Sony Group Corporation (SONY), the Japanese tech giant, recently confirmed raising the prices of its PlayStation Plus (PS Plus) subscription service by more than 30% across all benefit plans.

Implemented on September 6, 2023, the PS Plus Essential tier has gone up to $72-$80/year depending on where you’re located, with the PS Plus Extra increasing to a whopping $134/year. The most significant bump is for the Premium tier, which has increased by $40 to $159 for a year of access. This move has, predictably, not gone down well with the gaming fraternity.

SONY justified this decision, suggesting that the price adjustment is pivotal to ensure that the company can “continue bringing high-quality games and value-added benefits to your PlayStation Plus subscription service.”

Adding to its stance, the Tokyo-based company emphasizes the cost efficiency of its 12-month subscription plan, stating it provides a significant discount when compared to the cumulative cost of purchasing several one- or three-month plans during the same period.

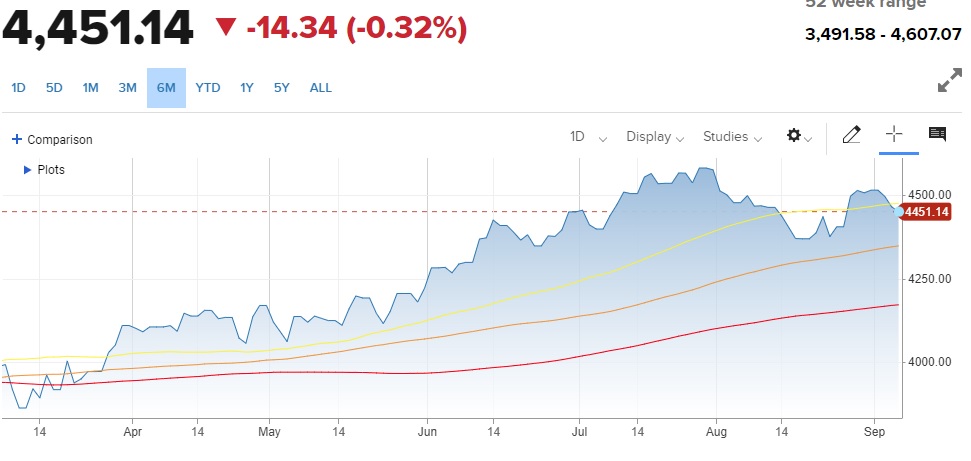

After the PlayStation Plus price hike announcement, SONY’s stock has risen the most since July. According to CLSA’s analyst Amit Garg, Sony’s move could cause a series of regular price increases from other subscription service providers.

This “steep” increase is expected to boost the company’s annual net sales by ¥100 billion, which is nearly $680.50 million. It could also add ¥55 billion (approximately $374.27 million) of operating profit annually. However, Amit Garg warned that there may be a fallout for gamer spending amid the challenging macroeconomic conditions.

Shares of SONY have gained nearly 2.5% over the past month and more than 10% year-to-date.

Although Sony’s rising stock price will benefit shareholders in the short term, gamers may be contemplating their PS Plus subscriptions, potentially leading to declined revenue in the long term.

Now, let’s review in detail what has happened over the year and discuss several factors that could impact SONY’s performance in the upcoming months:

Positive Recent Developments

On August 29, 2023, SONY’s subsidiary, Sony Electronics Inc., launched the wide-angle zoom lens G-Master™ FE 16-35mm F2.8 GM II, a 35mm full-frame α™ (Alpha™) E-mount lens that covers focal lengths from 16mm to 35mm with a maximum aperture of F2.8 over the entire zoom range.

The new launch FE 16-35mm F2.8 GM II satisfies the needs of photographers and videographers looking for high-performance lenses, with the descriptive power and high-speed AF (autofocus) unique to G Master.

Also, in the same month, the company unveiled two new additions to the Alpha 7C series of compact full-frame interchangeable lens cameras, the Alpha 7C II (model ILCE- 7CM2) and Alpha 7C R (model ILCE-7CR). These additions ensure top-tier imagery and visual performance across Sony’s state-of-the-art imaging devices and respond to the wide range of image expressions creators seek.

These fresh additions to the company’s product portfolio are expected to extend its market reach and drive its revenue stream and growth.

On June 6, Sony Electronics announced its partnership with SQUARE ENIX® on the latest standalone title in the esteemed FINAL FANTASY game franchise, FINAL FANTASY® XVI, available exclusively on PlayStation®5 (PS5™).

Deteriorating Financials

For the first quarter that ended June 30, 2023, SONY’s total sales and financial services revenue increased 32.9% year-over-year to ¥2.96 trillion ($20.14 billion). However, its operating income declined 30.1% year-over-year to ¥253.04 billion ($1.72 billion). The sharp drop in operating income was due to decreased profits in the company’s financial services and movie businesses.

Furthermore, the company’s adjusted EBITDA was ¥406.20 billion ($2.76 billion), down 18.3% year-over-year. Its net income decreased 16.6% from the year-ago value to ¥217.94 billion ($1.48 billion). Also, net income attributable to SONY’s stockholders came in at ¥175.67 per share, a decline of 16.2% year-over-year.

As of June 30, 2023, SONY’s cash and cash equivalents stood at ¥1.53 trillion ($10.41 billion), compared to ¥2.05 trillion ($13.95 billion) as of April 1, 2022.

Solid Historical Growth

Over the past three years, SONY’s revenue and EBIT grew at CAGRs of 13.9% and 8.1%, respectively. The company’s net income increased at a CAGR of 12.7% over the same time frame, while its EPS and total assets grew at 13.2% and 11.6% CAGRs, respectively.

Improved Full-Year Sales Forecast

Despite a disappointing financial performance in the last reported quarter, SONY raised its revenue forecast for the full year ending March 31, 2024, by 6.1% from the April forecast to ¥12.20 trillion ($83.02 billion), thanks to strength in its PlayStation gaming unit. The company made a 7% upward revision to its sales forecast for the Games & Network Services unit to ¥4.20 trillion ($28.58 billion).

Net income attributable to SONY’s stockholders is forecasted to be ¥860 billion ($5.85 billion), compared to its April forecast of ¥840 billion ($5.72 billion). The company’s August forecast for operating income remained unchanged at ¥270 billion ($1.84 billion). It expects full-year adjusted EBITDA of ¥1.75 trillion ($11.91 billion), which is also unchanged from the April forecast.

SONY is expecting a great year for its PlayStation gaming business. The company previously said it expects to sell a record 25 million PlayStation 5 units in the ongoing fiscal year 2024, compared with 19.1 million units in the prior year.

Moreover, the company sold 3.3 million units of the PlayStation 5 in its April-June quarter, an increase of 38% year-over-year. Although the numbers are softer compared with the December quarter, when consumer electronics tend to do well thanks to the holiday shopping period, it is still a solid result, given the macroeconomic weakness that has caused consumers to cut back their spending.

Piers Harding-Rolls, analyst at Ampere Analysis, said that Sony’s strong PlayStation results reflected its “much healthier position with regards to console availability.”

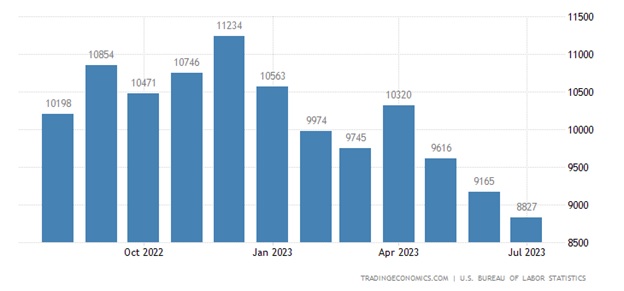

Warning About Delays in Smartphone Market Rebound

Last month, SONY warned about delays in the smartphone market recovery. The key supplier of image sensors, which are vital semiconductor components for smartphone photography and used by Apple Inc. (AAPL) and other device markers, said that it doesn’t expect demand in the smartphone market to bounce back until 2024 at the earliest due to sluggish demand in China and the U.S.

The entertainment and electronics group earlier said it expected a rebound in global smartphone sales in the second half of this year.

As a result, SONY expects its imaging sensors business to perform weaker than anticipated. For the full year 2024, the company’s operating income for the imaging sensors unit is projected to be ¥180 billion ($1.22 billion), down from an earlier forecast of ¥200 billion ($1.36 billion).

Mixed Analyst Estimates

Analysts expect SONY’s EPS to decline 21.9% year-over-year to $1.13 for the fiscal 2024 second quarter ending September 2023. However, the company’s revenue for the ongoing quarter is estimated to increase 5.1% year-over-year to $19.53 billion. Moreover, it surpassed the consensus EPS estimates in all four trailing quarters and consensus revenue estimates in three of the trailing four quarters.

For the fiscal year 2024, the company’s EPS and revenue are expected to decrease 9.6% and increase 2,172.5% year-over-year to $5.04 and $81.88 billion, respectively. Analysts expect its EPS and revenue for the fiscal year 2025 to grow 12.1% and 2.2% from the previous year to $5.64 and $83.67 billion, respectively.

Bottom Line

SONY reported a nearly 31% decline in operating income in the fiscal 2024 first quarter as its life insurance and movies units dragged on its bottom line. Nevertheless, the company raised its full-year 2024 sales forecast due to an anticipated strength for its PlayStation gaming business.

While expecting strength in the PlayStation gaming business, SONY’s key image sensor business will likely get hit by the uncertainties associated with the smartphone market this year. Sony, last month, pushed back expectations for a smartphone market recovery to 2024 at the earliest following gauging worsening demand from China and the U.S.

After falling for most of this year due to smartphone market weakness, eroding gamer spending, and other macro headwinds, SONY’s stock rose its most in more than a month after the company hiked the price of its core gaming PlayStation Plus (PS Plus) subscription service by nearly a third, potentially boosting its bottom line.

While Sony already seems to be benefitting from the PS Plus price hike, some analysts warn that the increasing stock and revenue will only last for the short term as it may cause gamers to consider canceling their subscription, leading to declined sales in the long run.

Given this backdrop, waiting for a better entry point in this stock might be prudent.