We have all heard the tale of the Tortoise and the Hare, wherein Aesop teaches us the lesson that "slow and steady wins the race." Like wise in trading, consistent, steady profits and solid money management translate into a winning portfolio. With us today to share his thoughts on money management is Mark Hodge, Head Trading Coach at Rockwell Trading. After you have read Mark's take on this important facet of market success, please share your thoughts, comments, or questions below.

We have all heard the tale of the Tortoise and the Hare, wherein Aesop teaches us the lesson that "slow and steady wins the race." Like wise in trading, consistent, steady profits and solid money management translate into a winning portfolio. With us today to share his thoughts on money management is Mark Hodge, Head Trading Coach at Rockwell Trading. After you have read Mark's take on this important facet of market success, please share your thoughts, comments, or questions below.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

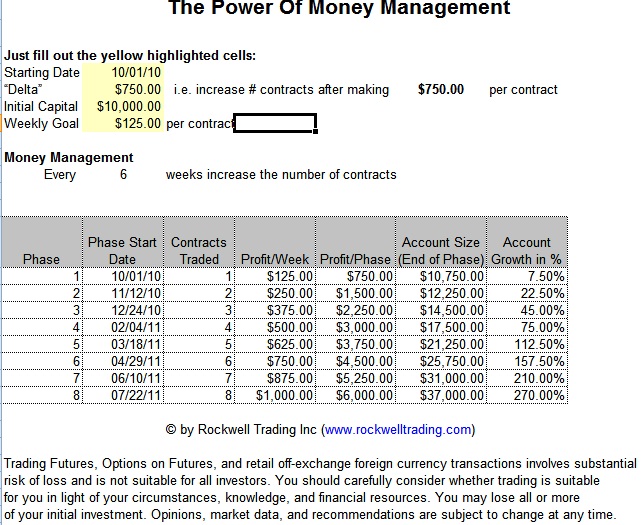

In my experience very few traders truly understand money management and how to use it. This is unfortunate. I’d argue that money management is the single most influential factor on your financial growth as a trader. Using the example below, I’ll even show you how you can double your trading account in less than a year, averaging only $125 a week.

Before I show my favorite approach to money management, it’s important to understand that you need to show consistency, and at a minimum, have a strategy with a positive expectancy (net profitable over time) before a money management strategy will be effective. I know some of you will miss this point at the end of this article and say “ya, well the money management plan you show requires profits to be successful”…ABSOLUTELY! If you’re not at a level where you can take profits out of the market, even small conservative ones, a money management strategy won’t do you any good. (If you’re not at this level, here are some tips that may be able to help you.)

So let’s talk money management. Money management methods can be broken down into two categories: Martingale Money Management (increasing position sizes after losses), and Anti-Martingale Money Management (increasing position sizes after profits). At Rockwell Trading we believe that the safest way to grow your account is to increase your position size after profits.

There are a few strategies that fall under the anti-martingale money management umbrella, but the money management technique I use and teach is the Fixed Ratio money management strategy by Ryan Jones. The idea is to increase your position size after you’ve accumulated profits. In a sense, you are “buying the right” to trade a larger position size. What I like about this approach is that the emphasis is really put on your performance, instead of your account size. The amount of accumulated profits necessary before increasing your position is going to be known as your “delta”.

Let’s assume that you are a futures trader, and you begin trading with a $10,000 account. Since you haven’t proven yourself as a trader, and don’t have any accumulated profits yet, you should begin by trading 1 contract. So trading only 1 contract, how much profit can you achieve daily, or weekly? Ultimately this will depend on your experience and your trading plan, but let’s keep it conservative and say that on average you are able to achieve $125 a week, or $25 a day (this is just 2 ticks on the E-Mini S&P 500).

For this example, we’ll use a delta of $750. This means that we need to accumulate a total of $750 in profits, before we have the “right” to increase our position size. If we average just $125 a week, we would have the “right” to increase our position size after every 6 weeks of successful trading ($125 x 6 = $750). Once our delta is reached, our account would have grown by $750 for a total of $10,750, and it would now be time to trade 2 contracts.

|

# Contracts |

Ave Weekly $ |

Profits to Increase Position |

Acct Size |

Next Level |

|

1 Contract |

$125 |

$750 (delta) |

$10,750 |

2 Contracts |

Trading 2 contracts, we would make more money each week due to our larger position size, even if our weekly average remained the same. If we continued to maintain our $125 average per contract, our weekly profit would be $250 per week ($125 week x 2 contracts). After another 6 weeks of successfully achieving our $125 goal per contract, we would have made $750 per contract, for a total of $1500 ($750 x 2 contracts). Our account would now show a total of $12,250, giving us the right to trade 3 contracts.

|

# Contracts |

Ave Weekly $ |

Profits to Increase Position |

Acct Size |

Next Level |

|

2 Contracts |

$125/contract |

$1500 ($750 delta x 2) |

$12,250 |

3 Contracts |

Trading 3 contracts, we continue with a goal of achieving $125 in profits per contract, but we’re now seeing $275 in weekly profits ($125 x 3 contracts). If we maintain our $125 average profit per week, we would be able to increase our position size after another 6 weeks. Once accomplished, we’d make another $2,250 ($750 x 3 contracts) and would now have an account balance of $14,500.

|

# Contracts |

Ave Weekly $ |

Profits to Increase Position |

Acct Size |

Next Level |

|

3 Contracts |

$125/contract |

$2,250 ($750 delta x 3) |

$14,500 |

4 Contracts |

Before seeing what happens when we add a 4th contract, it’s important to point out that small consistent profits and sound money management have led to a 45% return on this account! We didn’t double our account over night. However, we did require small consistent weekly goals in order for this method to work. This is one of the reasons we highly encourage traders to work with weekly goals, and to avoid giving profits back by overtrading.

Now this is where it starts to get fun. Let’s see what happens when we add another contract.

Trading 4 contracts, we would still be looking for a conservative $125 per contract weekly average. However, now we’d be realizing a $500 profit per week ($125 x 4 contracts). After another 6 weeks of averaging $125 per week, we would have earned the right to add another contract.

|

# Contracts |

Ave Weekly $ |

Profits to Increase Position |

Acct Size |

Next Level |

|

4 Contracts |

$125/contract |

$3000 ($750 delta x 4) |

$17,500 |

5 Contracts |

Adding a fifth contract, we would now be averaging $625 a week ($125 x 5 contracts) with our conservative weekly average of $125. After 6 weeks of achieving our $125 a week average, it would be time to add another contract.

|

# Contracts |

Ave Weekly $ |

Profits to Increase Position |

Acct Size |

Next Level |

|

5 Contracts |

$125/contract |

$3,750 ($750 delta x 5) |

$21,250 |

6 Contracts |

Do you see how powerful conservative weekly profits and money management can be? So what type of profits do you think you could achieve averaging just $25 a day, or $125 a week in a year? Using the spreadsheet below, we can see just that:

Starting with a $10,000 account on October 1, 2011, we would be on track to trade 9 contracts in September 2011, with a $37,000 account. This represents a 270% return and it hasn’t even been a full year yet!

Now to make sure it is 100% clear, these results are hypothetical and based on a conservative profit that is achieved weekly. You still need to perform as a trader. However, if you trade multiple strategies and multiple markets with your trading plan, you might be able to average a higher weekly profit. It just goes to show that you don’t always need to hit homeruns in order to grow your account. When you understand Fixed Ratio Money Management you can also adjust your delta to be more conservative, or aggressive depending on your comfort level. Of course, there’s also the fact that there will be down days and down weeks from time to time. This makes it even more important to focus on conservative weekly profits that can be achieved, and to make sure that profits aren’t given back.

Many traders overlook money management, or never learn to appreciate money management and the power it can have on your account. With consistency and sound money management, you’ll likely be able to achieve your trading goals in a more conservative way than you first expected. So start small, grow BIG, and let money management be your guide to greater profits.

Happy Trading,

Mark Hodge

Rockwell Trading

If you’re interested in day trading and looking for a strategy that can produce conservative profits like those introduced above, check out our Day Trading Starter Package.

|

# Contracts |

Ave Weekly $ |

Profits to Increase Position |

Acct Size |

Next Level |

|

1 Contract |

$125 |

$750 (delta) |

$10,750 |

2 Contracts |

Mark -- if your Delta is $750, and when you are trading two contracts then you don't have to wait 6 weeks. $125 x 2 = $250 per week. You get to $750 in just 3 weeks, not 6. So you could step up to 3 contracts after 3 weeks not 6. And so on. It compounds much faster.

What I'm not accepting is consistently getting $125 a week per contract. Also you need subtract the losses that are going to happen. What you have up there is an overly optimistic spreadsheet.

Still you are right in principle that money needs to be managed ...anpther simple way is to not risk more than 3% of your capital on each trade.

OTOH if you never trade in a way that can make a killing then why bother trading? Your day job already puts food on the table. You don't really need that $10K so you can risk it. Then the question is what happens when it has turned in to $25,000? Do you still risk it all? At 100,000 do you have the guts to risk it all and make $200,000?

Sid

Commissions and expenses / taxes should be accounted for?

Thanks for the info. Seems quite useful. I would say that consistency on a weekly basis seems to be the key to making this work. However as a neophyte in the market I find it hard to achieve that level of consistency without in fact being a good day trader. In other words, waiting a month or more than a week for a stock to move in your direction does not give you the type of control that you need to achieve these results.

I started w/C$ 100,000.00 in my TD Waterhouse self-directed brokerage account in April of 2010. I'd decided to focus 80% on Canadian junior gold and silver explorer/miners, along w/some energy and agri shares for the remaining 20%.

Using the seasonals as a trading aid, and w/a reasonably good knowledge of TA as well, I decided that I'd take profits every time my pick at least doubled, so that the first move secured the rest of my shares for the cost of the trade. I'd then hold the rest for whatever

To date my equity valuation is up more than C$ 20,000.00, apart from the cash I've taken out for other investments. Overall it appears that I'm up about C$ 25,000, and I used it to pay rent, as well as send $500.00 to my daughter. I think what I'm doing is very similar to that suggested in the article, but I learned it from Dr Bruce Gould, who was formerly the head of General Mills commodities department.

Is there a reason you're NOT trading futures Aldo? 🙂 I want liquidity and transparency as a trader. CFDs or spreadbetting, do not provide market transparency since traders aren't traded through a centralized exchange. My intention isn't to get into a "my market is better than yours" argument here, but I know a lot of our European and Australian traders are trading U.S. futures markets for these very reasons.

If you're set on using spreadbetting, the same idea applies...focus on conservative daily and weekly goals, determine a delta that's appropriate for you, and use money management to build your account! (you just need to be right about larger moves so you can cover those spreads.) 🙂

Happy Trading!

Mark

I am in total agreement with your strategy, BUT, your comments are for USA citizens, dealing with the American markets, but here in the UK we are mainly dealing with Spreadbetting Companies. my question is; How would you deal with this same kind of scenario in the UK. Could you please give examples (I hope you are conversant with england's spreadbettting techniques?).

Our leverage is somewhat different to the USA.

I would greatly appreciate your views and take on board your professional advice Mark.

Regards

Aldo (UK)

Hi Lane, I appreciate your comments, but I'd encourage YOU to give it a try! Most traders spend so much time trying to go for big profits, they give it all back and have nothing to show for their time and effort. I've found that Fixed Ratio money management is a great way to grow an account, but consistency, discipline and dedication are still requirements for this to happen.

P.S. There's a huge difference between managing a fund and being a private trader. I know many people who consistently beat the S&P that would never want to manage money or be in the spotlight. I'd argue that most of the best minds in the industry are just doing their thing, and not looking for publicity. 😉 Good luck with your trading!

Man that is what I call hokus pokus. If an individual can trade with that kind of consistency almost whatever he does by doubling his bet is going to do well. The problem with this theory is what percent of the stock, futures, ETF traders can pick that many winners? As proof of that the best minds in the industry rarely can beat the SP 500. Once again an overly simplistic approach to trading.