It’s been a volatile year for the major market averages, and the Nasdaq Composite (COMPQ) remains down 28% for the year and on track for its worst annual decline since 2008.

The difference this time is that it’s coming off a multi-year win streak and a more than decade-long bull market, making the current sell-off look more similar to 2000 than the 2008/2009 lows.

That said, for investors willing to look outside of the traditional FAANG names that have massively outperformed for years, there are always opportunities to hunt down alpha. This update will look at two general market names trading at deep discounts to fair value.

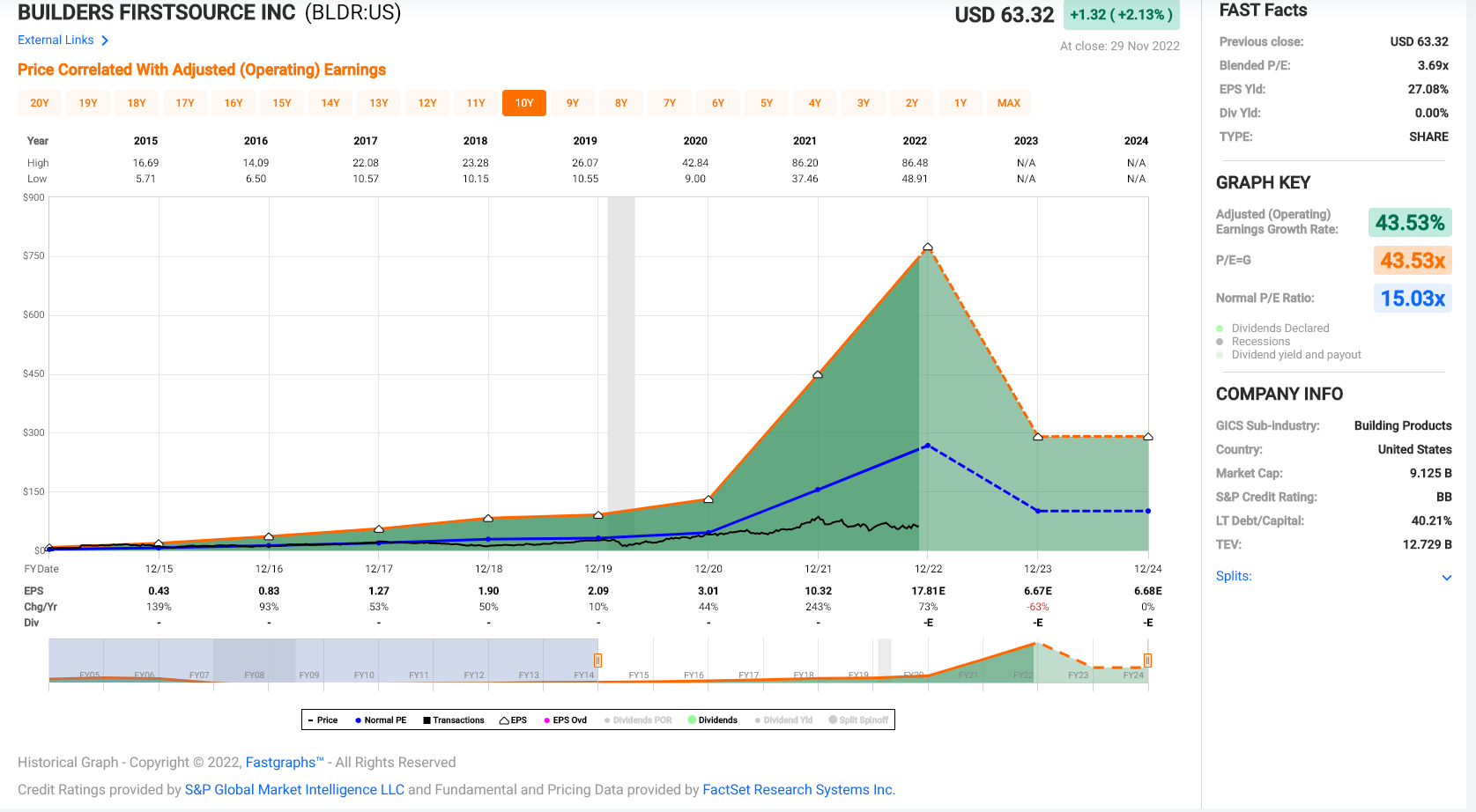

Builders FirstSource (BLDR)

Builders FirstSource (BLDR) is the largest supplier of structural building products, value-added components, and services to the professional market for the single-family and multi-family construction/repair/remodeling market in the United States.

The company has ~560 distribution/manufacturing locations across 42 states and boasts a market cap of $9.7BB.

Unfortunately, though, with the housing market teetering on a recession with new and existing home sales down sharply, investors have become worried about buildings products name, and Builders FirstSource hasn’t been immune from this anxiety despite continuing to put up phenomenal results.

In fact, the company just recently reported revenue of $5.8BB (+ 5% year-over-year) and adjusted annual EPS of $5.20, a 53% increase from the year-ago period.

Notably, these results were lapping already difficult comparisons from the year-ago period, with Q3 2021 annual EPS up 308% in the year-ago period. The strong growth in earnings was driven by ~20% growth in its higher-margin value-added products combined with aggressive share repurchases, repurchasing $2.0BB in shares to date (~30% of common shares).

Normally, I would be skeptical of a company growing annual EPS through share buybacks and buying back shares to this degree, given that many companies have a bad habit of buying back shares to prop up earnings vs. doing it opportunistically.

However, Builders FirstSource’s core business is strong with growth in its key segments (core organic sales in Value-Added Products up 20%, Repair, Remodel & Other up over 30%), and the stock is significantly undervalued.

In fact, BLDR is trading at just 9.3x FY2023 earnings estimates at a share price of $63.00, even if annual EPS is expected to fall off a cliff next year ($6.75 estimates vs. $17.60 in FY2022).

So, while the peak in earnings isn’t ideal, I see it as mostly priced into the stock here.

Based on what I believe to be a fair multiple of 11.5x earnings (historical multiple: 15.0) and FY2023 estimates of $6.75, I see a fair value for the stock of $77.60.

This points to a 23% upside from current levels, which may not appear that attractive, but I believe these estimates are far too conservative.

In fact, I would not be surprised to see annual EPS of $7.10 or better, translating to a fair value of $81.65 (30% upside) even using a conservative earnings multiple.

So, with BLDR out of favor and trading at a very reasonable valuation, I would view any pullbacks below $61.00 as buying opportunities.

Perrigo (PRGO)

Perrigo (PRGO) is a mid-cap company that develops over-the-counter and generic pharmaceuticals, diagnostic, and nutritional products.

The company’s products include YourBrand Ibuprofen, Allergy Relief, Acetaminophen, Minoxidil, Acid Reducers, and many other products, including Infant Formula.

The latter is is in short supply, and Perrigo recently scooped up Nestle’s Good Start brand and Wisconsin Plant as part of a $170MM investment in its US infant formula manufacturing.

Following the acquisition, Perrigo plans to expand plant capacity, allowing it to meet the rising demand for its store-brand infant formula that it’s struggled to fill due to the closure of the Michigan Plant held by Abbott Laboratories (ABT).

For those unfamiliar with Perrigo and looking at its chart, its been a steep fall from grace and it’s undoubtedly in a sharp downtrend.

The most recent leg down from $48.00 was related to the stock being punished for its acquisition of HRA Pharma in a deal valued at $1.8BB, and over the past five years, PRGO is down 85% from its highs of $215.00.

Normally, a stock that has lagged this badly would be one to be concerned about, and the last thing I’m interested in is negative earnings trends.

However, as we can see from the above chart, annual EPS looks like it will bottom out in FY2021 and march higher to $2.96 in FY2023 and $3.29 in FY2024.

I think a beat is possible with a tailwind as consumers trade down within self-care products due to shrinking budgets, and they go from brand names to generic no-name brands like those in Perrigo’s portfolio.

Lastly, Perrigo will see a further tailwind from a tight infant formula market as it ramps production.

Given these tailwinds combined with the fact that annual EPS looks to have bottomed out and PRGO’s attractive dividend yield of ~3.30% at $31.80 per share, I see a reason to be excited for newer investors, especially with it being a defensive name.

However, the amazing thing is that despite being a defensive name in a period where defense stocks have done very well, Perrigo is trading at its most attractive valuation in years.

In fact, at a share price of $31.80, it’s trading at just ~10.7x FY2023 earnings estimates vs. a historical multiple of 16.6x earnings.

Even if we assume a more conservative multiple of 14.9 (10% discount), PRGO’s fair value would come in at $44.10, pointing to a nearly 40% upside from current levels.

So, for investors looking for a safe way to diversify their portfolio, I see PRGO as a steal under $31.80.

While finding value in the current market isn’t easy after a 15% rally off the lows for the S&P 500, I see PRGO and BLDR as two stand-out names that are being unfairly punished and ignored by the market temporarily.

In summary, I see PRGO as a Buy at $31.80, and I would view pullbacks below $61.00 in BLDR as buying opportunities.

Disclosure: I am long PRGO

Taylor Dart

INO.com Contributor

Disclaimer: This article is the opinion of the contributor themselves. Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information in this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.