It’s been a volatile month thus far for the S&P-500 (SPY), with the index starting the month up nearly 5% before giving back all of its month-to-date gains.

This sharp reversal should not be surprising, given that the 200-day moving average is often a strong area of resistance for the general market when it’s in an intermediate downtrend.

From a fundamental standpoint, the give-back also makes sense, given that little has fundamentally changed with the Federal Reserve still laser-focused on stamping out inflation, regardless of the collateral damage caused by its hawkish stance.

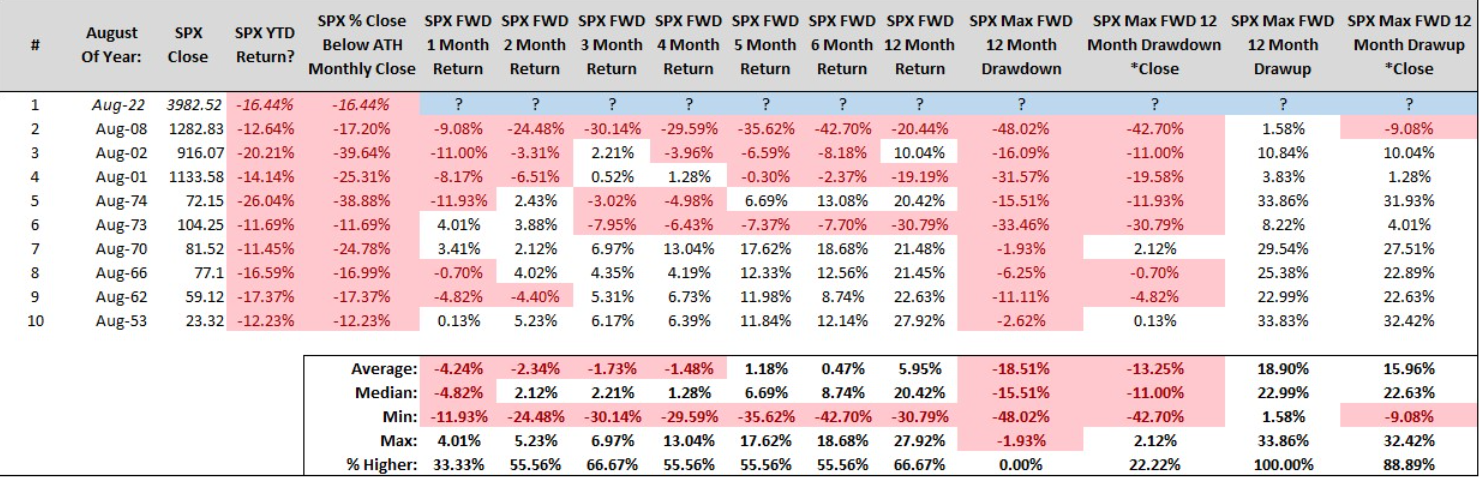

Given the weak performance, the market is now on track to close August down more than 10% year-to-date, which has historically led to further drawdowns in all cases. In fact, the median forward draw-down over the following twelve months was 15.5%, and even using the best four case drawdowns, the average twelve-month forward draw-down was 5.5%.

History doesn’t repeat itself, but it often rhymes, and assuming the S&P-500 closed at 4000 for August, this would point to a drawdown to 3380 between now and summer 2023, or a best case drawdown (average of four smallest draw-downs) to 3780. With even the best-case scenario points to a meaningful downside, caution remains warranted.

The good news is that it’s a market of stocks, not a stock market. Even in intermediate bear markets, investors can enjoy alpha by hunting down the best growth names that exhibit unique relative strength characteristics.

With many FAANG names down over 50%, finding stocks in intermediate uptrends is challenging, but there are a few stand-out names that also have impressive growth metrics. This combination is a recipe for success in all markets, and in this update, we’ll look at two names that fit this bill:

Driven Brands (DRVN)

Driven Brands (DRVN) prides itself on being a one-stop shop for comprehensive car care and has a portfolio of brands that include Maaco, Meineke, and CARSTAR, as well as Take-5 Oil Change, 1-800 RADIATOR & AC and Driven Brands Car Wash.

Maaco and Meineke provide auto repair, paint repair, and other maintenance/repair services, while CARSTAR focuses on collision work, and Driven Brands Car Wash is the world’s largest car wash company, cleaning 35+ million vehicles per year. This makes Driven Brands the leader in the automotive aftermarket and the US’s largest automotive franchise (4,400+ stores).

The company was founded in Charlotte, NC; it has a market cap of $5.2 billion, went public in Q1 2021, and has held its ground since. In fact, it’s up 17% from its IPO debut in a period when the Nasdaq-100 (QQQ) has lost over 5%.

The outperformance can be attributed to the company’s strong earnings growth and its relatively recession-resistant business model, given that car repairs are more of a need than a want. Meanwhile, though car washes are discretionary, they do not break the bank.

This recession-resistant business shone in the most recent quarterly results, with quarterly earnings per share up 40% year-over-year to $0.35, while sales soared 36% to $508.6MM. On a full-year basis, DRVN is expected to grow annual EPS by 36% ($1.20 vs. $0.88), with double-digit growth on deck in FY2024 as well.

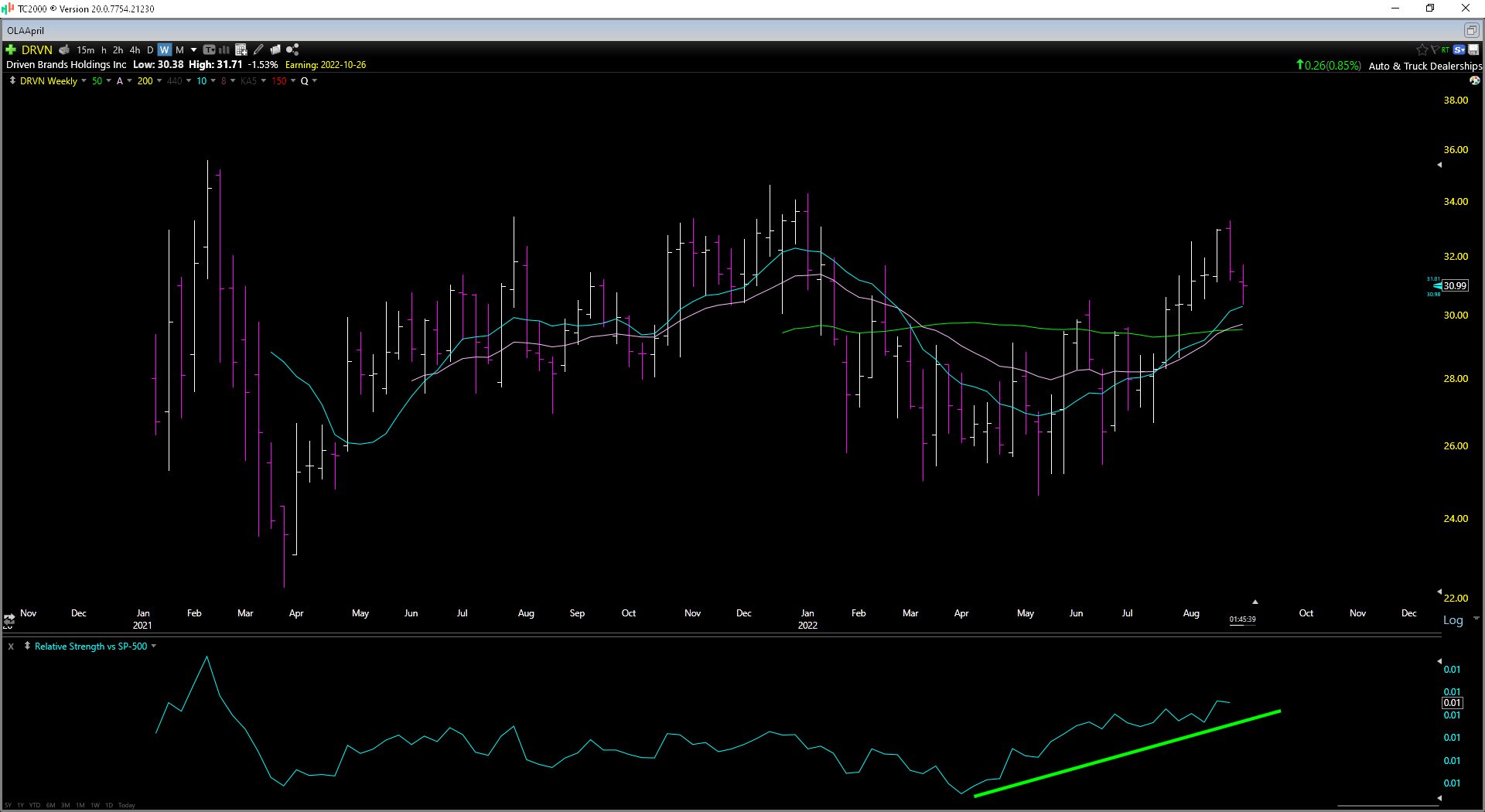

However, the most impressive part about the stock is its relative strength, which shows that it continues to outperform the S&P-500 by a wide margin, and the stock is above all of its key moving averages.

If we look at the chart above, we can see that DRVN’s relative strength line (bottom pane) continues to trend up vs. the S&P-500, suggesting that the stock may be under accumulation, evidenced by its ability to shrug off general market weakness.

In addition, the stock looks to be building a 30+ week cup base since the start of the year, and while we often see breakouts from cup-shaped bases in bull markets, the typical scenario is that handles or pullbacks on the right side of the base emerge in bear markets for the S&P-500.

I believe a further handle-building period would be a bullish development, given that it would allow DRVN to re-test its rising moving averages and shake out any weak hands. So, for investors looking for growth with momentum at their back, I see DRVN as a name worth considering on any pullbacks below $29.15.

Staar Surgical (STAA)

The second name worth keeping an eye on is Star Surgical (STAA), a mid-cap stock in the Medical Devices Sector best known for developing, patenting, and licensing the first foldable intraocular lens [IOL] for cataract surgery.

However, the company’s newest product that recently received FDA approval in the United States appears to be the real game-changer from a growth standpoint. This is its Visian Implantable Collamer Lens [ICL], a proprietary biocompatible Collamer lens material that’s implanted behind a patient’s iris, designed to treat myopia, hyperopia, and astigmatism.

For those unfamiliar with the benefits of its ICLs sold by Staar Surgical, it is that they allow another option for those looking for freedom from glasses/contacts with minimally invasive surgery and with no corneal tissue removed.

This is superior to LASIK eye surgery, given that it allows flexibility for future operations and can treat thin corneas, unlike LASIK, which is permanent due to corneal tissue removal. So far, the demand for the product is quite strong, and the total addressable market is massive, with over 100 million adults being potential candidates for its EVO ICLs.

Staar reported revenue growth of 30% ($81.1 million vs. $62.4 million) in Q2, despite limited marketing for its EVO ICLs, given that the FDA only approved them in March. On a full-year basis, the company is on track to report 28% revenue growth, or a 2-year average revenue growth rate of 34.5%, having to lap 41% growth last year.

If we look out to FY2026, these industry-leading growth rates should be maintained, with revenue on track to increase 168% from FY2022 to FY2026 ($782MM vs. $294MM). However, this will have an outsized impact on its bottom line, with the EVO ICLs having higher margins than its current product mix.

Based on what I believe to be a fair revenue multiple of 14 and FY2024 revenue estimates of $472MM, I see a fair value for the stock of $139.60 (18-month price target).

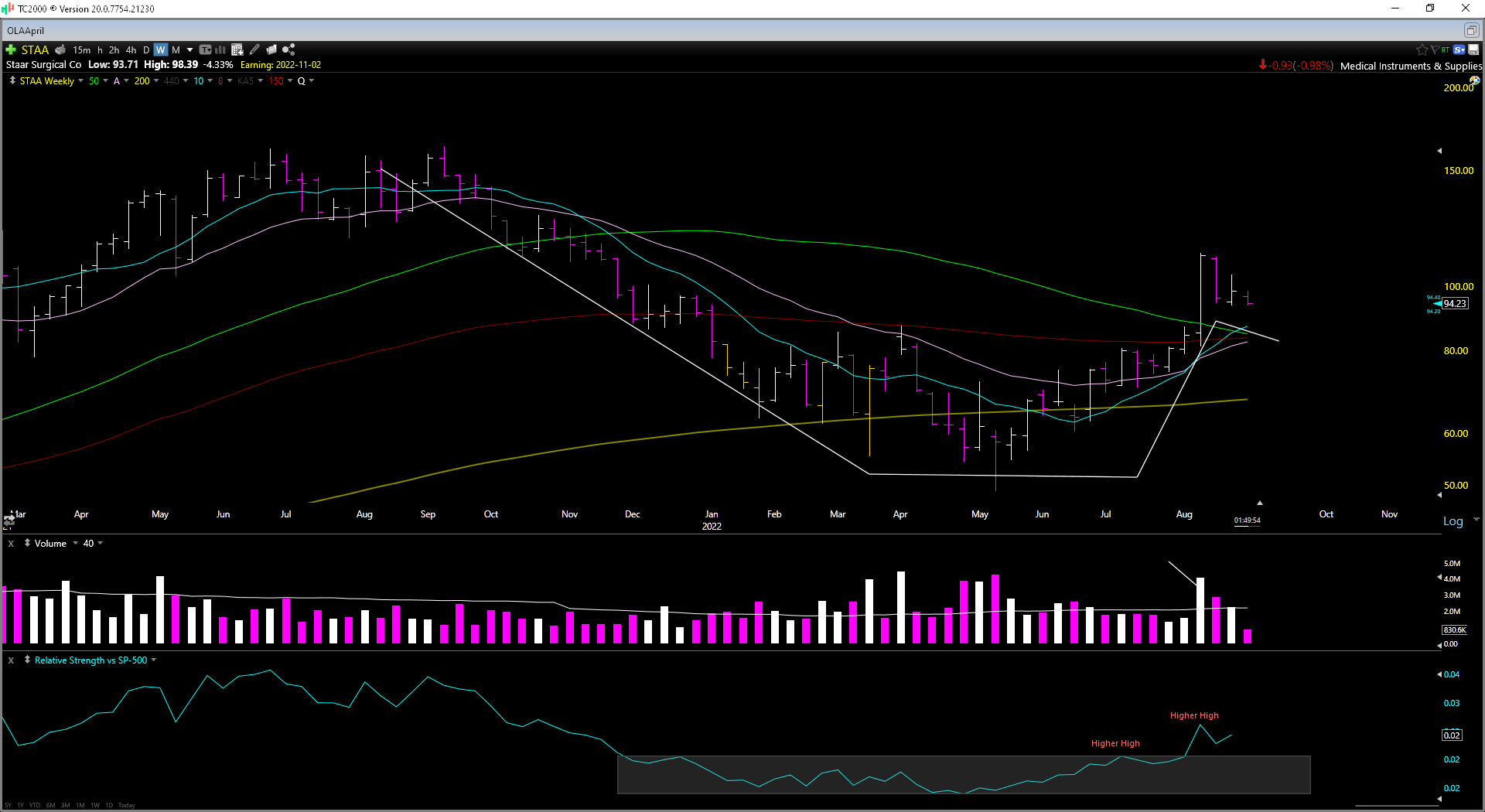

While the fundamental story is rock-solid with accelerating earnings growth on deck, the stock’s relative strength makes it stand out. As shown above, STAA is also building a cup & handle base, saw significant accumulation with 2x average volume four weeks ago, and has given up ground grudgingly in the recent market correction.

Meanwhile, it continues to make higher highs vs. the S&P-500, suggesting that it’s under accumulation. So, like DRVN, if we were to see further market weakness, I would view this as a buying opportunity for STAA.

Taylor Dart

INO.com Contributor

Disclaimer: This article is the opinion of the contributor themselves. Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information in this writing.