Dividend investing has always been a great strategy to ensure a steady income generation irrespective of a stock's price movement.

Dividend-paying companies are mostly stable, profit-earning companies and these stocks are especially popular among those in or nearing retirement.

Of course, who doesn’t like having a little extra cash on hand? In fact, owning dividend stocks can help ensure returns from two sources, income from dividends and from share price appreciation.

So, in basic terms, a dividend is a payment made by a company to its shareholders. Mostly the dividend is quarterly, with the board of directors deciding the exact timing of the dividend and the size, which is primarily determined based on the company’s earnings and cash position.

Types Of Dividends

Cash dividends: This is the most common way companies pay dividends. The cash is directly paid into the shareholder’s account.

Stock dividends: Companies pay investors additional shares of stock instead of distributing any cash.

Dividend reinvestment program (DRIP): In this program, investors can choose to reinvest dividends received back into the company’s stock, often at a discount.

Special dividends: A company might offer a special dividend, which is a non-recurring distribution.

Preferred dividends: Preferred stock is a type of stock that functions less like a stock and more like a bond. Dividends on preferred stock are generally fixed, unlike dividends on common stocks.

How Do Dividend Stocks Work?

So, to receive dividends on a stock, you simply need to own shares of the company, and the cash will automatically be deposited into your account when the dividend is paid. Typically, companies pay dividends to share the firm’s profits with its shareholders.

However, companies might also pay dividends if they don’t have enough reinvestment opportunities. Companies usually pay dividends quarterly, monthly, or semiannually.

After a company decides to share its profits in the form of dividends, it announces the amount to be paid, the date of payment, and the ex-dividend date. This ex-dividend date is important to investors because they must own the stock to receive the dividend by that date.

Investors who purchase the stock after the ex-dividend date are not eligible to receive it. However, investors who sell the stock after the ex-dividend date are still entitled to receive it.

What Is Dividend Yield?

The dividend yield is expressed as a percentage. It is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. It is calculated by dividing the company’s annual dividend by the stock price on a certain date.

While a higher dividend yield seems an attractive opportunity, it is to be noted that a stock's dividend yield may be elevated due to a declining stock price. Dividend yield usually goes up in two ways, either because the company raised its dividend or due to a declining share price.

Here is an example to understand dividend yields:

Suppose an investor buys $10,000 worth of a stock with a dividend yield of 4% at a rate of a $100 share price. This investor owns 100 shares that all pay a dividend of $4 per share (100 x $4 = $400 total).

Assume that the investor uses the $400 in dividends to purchase four more shares.

The price would be adjusted by $4 to $96 per share on the ex-dividend date. Reinvesting would purchase 4.16 shares; dividend reinvestment programs allow for fractional share purchases. If nothing else changes, the next year, the investor will have 104.16 shares worth $10,416.

This extra amount can be reinvested into more shares once a dividend is declared, thus compounding gains similar to a savings account.

Why Should You Own Dividend Stocks?

Dividend-paying stocks tend to be relatively less volatile and may provide some hedge against inflation. Moreover, dividend stocks can be a good choice for investors looking for passive income or a long-term investment.

Warren Buffett is considered the greatest investor of all time by many. He believes in focusing on the long term, and his portfolio shows his commitment to owning shares of dividend-paying stocks.

The Fed’s aggressive monetary regime caused a bout of sell-off last year. Moreover, Fed officials have also indicated that the rate hikes will continue as the slowdown in inflation is not enough to counter the need for more interest rate increases.

The threat of a U.S. recession remains alive this year, with a recent poll of economists from the Wall Street Journal pegging the recession chances in 2023 at 61%.

Dividend-paying stocks like The Clorox Company (CLX) and Spok Holdings, Inc. (SPOK) could ensure consistent income generation for investors to endure a topsy-turvy market.

Let’s discuss these stocks in detail:

The Clorox Company (CLX)

With 100+ years of experience, CLX manufactures and markets consumer and professional products worldwide, operating through four segments: Health and Wellness; Household; Lifestyle; and International.

The company now operates in about 25 countries and territories worldwide, while its products are sold in more than 100 countries.

The company recently announced the launch of CloroxPro HealthyClean® Introduction to Healthcare, a new instructional designed microlearning module for environmental service (EVS) managers and supervisors, as part of CloroxPro HealthyClean®, an online learning platform.

Amid staffing shortages, burnout, high employee turnover issues, and training gaps, CLX’s new offering addresses these challenges. The company is constantly evolving in the cleaning and disinfecting space.

Last year, the company opened a new cat litter manufacturing plant in Martinsburg, West Virginia. The facility is projected to bring some $190 million to the local economy by manufacturing Fresh Step and Scoop Away, cat litter. This marked the third facility in the state.

CLX’s impressive track record of returning capital to shareholders is supported by its fundamentals. The company has increased its dividend for 20 consecutive years and paid an annual dividend for more than 50 consecutive years.

While CLX’s four-year average dividend yield is 2.64%, its forward annual dividend of $4.72 per share translates to a 3.04% yield at the current price. CLX’s dividend payouts have grown at a CAGR of 4.3% over the past three years and 7.2% over the past five years.

For the fiscal second quarter ended December 31, 2022, net sales increased 1.4% year-over-year to $1.72 billion. Gross profit came in at $620 million, up 11.1% from the year-ago period. Also, net earnings attributable to Clorox grew 43.5% year-over-year to $99 million. Non-GAAP EPS rose 48.5% from the prior-year quarter to $0.98.

Moreover, analysts expect CLX’s EPS to increase 2.8% year-over-year to $4.21 in the current fiscal year ending June 2023. Its revenue is expected to come in at $7.11 billion, indicating a marginal increase year-over-year.

CLX shares have gained 10.8% year-to-date to close the last trading session at $155.44. The stock is currently trading above its 50-day and 200-day moving averages of $146.35 and $143.20, indicating an uptrend.

According to MarketClub’s Trade Triangles, CLX’s long-term trend has been UP since November 22, 2022, while its intermediate-term trend has been UP since February 3, 2023. Also, the short-term trend has been UP since February 28, 2023.

The Trade Triangles are our proprietary indicators, comprised of weighted factors that include (but are not necessarily limited to) price change, percentage change, moving averages, and new highs/lows. The Trade Triangles point in the direction of short-term, intermediate, and long-term trends, looking for periods of alignment and, therefore, intense swings in price.

In terms of the Chart Analysis Score, another MarketClub proprietary tool, CLX scored +100 on a scale from -100 (strong downtrend) to +100 (strong uptrend), indicating that the uptrend will likely continue. Traders should protect gains and look for a change in score to suggest a slowdown in momentum.

The Chart Analysis Score measures trend strength and direction based on five different timing thresholds. This tool takes into account intraday price action, new daily, weekly, and monthly highs and lows, and moving averages.

Click here to see the latest Score and Signals for CLX.

Spok Holdings, Inc. (SPOK)

SPOK provides healthcare communication solutions. The company’s products help improve patient care by connecting clinical teams with the people and information they need. Spok solutions are in more than 2,200 hospitals.

Earlier this month, Spok, Inc., a wholly owned subsidiary of SPOK, announced that it had received ISO 13485:2016 certification from DEKRA Certification Inc. for designing and manufacturing of Spok® Messenger. This is a milestone achievement for the company and further confirms the reliability of its medical device.

Last year’s capital returned to stockholders totaled $25 million in the form of its regular quarterly dividend. SPOK’s four-year average dividend yield is 6.67%, and its annual dividend of $1.25 translates to a 12.51% yield on the prevailing price.

Over the past three and five years, SPOK’s dividend payouts have grown at 35.7% and 10.8% CAGRs, respectively.

In addition, the company witnessed solid bottom-line growth in its last reported quarter. SPOK’s net income increased substantially year-over-year to $24.23 million in the fiscal fourth quarter ended December 31, 2022.

Its EPS came in at $1.21, compared to a loss per share of $0.86 in the prior-year quarter. Moreover, adjusted EBITDA came in at $5.65 million, indicating an increase of 249.1% from the year-ago period.

Street expects the company’s revenue and EPS to come in at $32.26 million and $0.14 in the fiscal first quarter ending March 2023.

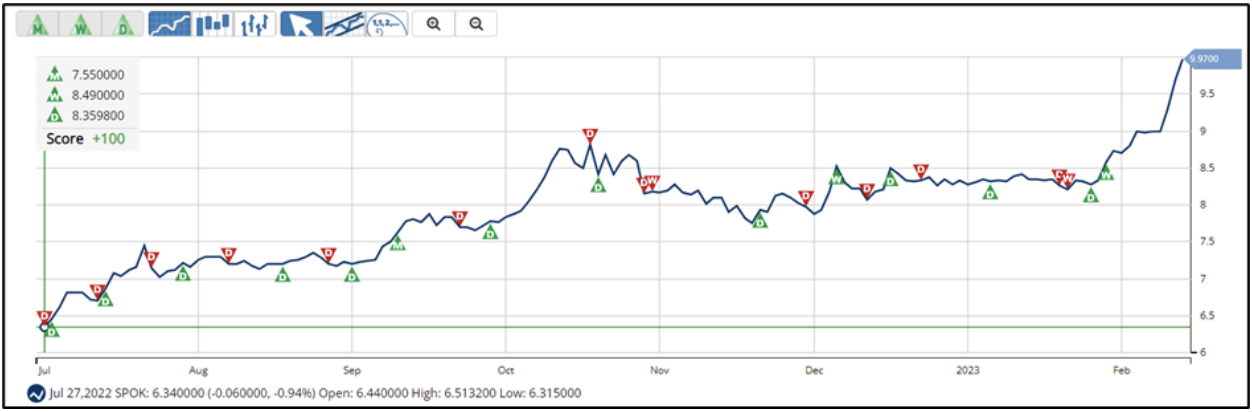

The stock has gained 18.8% over the past month to close the last trading session at $9.99. It is trading above its 50-day moving average of $8.42 and 200-day moving average of $7.62.

Trade Triangles show that SPOK has been trending UP for all three-time horizons. The long-term trend has been UP since September 30, 2022, while its intermediate-term trend has been UP since February 13, 2023. Also, the short-term trend has been UP since February 9, 2023.

In terms of the Chart Analysis Score, SPOK scored +100 on a scale from -100 (strong downtrend) to +100 (strong uptrend), indicating that the strong uptrend will likely continue. Traders should protect gains and look for a change in score to suggest a slowdown in momentum.

Click here to see the latest Score and Signals for SPOK.

What's Next for These Dividend Stocks?

Remember, the markets move fast and things may quickly change for these stocks. Our MarketClub members have access to entry and exit signals so they'll know when the trends starts to reverse.

Join MarketClub now to see the latest signals and scores, get alerts, and read member-exclusive analysis for over 350K stocks, futures, ETFs, forex pairs and mutual funds.

Best,

The MarketClub Team

su*****@in*.com