Today I'd like everyone to welcome Lance Beggs from Your Trading Coach.com. Over the past few months I've gotten to know Lance, his site, and his teachings. Overall I'd say he ranks up there with Adam when it comes to his genuine desire to help traders. I've asked him to come and teach us a little about price analysis. Enjoy!

================================================================

Hi MarketClub traders,

Many thanks to Trader's Blog and Adam for the invitation to write today’s Guest Blogger entry.

One of the key features in my analysis involves monitoring price action, in order to gain an insight into the short term sentiment of the market. Determining who is in control at that time – the bulls or the bears, and assessing how they’re likely to respond to changes in the market.

I thought today I’d prepare a quick article to give an overview of how I analyze price. Those of you who know me know that I’m a great fan of candlestick charting. However, price analysis is much more than just watching for your favorite candlestick patterns. Too many people just teach the candlestick patterns, which are fine, but in my opinion there’s some essential analysis missing that an astute trade needs to consider BEFORE they look at price action and respond to every candlestick or bar chart pattern. Let’s have a look at what I mean.

Price analysis for me is essentially a top down approach, working from the macro level of Market Structure (so we analyze the big picture first), then down to the current Trend within that structure, and only then do we look at the current price pattern, whether through candlestick analysis or whatever other method works for you.

So I basically start off with a wide view of the market, and drill down to the detail in the current price bar or pattern. I prefer to do this over two timeframes.

The market structure is defined primarily on a higher timeframe. For me, as a daytrader, that’s the one hour charts. Of course, if you trade differently to me then that can be any other time period you wish. Just make it higher than the timeframe you trade on – I recommend by at least a factor of four.

Then on the shorter timeframe (what I call the trading timeframe) I refine the market structure a little further, analyze the movement and strength of the trend, and then assess the bullish or bearish sentiment based on the current price patterns.

For me, the trading timeframe’s anywhere from 1 minute to 5 minute charts, depending on the market and its volatility, and how well the price is flowing.

So, what do I mean by market structure, trend analysis and price analysis?

Firstly Market Structure:

(a) The higher timeframe chart is opened and any areas of major support or resistance are identified and clearly marked on the chart.

(b) Support & Resistance for me are areas of past price congestion, swing highs or lows, or gaps. That doesn’t include any ‘guessing’ at future support or resistance, via the use of pivots points or Fibonacci levels. I’m not a fan of these analysis techniques. Of course, if they work for you, good on you, keep using them.

(c) My expectation when I trade is that there is a higher probability of price stalling or reversing at these areas of major support or resistance.

(d) I then narrow my focus to the shorter trading timeframe and add to the market structure framework, by identifying areas of minor support or resistance. (Typically we look on the current trend first, but you may at times need to look back beyond the current trend, to previous market action, to find applicable areas of minor support or resistance)

(e) Once again, these come from areas of congestion, swing highs or lows, or gaps. That is, areas which are proven to stall price movement or reverse price direction. My expectation with minor support or resistance is for a higher probability of minor support holding in an uptrend, and minor resistance holding in a downtrend.

That’s it for Market Structure – simply identifying a support and resistance framework within which price moves. Simple!

Having defined our market structure, or a framework within which price will move, we now focus our attention on the current trend. This occurs, as does all further analysis, on the trading timeframe.

(a) I conduct analysis on the trend to identify its strength. Is the trend moving strongly, in which case we can anticipate it being more likely to break through the next support or resistance levels, or is it weakening, in which case we have a greater probability of the support or resistance levels forming a barrier to further price movement?

(b) We determine the strength of the trend by looking at its proximity to the support and resistance barriers within the framework, and also gain clues from changes in momentum or volatility.

(c) Is the current price swing, faster or slower than preceding swings within that trend? Is the current price swing speeding up, or slowing down?

(d) Is the volatility changing? Is the average range of the price bars increasing or decreasing?

(e) These sorts of questions regarding changes of volatility and momentum can give you clues into the changing strength of the trend, and the likelihood of a reversal at, or continuation through, an area of support or resistance.

(f) If you want to get experienced at this, it takes time. Review price charts over and over, identifying how changes of momentum and volatility precede either a continuation or reversal of that trend.

Having gained an appreciation of the strength of the trend, and its location within the support and resistance framework, ONLY THEN, finally, do I concern myself with the current price action to determine the bullish or bearish sentiment (or more particularly a potential change of sentiment) through candlestick analysis.

What does this little bit of extra work give me?

Here are a couple of examples:

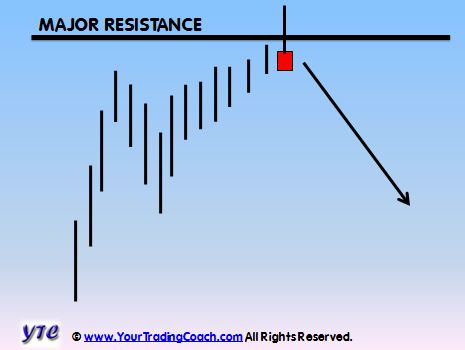

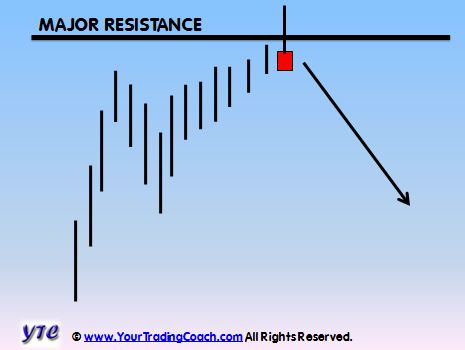

In the diagram above, instead of entering short on a shooting star reversal pattern, just because it matches the shooting star diagram in my book on candlestick patterns, I’m entering short because price just meandered slowly up to a major resistance level. The current price swing has clearly less momentum than both the previous upswing and downswing. And the price bar range is clearly narrowing. This gives a reduced likelihood of the commitment required from the bulls to break through the area of increased supply. The shooting star pattern provides evidence of a clear rejection of prices at that resistance level. This provides me with a lower risk or higher probability trade in the short direction.

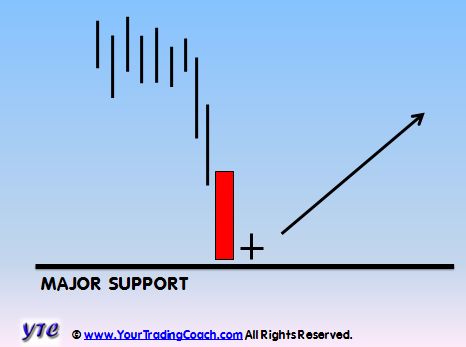

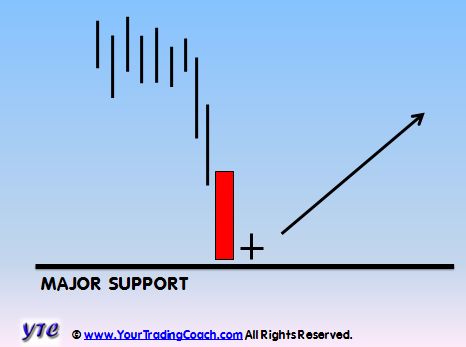

Again, in the diagram above, instead of entering long on a harami cross reversal pattern, just because it matches the harami cross in my book on candlestick patterns, I’m entering long because a strong and accelerating move downward, on greatly increased volume, extended price rapidly to great distances below its average, right into an area of major support. This is an area where I expect increased demand is likely to be sufficient to absorb and overcome the force of the bears who have spent all their energy on the climactic move downwards. This is an area where I expect price to find support. The harami cross shows a clear halting of the rapid move down, and allows me an opportunity to enter a low risk trade close to an area of major price support.

Seriously, the end result might be the same, but at least I’ve entered based on a reasonable assessment of the price action in order to maximize the potential for a lower risk or higher probability trade. Over a lifetime of trading I expect this approach will produce more favorable results than just entering because the pattern matched one I’d memorized from a book.

Ok, time for a bit of a summary. Don’t just blindly take your entry triggers. Think about where they occur within the bigger picture structure of the market.

The market structure defines where you trade. The trigger, whether a candlestick pattern or some other form of entry trigger, tells you when to get in, ONLY when you’ve first met the requirements of the market structure rule.

Think about where the current price movement is within a framework of support and resistance. Think about the changing strength of the current trend, or price swing, as it approaches this area of support or resistance. Watch for signs of strength or weakness in the trend, through the clues evident in changes of momentum and volatility.

And don’t forget – ALWAYS USE STOPS, because there are no guarantees. This is a game of probabilities.

Happy trading,

Lance Beggs

Would you like to learn more about how I trade the forex and equity index markets? Check out the articles, videos and trading resources on my website right now at YourTradingCoach.com .

Studying the writings of traders who were active in the first three or four decades of this century has often inspired me to do additional research. This has allowed me to develop additional tools and theories. In reality, what I present in this segment will not "pure" Gann. Instead, I will present applications and approaches which I have found to be useful and successful. Hopefully, this will provide a foundation for anyone who wants to study further on his/her own.

Studying the writings of traders who were active in the first three or four decades of this century has often inspired me to do additional research. This has allowed me to develop additional tools and theories. In reality, what I present in this segment will not "pure" Gann. Instead, I will present applications and approaches which I have found to be useful and successful. Hopefully, this will provide a foundation for anyone who wants to study further on his/her own.