With millions of kids heading back to school in just weeks, investors may want to keep an eye on oversold retailers like Target Corp. (TGT).

Granted, Target hasn’t been popular among investors.

After all, the stock collapsed on an earnings miss. EPS came at $2.19, which was short of expectations. Revenue came at $25.17 billion. Analysts were expecting sales to come in at around $24.49 billion.

“Throughout the quarter, we faced unexpectedly high costs, driven by several factors, resulting in profitability that came in well below our expectations, and where we expect to operate over time,” Target Chief Executive Brian Cornell added.

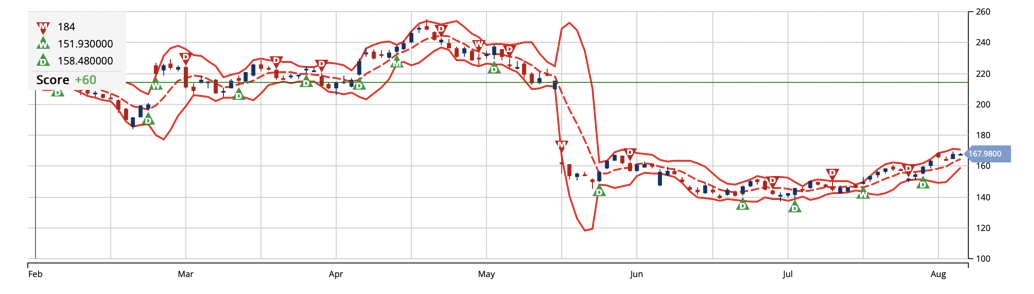

It’s why the TGT stock plummeted from about $207 to a low of $140.

But the pullback has become overkill, creating a solid opportunity.

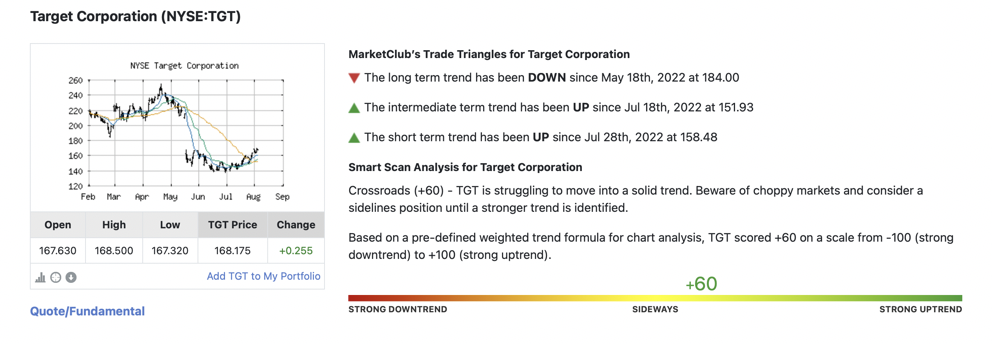

For one, according to the MarketClub tools, the intermediate and short-term trends are moving in the right direction. MarketClub is showing green weekly and daily Trade Triangles, which is an indication of further short term upside in the beaten-down retail stock.

Other analysts, such as Wells Fargo’s Edward Kelly, are just as bullish.

Kelly just upgraded TGT stock to overweight from equal weight, with a new price target of $195 a share. Even with negatives, the analyst says the sell-off is overdone, creating “the opportunity to pick up a proven share gainer into an underappreciated earnings recovery at the right price,” as quoted by Barron’s.

The back-to-school season could make the stock even more attractive.

According to K12dive.com, “A 2022 back to school survey from consulting services firm Deloitte shows concerns about inflation are not stopping parents from spending more than last year to get their children ready for the new school year. Although 57% of parents are concerned about inflation’s impact on the cost of school products, 37% plan to spend more than they did last year, the survey found. Deloitte estimates this will result in an 8% annual increase in back-to-school spending, which calculates to $661 per child versus $612 in 2021.”

Target also has a strong history of running during the back-to-school season.

In 2019, for example, TGT ran from about $80 to about $106. In 2020, TGT ran from $118 to $134. In 2021, it ran from about $237 to $263. And while the U.S. economy isn’t doing so hot at the moment, I still believe TGT could see another good run as kids get set for school again.

With MarketClub's shorter term green Trade Triangles, oversold conditions, bullish analysts, and back-to-school season just weeks away, Target could be a winner.

Ian Cooper

INO.com Contributor

The above analysis of Target Corp. (TGT) was provided by financial writer Ian Cooper. Ian Cooper is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Ian Cooper expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.