On December 20th, the Commerce Department released data showing that housing prices remain high, renter demand is still strong, and the supply and demand imbalance appears to show no relief.

These economic data points indicate that the housing crash, or pull-back many expected to see with housing prices in 2023, may not be coming.

Let's look at the numbers and then explain why a housing crash doesn't appear to be on the horizon in 2023.

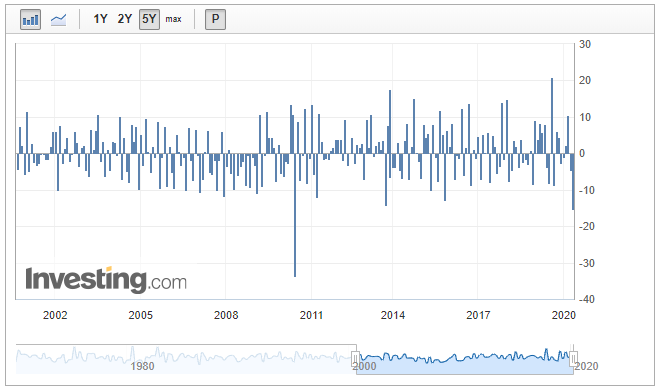

The December housing numbers showed US single-family homebuilding dropped to a two-and-a-half-year low in November 2022. Permits also fell in November by 7.1% for single-family homes and 11.2% for overall building permits. Overall housing 'starts' dropped 0.5% in November, with single-family starts falling 4.1% and multi-family units up 4.8%.

So essentially, we are seeing that construction of new single-family homes is slowing when we are already in a tight supply-demand situation with those types of units. This supply shortfall comes from data showing that from June 2012 to 2021, the US had 12.3 million new households formed, but only 7 million new single-family homes were built.

The pandemic played a role in making this shortfall wider, as it is estimated that in 2019 the US was only short 3.84 million units. But, labor shortages before the pandemic started, which worsened during the pandemic, and costs of materials and land, all pushed housing prices higher.

Higher housing prices make it harder for more people to afford a home. Thus, fewer homes get built. High housing prices were likely one reason we didn't see more homes built in 2021. In 2022, the main reason was increasing interest rates. Again, higher interest rates push the overall cost of ownership higher, resulting in fewer people building homes.

Another interesting data point from December was the Homebuilders' confidence levels also plummeted in December for a record 12th month straight. This data point only adds to the idea that single-family homes will continue to be underbuilt in the near future. Continue reading "2023 Housing Market May Be Different Than Expected"