Pandemic Lows"