|

Now you can learn the swing trading methodology that one professional trader called ""...one of the most elegant futures trading methodologies I've seen."

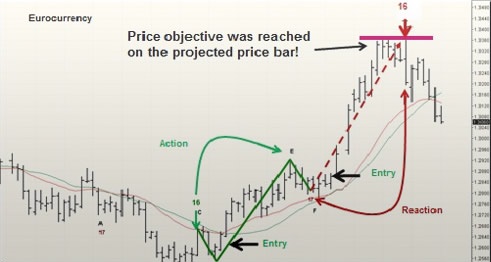

Simply put, "Action-Reaction" swing trading strategy provides the tools to take advantage of the entire trend, where other strategies are forced to wait for the trend to mature. "Action/Reaction," combined with Market Timing Intelligence, is the only strategy to give you all three essential components - market direction, price projection and trade duration - needed for a successful swing trade.

The “Action-Reaction” signal pattern has the unique ability to identify the "sweet spot" where a market is building

energy inside a trend that can precede explosive market moves and capture the entire move, from beginning to end! It

does not matter what market or what time frame you use! You will learn to:

John Crane has laid out a clear and concise tutorial so you can quickly learn these powerful strategies and quickly begin to use one of the most powerful swing trading strategies available today. Sign up today, for the free “Swing Trading with Market Timing Intelligence” webinar illustrating this powerful strategy Just for signing up you will also receive the following: A 30-day free subscription to the Traders Market Views – Swing Trading Report, now in its 23rd year of publication. The Traders Market Views Swing Trading Report is the only newsletter that provides detailed swing trading opportunities using “Action-Reaction” combined with the Reversal Date Indicator. Free access to John Crane’ s daily blogs and tweeter updates on current or new swing trading opportunities with educational chart illustrations Access to free telephone or e-mail assistance from a highly trained staff to assist you with any questions. |

Copyright 2025 INO.com, Inc. All Rights Reserved.

Usage Agreement

- Privacy Policy

U.S. Government Required Disclaimer - Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

All trades, patterns, charts, systems, etc., discussed in this advertisement and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher or INO.com. No system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. No representation or implication is being made that using the INO.com or MarketClub methodology or system will generate profits or ensure freedom from losses. The testimonials and examples used herein are exceptional results, which do not apply to the average member, and are not intended to represent or guarantee that anyone will achieve the same or similar results. Each individual's success depends on his or her background, dedication, desire, and motivation.

The most important element of a successful swing trading approach is market timing of both entry and exits. In this

educational webinar, you will learn to predict, identify, and trade short-term swing trades in futures, stocks or

forex using a unique swing trading "market timing intelligence" methodology. Veteran futures trader and best-selling

author John Crane will show how he combines his highly acclaimed “Action/Reaction” market timing methods with a

selective set of Elliott Wave and Fibonacci principles to analyze the market action and project future market swings.

The most important element of a successful swing trading approach is market timing of both entry and exits. In this

educational webinar, you will learn to predict, identify, and trade short-term swing trades in futures, stocks or

forex using a unique swing trading "market timing intelligence" methodology. Veteran futures trader and best-selling

author John Crane will show how he combines his highly acclaimed “Action/Reaction” market timing methods with a

selective set of Elliott Wave and Fibonacci principles to analyze the market action and project future market swings.