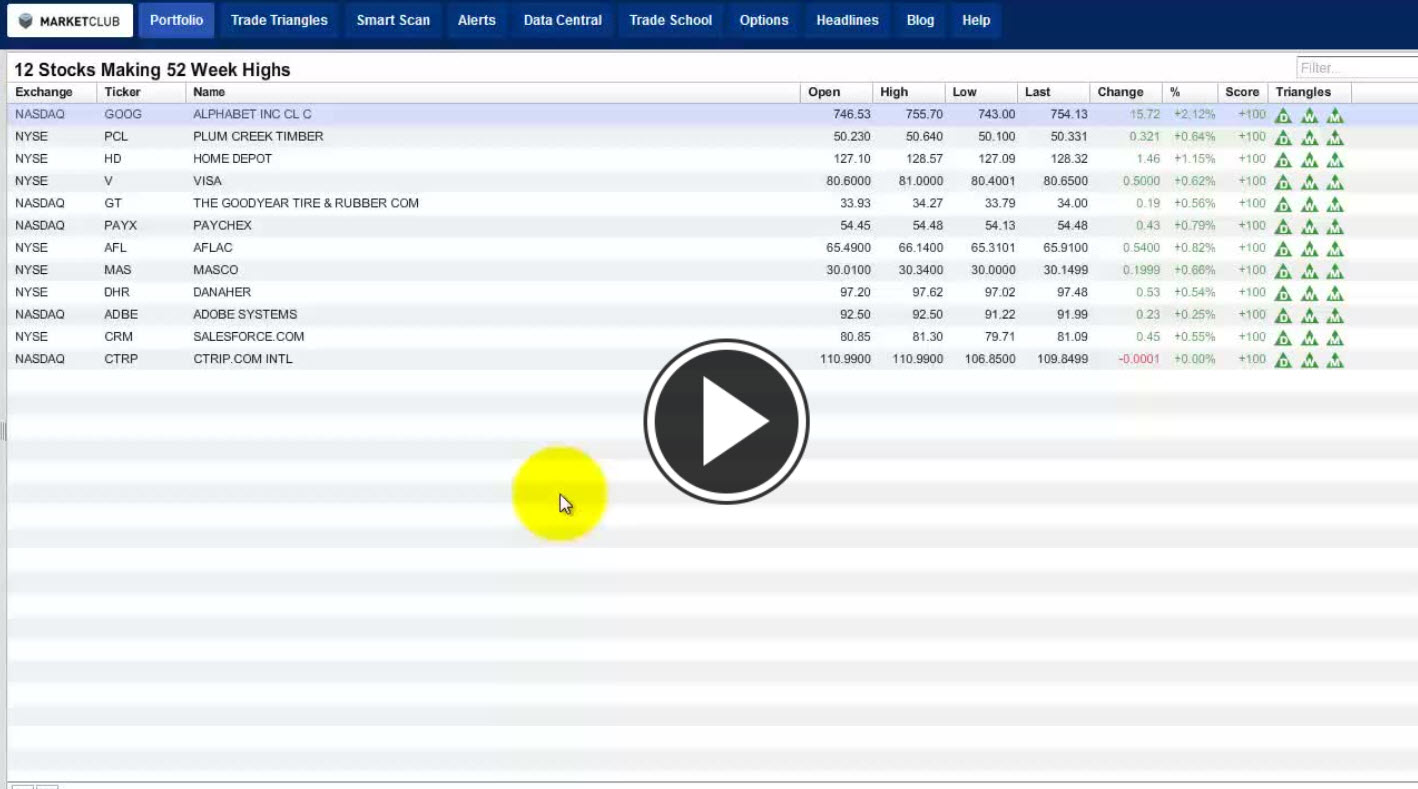

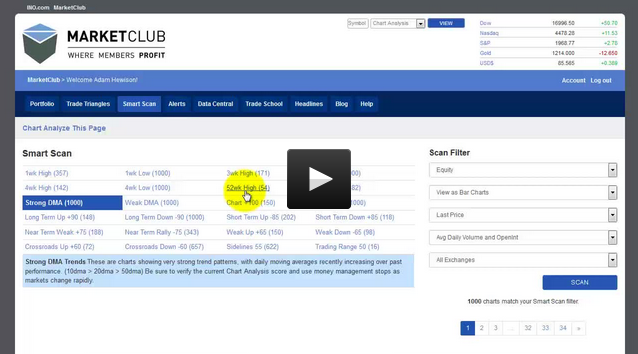

MarketClub's Smart Scan technology contains an amazing amount of information that you can use to help trade with the trend. Smart Scan can also alert you to changes in the bigger picture for the general market.

Let me share with you and example of how that would work. Looking at the graph below, you'll see a series of numbers, 1 through 4. I've illustrated the graph with these numbers to showcase what's going on right now in the general market.

1. "Long-Term Trend Up +90 (178)" - This means only 178 stocks have a +90 reading or higher.

2. "Long-Term Down -90 (832)" - This means 832 stocks are trending down and have a reading of -90 or lower. The number of stocks in a strong downtrend clearly outweighs the number of stocks in an uptrend over 4:1.

3. Looking at the stocks making "52-Week Highs," we see only 35.

4. The number of stocks making "52-Week Lows" is 646, which far outweighs the number of stocks that are making new highs.

At this point in time, I think it's clear to say that negative trend is winning out and in the majority.

In each of the 24 scans found in Smart Scan, it can really tell the story of the market. I highly recommend you spend some time looking at Smart Scan to see how you can successfully incorporate some of these scans into your own trading approach.

I find I constantly go back to this tool, not only to find stocks that are making new highs and trending higher, but also to see what's making new lows and what opportunities there are to short the market.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub