2022 was a year to forget for investors and one of the worst years in history for the 60/40 stock/bond portfolio strategy in history.

This was evidenced by both assets posting double-digit declines, with the S&P 500 (SPY) actually performing the best with a 20% decline for the year, which says a lot about the magnitude of the decline in bonds.

Fortunately, 2023 is off to a better start, and while the S&P 500 entered the year in rough shape, the Nasdaq Composite was over 30%, with sentiment for the tech sector arguably the worst it’s been in nearly a decade.

This has set up some oversold buying opportunities, and some tech names have ~65% of their value, placing them in an interesting position from a valuation standpoint.

In this update, we’ll look at two tech stocks that look to have finally bottomed and where investors could find some value in buying the dip.

Crowdstrike (CRWD)

Crowdstrike (CRWD) is a $24 billion company in the cybersecurity space, and it continues to be one of the fastest-growing companies globally, increasing annual revenue from $119 million in FY2018 to $1.45 billion in FY2022, and sales estimates are sitting at $3.8 billion for FY2025.

The company is currently the market leader in endpoint security. Its flagship product is the Falcon Platform, with continuous AI analytics on trillions of signals helping to defend the thousands of customers on its platform.

As of the company’s most recent quarter, it has 15 of the top 20 US banks on its platform, 537 of the Global 2000 companies, and 21,100 customers in total.

Notably, the company is certainly not seeing a slowdown in line with other S&P 500 companies in this recessionary environment, growing customers by 44% year-over-year and revenue by 53% to $580.9 million.

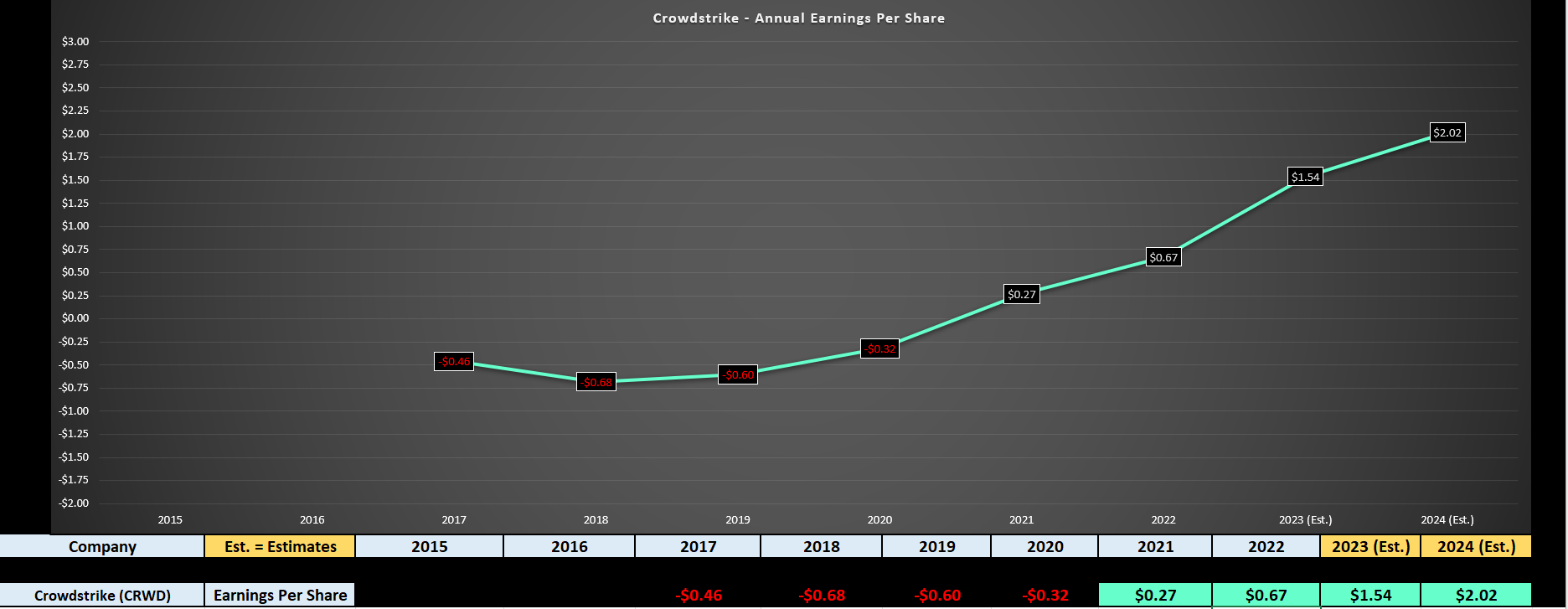

The result is that Crowdstrike is set to grow annual EPS yet again this year by a market-leading 130%, with annual EPS estimates sitting at $1.54, up from $0.67 last year. This growth is expected to continue in FY2024, with annual EPS set to come in at $2.02.

Based on what I believe to be a fair earnings multiple of 65 to reflect Crowdstrike’s market-leading growth rates and positioning as a leader in its industry, I see a fair value for the stock of $131.30, pointing to 30% upside from current levels (FY2024 estimates: $2.02).

However, Crowdstrike is likely to triple annual EPS by F2027 to $6.50,, and even at a more conservative multiple of 50, this would translate to a fair value of $325.00 per share (230% upside from current levels).

So, for investors looking for high growth at a reasonable price, I would view any pullback below $99.00 on CRWD as low-risk buying opportunities for an initial position.

Intuit (INTU)

Intuit (INTU) is a $110 billion company in the computer software industry group and is best known for QuickBooks, an accounting software package developed and marketed by the company and first offered in 1983.

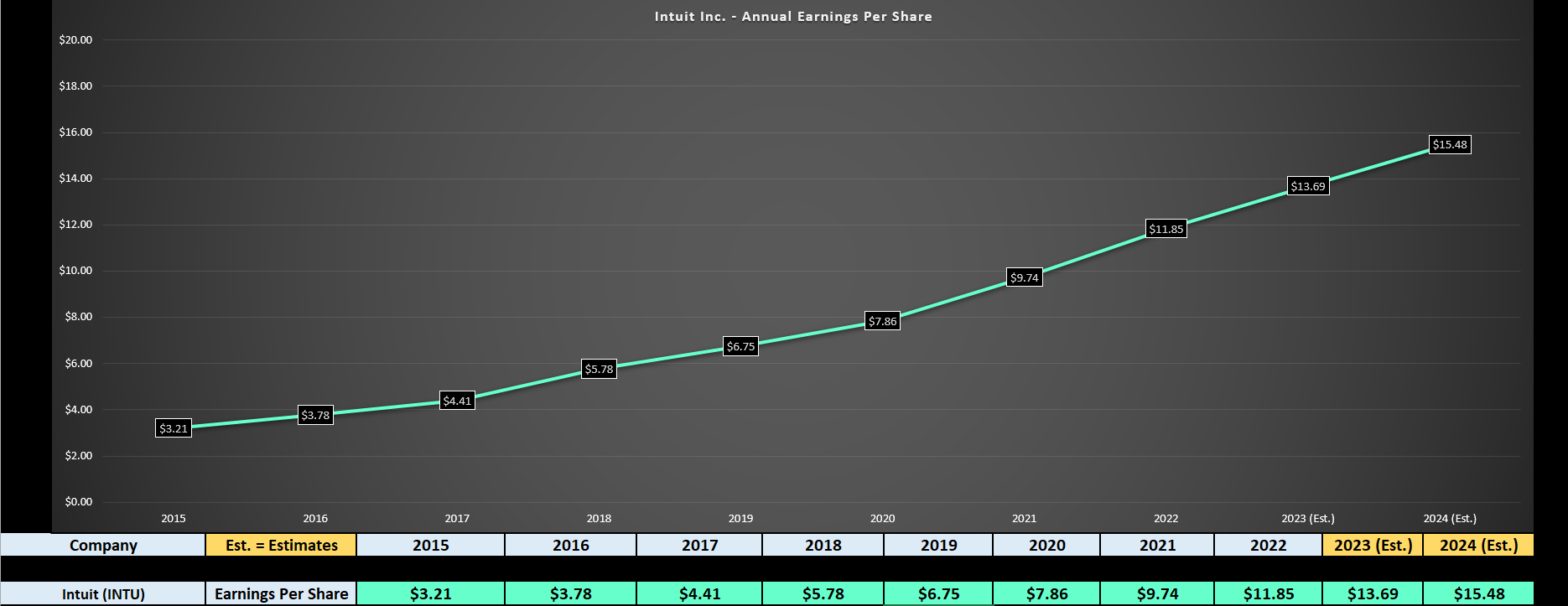

Like Crowdstrike, Intuit has seen incredible earnings growth over the past several years and, despite the recessionary environment, continues to see strong top-line growth as well. This was evidenced by revenue of $2,597 million in Q1 2023, a 29% increase from the year-ago period.

At the same time, margins have seen minimal contraction, coming in at 75.5%, with annual EPS up 9% to $1.66.

Unfortunately, with the higher interest rate environment leading to multiple compression across the market as higher discount rates are used to calculate future cash flows, Intuit has suffered materially.

This is evidenced by its share price decline by nearly 55% to a recent low of $352.00 (all-time high: $717.00). In addition, revenue in its Credit Karma segment was softer than expected, with guidance revised to a decline of 10-15% year-over-year vs. 10-15% growth, a massive guidance cut.

Still, the company still expects to grow annual EPS year-over-year due to strength in other categories, on track to report annual EPS of $13.69 in FY2023, a 16% increase year-over-year.

Historically, Intuit has traded at an average earnings multiple of 37 (10-year average), and the stock is currently trading at just ~25.2x FY2024 estimates at a share price of $390.00. This leaves the stock trading at a deep discount to historical multiples, and even based on a more conservative multiple of 32.0x earnings, I see a fair value for Intuit of $495.30.

If we measure from a current share price of $390.00, this translates to a 27% upside to fair value but assumes that Intuit doesn’t beat what I would consider conservative estimates.

So, if the stock were to decline below $373.00, which would give it a 33% upside to fair value, I would view this as a buying opportunity.

While the tech sector is full of unprofitable land mines, Intuit and Crowdstrike are unique because they are profitable and growing rapidly, but they’ve been thrown out with the bathwater.

Just as importantly, they’re now trading at more reasonable valuations and are oversold on their long-term charts. So, if we see further weakness in these names, I would view this as a buying opportunity.

Disclosure: I am long CRWD

Taylor Dart

INO.com Contributor

Disclaimer: This article is the opinion of the contributor themselves. Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information in this writing.

THANK YOU TAYLOR!! I found your article very useful (cybersecurity will be of PARAMOUNT importance going forward, & I'm impressed that CRWD is tapping A.I. analytics to help do the job)!!

Credit Karma runs a LOT of TV ads (which of course costs them money) so this likely softened their revenue (especially considering that signing up for "CreditKarma" is free...for the moment)! Management likely sees the "Credit Karma" venture as a worthwhile "good faith" investment in a future customer base! Thanks again!

PJV