I was recently talking to Idan, CEO of FocalEquity.com, when he mentioned something I thought was worth repeating. From '09 - '10, Idan says that he has seen a major change in trader mindset. Idan believes that shorter term traders have moved to longer time frames due to a change in market conditions.

I was recently talking to Idan, CEO of FocalEquity.com, when he mentioned something I thought was worth repeating. From '09 - '10, Idan says that he has seen a major change in trader mindset. Idan believes that shorter term traders have moved to longer time frames due to a change in market conditions.

Read on to see how Idan has come to this conclusion and be sure to visit FocalEquity.com.

-------------------------------------------------------------------------------------------------------------------------------

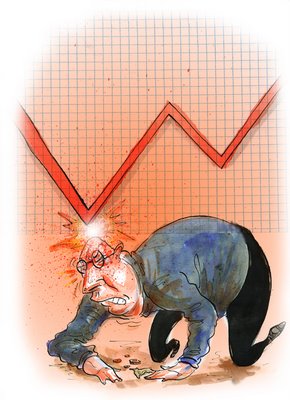

As the CEO of www.focalequity.com, I have witnessed staggering changes in the minds of retail investors in 2009. The most interesting phenomenon was that most day traders have been completely swept out of the current type of market. Continue reading "Why Day Traders of ’09 have become Swing Traders of ’10"