On March 15th, the Federal Reserve Chairman, Janet Yellen, announced that the Fed would raise its target rate to 0.75-1.00% from 0.5-0.75%. Yellen also stressed, in a clear, hawkish tone, that the United States economy is doing well. After roughly three months of “hints” embedded in the Fed’s many statements, that news was hardly a surprise.

But in the same speech, Yellen stressed that the Fed was not ready to start selling the $4.5 trillion in the Treasury Notes, Treasury Bonds and mortgage papers that it holds on its balance sheet. Instead, Yellen stressed that the Fed sees rate hikes as the monetary tool. Further, rate hikes, as a tightening measure, must first be exhausted before the Fed would start selling those trillions. That was a clear retreat from the hints the Fed had dropped in the weeks which followed President Trump’s inauguration.

In fact, one could go so far as to say Yellen’s rhetoric, with respect to the Fed’s balance sheet, has been dovish; the way Yellen specifically emphasized how cautious the Fed is about the prospect of trimming its balance sheet singled that option out as some kind of a “bomb” that the Fed doesn't really want to drop and which could send markets into panic mode. If, indeed, the US economy doing so well, why then is the Fed not ready to roll back Quantitative Easing, a stimulus measure generally considered life support for the banking system?

The first reason would be Trump’s budget. The Fed had previously signaled that it was warming up to the idea of shedding assets from its balance sheet. The federal budget under Trump was expected to swell and would, alongside catalyzing growth, catalyze inflation. But President Trump’s budget blueprint which was released earlier this month did not include details on planned tax cuts, Obamacare or any other critical agenda that could affect the overall deficit of the United States. Essentially, the Trump budget blueprint reflected merely 30% of the budget, with no clear indication of what the actual budget might end up being. And with the fiscal outlook still unclear, the Fed has more time before dropping the “bomb.”

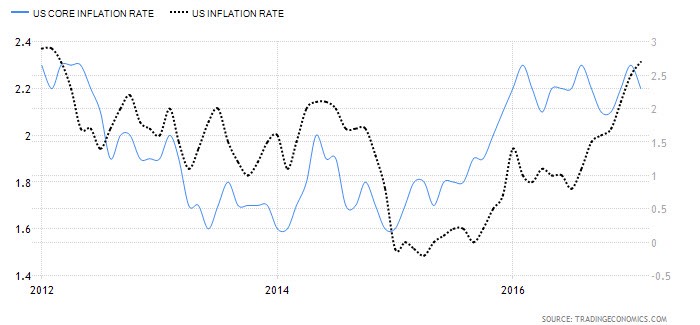

But the second reason goes a bit deeper; America’s inflation, as well as credit activity, is showing signs of cooling. As can be seen below, while headline inflation has continued to accelerate, hitting 2.7% year-on-year, core inflation has been stagnating between 2.1% and 2.3%, and that is not an encouraging sign for the near term. When it is outpacing headline inflation, core inflation can often indicate underlying inflationary pressures. However, when core inflation starts lagging headline inflation it may be an indication that inflationary pressures are beginning to stagnate.

Chart courtesy of Tradingeconomics

If we examine the credit growth in the US commercial banking system, short-term stagnation is evident as well, and when credit stagnates, it is hard for inflation to heat up.

Chart courtesy of FRED

Why The Fed’s Balance Sheet Matters

So, going back to the Fed’s so-called “bomb,” what does it matter to inflation, credit and growth? It is because of what’s on the Fed’s balance sheet – trillions of government and government agency debt that is currently “off-the-shelf” (i.e. not in the market because the Fed holds it). But, if the Fed starts to sell its holdings, that would be equivalent to a large issuance of government debt and, as is well known, for every debtor there is a creditor. Unleashing trillions of debt into the market would suck liquidity from the credit market and into government debt. If the credit market is heating up, then releasing US debt that would curb excess liquidity wouldn’t hurt too much. But when credit growth is cooling, releasing massive amounts of government debt could exacerbate what would otherwise only be a temporary slowdown in credit growth and, as we have already stressed, when credit growth slows, inflation cools.

The Fed wants inflation under control but what it dreads most is draining it too quickly and risking the health of the US economy. In fact, the temporary stagnation in inflation signals that, so far, hiking rates are, indeed, keeping inflation in check. So, when will the Fed really start to offload its balance sheet and drop the “bomb?” Simply put; when the rate hikes stop working.

Look for my post next week.

Best,

Lior Alkalay

INO.com Contributor

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

if inflation is cooling then why is the fed raising rates to begin with?. wont this cool inflation more?. i still dont understand the "fed balance sheet" . it still seems like an academic construction - it does not mean anything and it does not have any effect

thank you

The economy is simply not strong enough to do both. There is tremendous political pressure, brought forth by politicians who are economically illiterate to raise interest rates. Ergo, interest rate increases. This is not really a complex question. Since both actions have the same effect on the economy, and people are screaming that their CDs aren't paying anything, it should come as no surprise.

You have the leader of the free world declaring China is conducting "currency wars," for selling bonds, - not a totally baseless charge in this rare instance - at the same time screaming for higher interest rates - which has to make the Chinese leaders chuckle in delight, thereby accomplishing the same strong dollar. On the other hand, if the needless tax cuts for the rich and increasing the already bloated military comes to pass, then, of course, the increased deficit spending will work in the other direction.

The Fed is acting prudently, again, and it seems that now, they are the only adults in the room.