Leveraging covered call options in opportunistic scenarios may augment overall portfolio returns while mitigating risk. In brief, options are a form of derivative trading that traders can utilize in order to initiate a short or long position via the sale or purchase of contacts. An option is a contract which gives the buyer of the contract the right, but not the obligation, to buy or sell an underlying security at a specified price on or before a specified date. The seller has the obligation to buy or sell the underlying security if the buyer exercises the option. An option that gives the owner (buyer) the right to buy the security at a specific price is referred to as a call (bullish); an option that gives the right of the owner to sell the security at a specific price is referred to as a put (bearish). In the event of a covered call, this is accomplished by leveraging the shares one currently owns by selling a call contact against those shares for a premium. I will provide an overview of how a covered call is utilized and executed. Here, I’ll provide details focusing on optimizing stock leverage (covered calls). Emphasizing the ability to sell these types of options in a disciplined and conservative manner to generate liquidity while accentuating returns and mitigating risk.

A few characteristics to keep in mind for covered call options trading

1. Strike price: Price at which you can buy the stock (buyer of the call option) or the price at which you must sell your stock (seller of the call option).

2. Expiration date: Date on which the option expires.

3. Premium: Price one pays when he/she buys an option and the price one receives when he/she sells an option.

4. Time premium: The further out the contact expires the greater the premium one will have to pay in order to secure a given strike price. The greater the volatility, the greater the time premium received for covered call writing.

5. Intrinsic value: The value of the underlying security on the open market, if the price moves above the strike price prior to expiration, the option will increase in lock-step.

Having your cake and eating it too?

Can one be long an equity position while writing covered calls against her position to yield a scenario where at expiration of the contract the strike price is not reached thus retaining the shares, premium, and any dividends? I will walk readers through a disciplined approach to leveraging opportunistic covered calls that I employ on an infrequent basis to optimize my returns on long positions. If one is long a stock and has healthy unrealized gains, she may elect to write a covered call against her position. Writing a covered call far enough out-of-the-money will likely lock in a cash premium on the front end with a low risk of relinquishing shares on the back end. Thus, the premium, shares, and any dividends are retained, and now the ability to write another covered call against this equity position is now available. This recalibrating of strike prices as the underlying equity enables traders to ride the uptrend on a bi-weekly or monthly basis. The idea here is to allow enough of an upside buffer that is built into the strike price relative to the stock price at the time the covered call is written. This will likely result in a very low-risk scenario that shares will be relinquished at expiration while maintaining a long position. A soft upside buffer target that I focus on is 10% thus shares have another 10% to run over the course of roughly a month in order to reach the strike price and risk relinquishment.

Selling covered calls into strength – Facebook and Salesforce.com as opportunistic examples

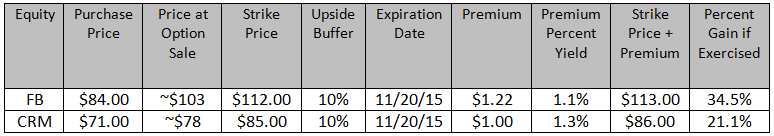

During the week of October 20th on the heels of very robust earnings from Microsoft, Amazon, and Alphabet (Google) the entire tech sector benefited and stocks such as Facebook and Salesforce.com witnessed a strong uptrend as a result. I wanted to capitalize on this uptrend as both Facebook and Salesforce.com broke through their respective 52-week highs. For these options trades I targeted my soft 10% upside buffer factored into the strike price. For my Facebook position, a 9% upside was built into the strike price ($112 strike - $103 at option) and factoring in the premium I arrived at a 10% upside buffer. For my Salesforce.com position, a 9% upside was built into the strike price as well ($85 strike - $78 at option) and factoring in the premium I arrived at a 10% upside buffer. This upside buffer was particularly important as earnings season was underway, and Facebook reported earnings on 04NOV15. Facebook handily beat expectations, and the stock shot up 5% the next day, briefly touching $110 per share. Salesforce.com reported earnings on 18NOV15 and handily beat earnings as well, and the stock jumped 5% the next day and touched $83 per share. In these cases, for a long position this 10% buffer was necessary in order to remain in the position while extracting value via far out-of-the-money covered call option writing while factoring in potential upside as witnessed after the conference calls and with the overall uptrend in the stocks (Table 1).

Table 1 – Details surrounding my conservative covered call approach with a built-in upside buffer

Premiums received to augment returns

Based on my scenario above, extracting ~1% realized gain on a monthly basis via writing far out-of-the-money covered calls doesn’t seem like much on the surface, however, extrapolating out on an annualized basis may augment returns by 12%-15%.

Appreciation beyond the strike price will be unrealized

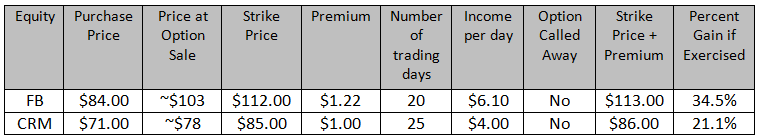

The major risk to this approach is attributable to any potential gains beyond the strike price. Put another way the call seller takes on the risk of relinquishing his shares at an agreed upon price by an agreed upon date while receiving a premium to take on this risk of relinquishment. Thus, any price appreciation beyond the strike price will result in unrealized gains and relinquishment of shares at the strike price plus the premium received at the time of selling the call contact. In order to substantially reduce this risk for a long investor that wishes to extract value throughout holding the underlying security will need to focus on writing far out-of-the-money covered calls. Using my example above and my soft upside buffer of 10% you can see that this allows plenty of upside while extracting a ~1% cash premium on a monthly basis. This buffer will substantially decrease one’s risk of relinquishing his shares (Table 2).

Table 2 – Details surrounding my conservative covered call approach with a built-in upside buffer over the course of a month

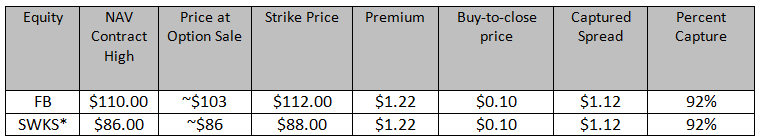

The power of closing out contracts (buy-to-close)

One of the advantages of writing covered calls is the ability to buy back the contact (buy-to-close) at a lower price and capture the spread prior to expiration. As the stock declines the underlying option will decline as well thus as a stock fluctuates throughout the contact timespan, the seller can cancel the contract via buying to close the option position (buy-to-close). Facebook peaked at $110 and fell back down into the mid-$100 range (far from the $112 strike price) and in combination of the time premium evaporating this option that I sold for $1.22 was now worth $0.10. I elected to cancel the option and buy-to-close the contact for $0.10, capturing a spread of $1.12 and keeping my shares (Table 3). This method accelerates closure of contracts to free up shares to no longer run the risk of relinquishment and the ability to write another covered call.

*Opportunistic 2-week covered call executed after post-earnings share price increase

Table 3 – Details surrounding my buy-to-close covered call approach to capture spreads and accelerate closure of contracts to no longer run the risk of relinquishment

A few questions/comments to consider prior to selling covered calls as long investors

1) As a long investor, would you be content with relinquishing your shares at the agreed upon strike price plus the premium if shares reach the strike price by expiration?

2) Chasing premium yield will likely result in a much higher risk of relinquishing shares thus it is important to remain disciplined and write far out-of-the-money covered calls with a generous upside buffer of ~10% to capture ~1% premium on monthly contracts.

3) Even if shares are called away, guaranteed money (strike price plus premium) was placed into your account. These funds can be used to add to other positions on pullbacks or initiating the same position if the stock comes down at a lower entry point.

Conclusion

The covered call option is a conservative way to utilize options to mitigate risk, generate cash via premiums and augment portfolio returns. Specifics surrounding an appropriate upside buffer and premium yield for long investors is outlined above. Important points to selling covered calls and extracting value via stock leveraging as long investors are outlined as well. This is a meaningful way to accentuate portfolio returns if the stock of interest decreases in value, trades sideways or trends upward (without crossing the strike price threshold) as the premium will be kept despite any of these outcomes. To offset the risk of losing out on potential appreciation, the option seller is paid a cash premium that is deposited into the option seller’s account and never relinquished. Taken together, the owner of an underlying security can leverage his/her shares in a meaningful manner to mitigate risk and augment portfolio returns. This can be performed in a conservative manner as long as the options are sold far beyond the current price (out-of-the-money). This exercise can be repeated on a monthly basis for small yields that can be very impactful to any portfolio over the long-term. The next piece will focus on aggressive covered call writing for short-term investors and how to optimize stock leverage.

Disclosure: At the time of publishing, the author owns shares of FB, CRM and SWKS and the author is long all these positions. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.

Don't forget that Theta. The more the better.