As America ages, healthcare is going to be an important issue. How companies approach this is going to make a big difference to their bottom line.

The new Affordable Care Act, which is slowly being implemented, is another dimension that will have to be factored into the future. How companies adapt and make money in the future may have more to do with how they do business, rather than the drugs they are pushing.

Today, I'll be looking at four stocks, two that are in strong bullish trends according to the Trade Triangle technology, and two that are in downtrends.

From the long side based on the Trade Triangle technology:

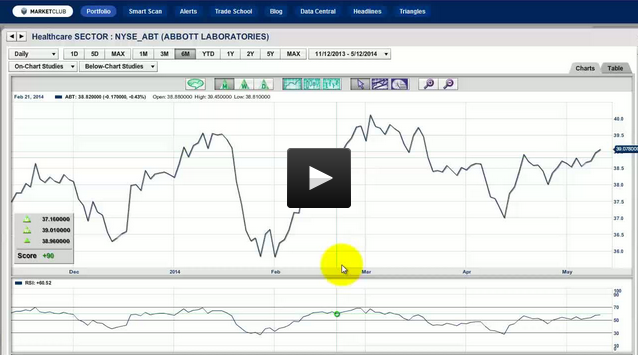

Abbott Laboratories (NYSE:ABT)

Johnson & Johnson (NYSE:JNJ)

From the short side based on the Trade Triangle technology:

Amgen Inc. (NASDAQ:AMGN)

Pfizer, Inc. (NYSE:PFE)

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

Adam appears frequently on the following financial news channels as a guest expert. Click on any cable logo to watch Adam's latest appearance.