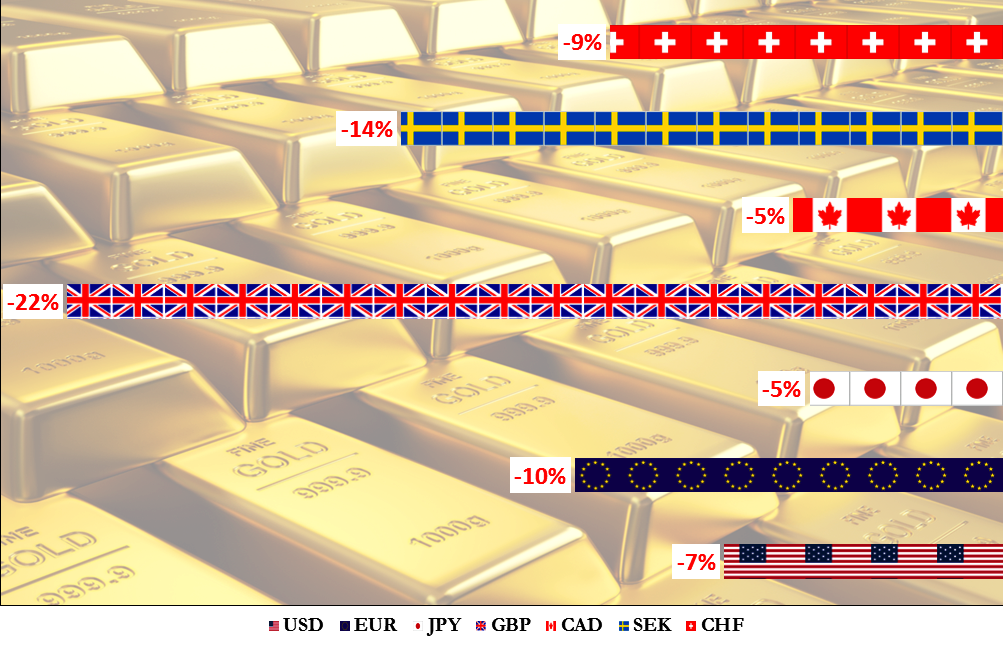

It becomes a tradition to post a performance review of the top currencies vs. gold at the beginning of the new year.

Fiat money is represented by 7 currencies: The US dollar (USD) and 6 components of the US dollar index (DXY) placed by weight: euro (EUR), Japanese yen (JPY), British pound (GBP), Canadian dollar (CAD), Swedish krona (SEK) and the Swiss franc (CHF).

Chart 1. Year-To-Date Dynamics Of Top 7 Currencies Versus Gold: No Comment

Diagram by Aibek Burabayev; Source: tradingview.com

The Euronews agency has a special rubric called “No comment” where they show video news without commentary as the picture speaks for itself when something dramatic, awful or really amazing is shown. I think the above diagram also speaks for itself and it shows the drama where the gold just smashed all of the fiat currencies as none of them could escape. None! Continue reading "Top Fiat Money Vs. Gold: What Shines Brighter in 2016?"