It’s been a rough past month for the S&P-500 (SPY), with the index down 15% in less than 30 trading before Wednesday’s rally.

The continued weakness can be attributed to the view that a 4.0% terminal rate for the Federal Funds Rate may not be enough to bring inflation to its knees, given how sticky inflation has been to date and with supply chain issues remaining in place.

Higher rates result in growth stocks becoming less attractive, given that higher discount rates must be used to discount future cash flows. At the same time, there is a greater risk of a hard landing, which does not paint a rosy picture of 2023 earnings for S&P-500 companies.

However, while many stocks are seeing declining earnings with pressure on profit margins, quite a few companies are bucking the trend, and given the general market weakness, they’ve found themselves trading at extremely attractive valuations.

Two names that stand out are Capri Holdings (CPRI) and Deckers (DECK), which both hail from the apparel industry group and are on track to grow annual earnings per share at double-digit levels this year.

Just as importantly, they’re expected to see new all-time highs in annual earnings per share next year as well. Let’s take a closer look below:

Capri Holdings (CPRI)

Capri Holdings is a global fashion company with three iconic brands: Versace, Jimmy Choo, and Michael Kors. While luxury brands might be considered the last thing that one is shopping for in a recessionary environment, they benefit from a very affluent customer base that’s seeing much less pressure than lower-income consumers to their discretionary budgets.

Meanwhile, from an industry standpoint, the personal luxury goods market continues to grow at an impressive rate. Based on recent research, sales are expected to grow 10% from FY2019 levels this year and are forecasted to increase another 20% from FY2022 to FY2025.

Given that Capri owns some of the strongest brands, it’s in great shape to capture some of this growth. In fact, its long-term goal is to increase total revenue to more than $8.0BB, up from FY2023 estimates of $5.85BB. This is expected to be driven by the following:

- leaning into data analytics to increase the lifetime value of its customers

- growing market share in its accessories segment

- growing its retail footprint within its Versace segment

- increasing sales in casual at Jimmy Choo to help drive sales

Finally, the company is looking at rationalizing its store fleet and doubling down on e-commerce at Michael Kors while also focusing on its men’s category.

To date, the company continues to see the fruits of its hard work, enjoying a compound annual EPS growth rate of 11.2% during a global pandemic following the acquisition of Versace, with this deal completed for mostly debt and a name to Capri Holdings.

However, there’s significant growth left in the tank, evidenced by annual EPS estimates of $6.85 in FY2023 and $7.40 in FY2024, translating to nearly 20% growth from FY2022 levels during a recessionary environment globally.

Despite this strong growth, CPRI trades at just 5.7x FY2023 earnings estimates, a massive discount to its 5-year average of 12.6x earnings.

Based on what I believe to be a conservative earnings multiple of 9x earnings, acknowledging that we’ve seen significant multiple compression in growth stocks, I see a fair value for CPRI of $66.60 per share, pointing to over 65% upside from current levels.

Hence, I see this sharp pullback in CPRI as a buying opportunity and a case of the baby being thrown out with the bathwater, with less recession-resistant brands seeing meaningful margin erosion.

Deckers (DECK)

Deckers is a similarly exciting story, owning several iconic brands, including UGG, Koolaburra, Hoka, Teva, and Sanuk, in the shoe category. Its UGG and Koolaburra brands are part of its fashion lifestyle group, while its Hoka, Teva, and Sanuk brands make up its performance lifestyle group, with Hoka being a high-growth brand that recently achieved its one-billion-dollar revenue milestone on a trailing-twelve-month basis, an incredible performance, given that it was doing sub $500MM in FY2020.

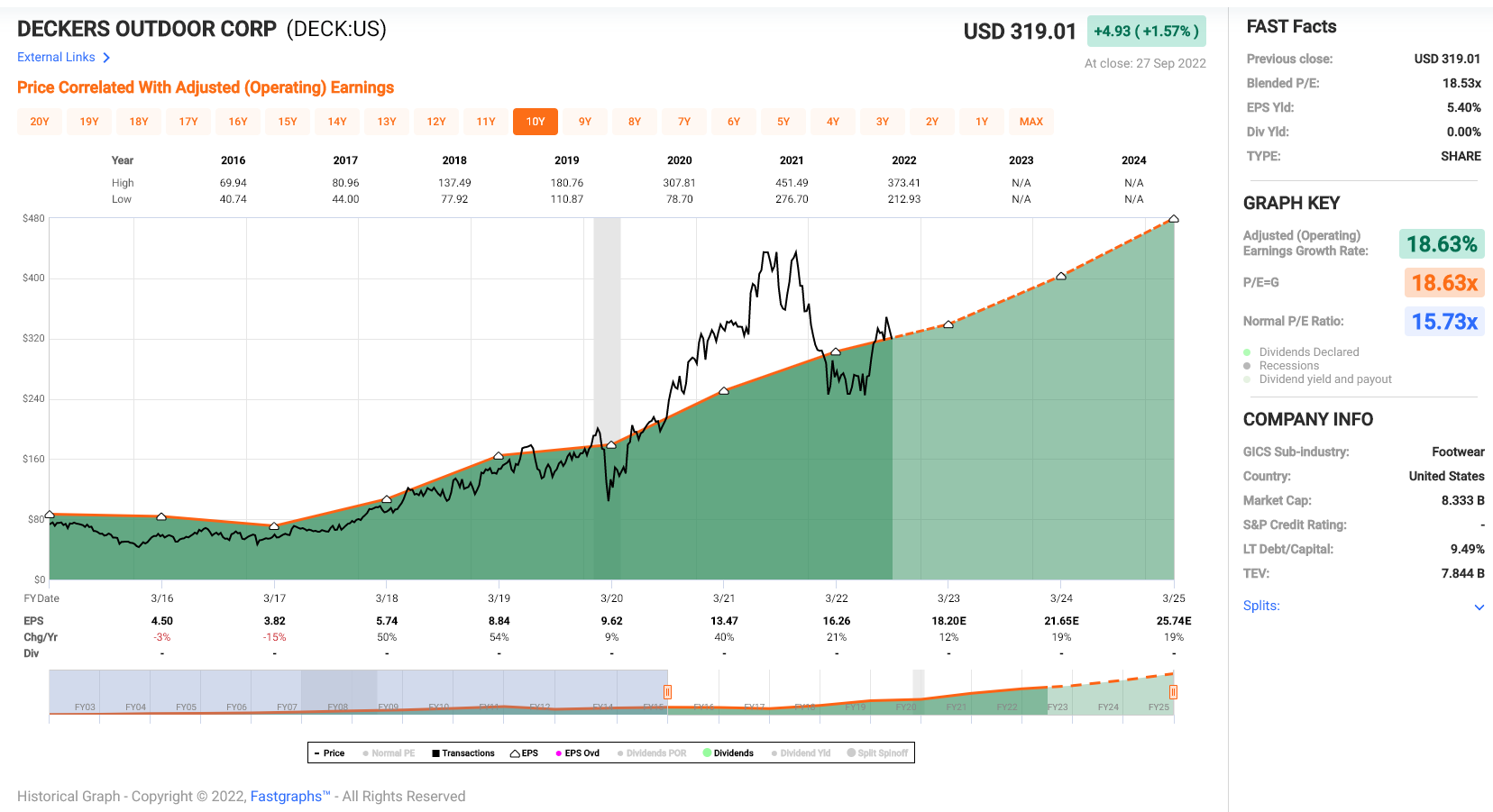

Like Capri Holdings, Deckers has enjoyed impressive earnings growth over the past several years, growing at a 22% compound annual earnings growth rate since FY2018 and being on track to report another year of record earnings in FY2023.

In the company’s most recent report, Deckers noted that sales jumped 22% to $615MM (23.5% constant currency), driven by a sharp increase in wholesale net sales and an impressive quarter internationally, sporting 36% growth. The stand-out brand was Hoka, with 55% growth in the period and fiscal Q1 2023 revenue of $330MM.

Although margins did slide slightly, gross margins remained strong at 48.0%, and the company reaffirmed FY2023 margins of 51.0% or better. Besides, sales are on track to more than offset any margin softness, setting the company up to grow annual EPS from $16.26 to $18.20 in a period where earnings estimates for other companies are falling off a cliff.

Finally, it’s worth noting that Deckers is in a position of strength and could potentially look at opportunistic M&A or buybacks, sitting on over $700MM in cash and no debt. In fiscal Q1 2023 alone, the company took advantage of share price weakness to repurchase over 1% of its float at $260 per share.

Looking at the above chart, we can see that DECK has historically traded at ~15.7x earnings (10-year average), but its 5-year average is closer to 20x earnings. The stock currently trades at 18.1x FY2023 earnings estimates.

I believe the stock can easily justify an earnings multiple of 20.5, given its strong balance sheet and upcoming earnings acceleration (FY2024 and FY2025 estimates of $21.65 and $25.74, respectively).

So, while the stock might only have a 14% upside to a fair value of $373.00, I think this stock could easily trade at $450.00 in the next 18 months, assuming it can beat estimates, given the strong growth expected in FY2024/FY2025.

That said, I prefer to buy at a 20% discount to fair value, so I see the more attractive buy point being on any dips below $299.00 per share.

While several stocks are down sharply from their highs and out of favor due to much weaker earnings growth, Deckers and Capri are two exceptions, and both stocks look to be trying to start new uptrends, well ahead of the major market averages. Given the favorable fundamental/technical picture, I see CPRI as a Buy below $38.50, and I would view pullbacks below $299.00 on DECK as buying opportunities.

Taylor Dart

INO.com Contributor

Disclaimer: This article is the opinion of the contributor themselves. Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information in this writing.