If you look at the major averages, stocks haven't done well so far this year. After a solid showing in

2014, The Dow Jones Industrial Average is down 1.06% and the S&P 500 is down 0.91% year-to-date.

But it's not all doom and gloom for all stocks. Take a look at the NASDAQ so far this year – up 2.40%.

Chart courtesy of StockCharts.com

On the surface it may seem as if the difference in performance can be attributed to the fact the the NASDAQ is heavily weighted in tech stocks, but that's not the case.

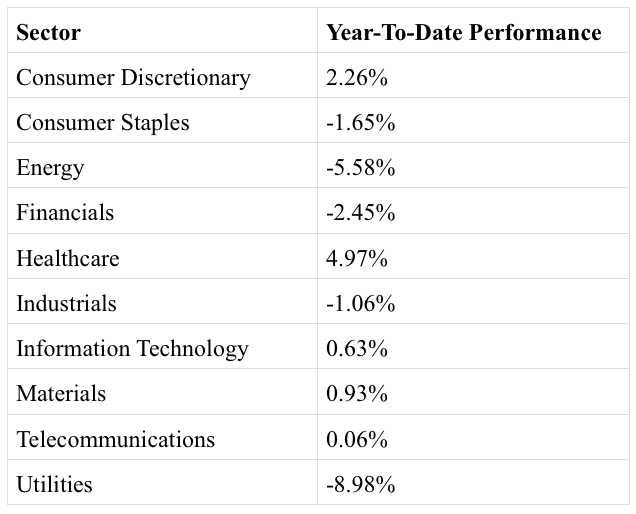

Here's how each stock sector has performed for 2015:

Chart courtesy of StockCharts.com

The biggest gainer has been healthcare while consumer discretionary and materials following behind. Based on that, it can't be technology carrying the NASDAQ with three other sectors outperforming it. So what's the secret ingredient?

The rise of small cap dominance

It's not tech stocks that are leading the way right now, it's small caps. The Russell 2000 is up 2.65% year-to-date and appears to have growing momentum behind it.

Chart courtesy of StockCharts.com

The 20-day moving average crossed over the 50-day in early February, a bullish signal that the index is gaining strength. Since then, it's climbed over 3% despite the recent pullback we've seen this month.

The top three performers in the Russell 2000 align with the top performing sectors so far this year as well:

• Molycorp (MCP) up 184.18%

• Cytori Therapeutics Inc (CYTX) up 133.33%

• Second Sight Medical (EYES) up 84.17%

The NASDAQ is being carried by the small cap tech companies that are thriving in the current low interest rate economic environment. Check out PowerShares S&P SmallCap Information Technology ETF (PSCT). It tracks the SmallCap 600 Information Technology Index and is up 3.76% year-to-date.

Chart courtesy of StockCharts.com

Still, it looks like there's been a hiccup in U.S. markets over the past few weeks. The news coming out of Europe regarding the ECB stimulus package to be released later this year and the falling euro has spooked investors in domestic markets to pull back and add weight to international holdings instead. But it's actually good news for small caps over the long term.

Tailwinds for small caps

The surging strength in the U.S. dollar along with the weakness in foreign currencies like the euro and yen may hurt larger firms with overseas operations. Exchange rate risks are going to have an adverse impact on those companies and the higher relative cost of U.S. based manufacturing will hurt earnings for larger firms.

Smaller companies generally have little, if any business overseas and may in fact actually import from foreign suppliers. The increasing spread between the dollar and other currencies will make it cheaper to operate and lower overall costs which will positively impact earnings. The disproportionate strength of the U.S. dollar will help out smaller companies while hurting larger ones.

The other big tailwind that's helping out small cap stocks is the low price of oil. With lower energy prices, companies are able to produce more for the same cost which will boost earnings. Larger companies depend on oil more heavily with increased international exposure while smaller ones have less exposure to international markets and energy.

Finally, small caps are more agile and able to take advantage of niche spaces in the market. They are able to focus on one product or design, especially in the healthcare and technology sectors. Take Second Sight Medical (EYES) for example. The company is involved in medical prosthetic devices for visually impaired patients.

Small capitalization, big volatility

If you're interested in small cap stocks, remember that they are subject to more volatility than their larger counterparts. These stocks tend to be riskier investments and react more strongly to changing economic conditions. Remember to keep your portfolio diversified to mitigate risk and add positions only after you've done due diligence.

Check back to see my next post!

Best,

Daniel Cross

INO.com Contributor - Equities

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Advise on forex and indices for example which currencies/indices can I trade today ? Which position (Long or Short ) should I take. That is the kind of advice I am looking for.