Thank you for your interest in this exclusive analysis and INO.com's Daily Analysis & Commentary. Please see the report below and don't hesitate to contact us at

su*****@in*.com

if you have any questions. You can also browse this Traders Blog for daily analysis, trading polls, and complimentary tools.

Published 3:00PM, September 8, 2014

I tell you, I've been around these markets a long time and I have to admit that the current run-up is amazing.

And I don’t have to prove my point with a chart of U.S. stocks. Everybody knows about the run-up: your grocer, your doctor, your baby-sitter... Ask them about stocks and you’re likely to get a simple answer:

They’re going straight up.

I won’t waste your time with a long discussion about stock market hyper-appreciation or other asset bubbles. We all know they happen. And to include this run-up in that dubious group wouldn’t be tough.

But here’s the deal: I was just as worried about the red-hot stock market two years ago. And since then the run-up, which began in January, 2009, packed on three more years of upside.

In other words, all my worry was for naught.

Certainly, a correction is down the road, even a hefty one in the 5% to 10% range. But I have no idea when that's going to happen. And neither do you. To make matters a bit easier, the run-up is backed by decent economic fundamentals. There’s growth, jobs are on the upswing, and companies are making money. Aside from the nagging grid-lock in Washington, a significant potential draw-back by the way, I would say we're in pretty good shape.

So, here we are, looking at the red-hot stock market and wondering what to do.

My thoughts? Let's keep our hands in the stock market and stick to our principals - buying good companies with outstanding fundamentals and attractive technical outlooks.

Let's add a "protective coating" to our picks by focusing on companies in traditional defensive sectors: Consumer Products, Food & Beverage, Utilities, and Healthcare. These sectors have consistent demand characteristics regardless of what's happening in the current business cycle, the economy or the stock market.

Let's also look at companies that pay a reasonable dividend and have done so for a long time. That way, we can earn extra cash income while enjoying potential stock upside.

Together these defensive plays with dividends can help us protect ourselves against any potential down-turn in the broader market or the individual stock itself.

And maybe that will ease my worry and perhaps yours as well.

For this issue, I want you to take a long look at a dividend ETF (Exchange Traded Fund) that's loaded with the best and most consistent dividend paying companies.

Then, I'll let you in on a company that boasts a mind-blowing dividend record, backed by some of the strongest fundamentals I've ever laid my eyes on.

This ETF Is A "Who’s Who" Of Top Dividend Companies

When I first rolled up on the S&P SPDR Dividend ETF (SDY) I could hardly believe my eyes. This ETF is packed with the best of the best when it comes to dividend paying stocks.

First off, the SDY buys companies that are members of the S&P Dividend Aristocrats Index. Think of this Index as an exclusive dividend club. It's not easy to get in and it's even harder to stay. So, if you're in the SDY, you're in refined dividend air indeed.

The SDY contains companies that follow a "managed dividend policy" (read: "dividends are super-important to us and we plan to pay them for a long, long time"). But here's the best part, SDY companies have to boast a record of increasing dividends for at least 20 consecutive years.

That's right, there's no typo. If you're in the SDY, you've been paying out dividends for over two decades.

I have to admit, doing just about anything for 20 years straight is a super-human accomplishment. And SDY members have to do it and do it better each year.

That's impressive.

We're not talking about some run-of-the mill list of companies either in the SDY. Not only are these dividend paying all-stars, SDY companies are also the best of the best when it comes to business. The SDY's top 20 holdings reads like a "Who's Who" of American business: AT&T, Target, Procter & Gamble, Chevron, Clorox, PepsiCo, McDonald’s, Kimberly-Clark, Coca-Cola, and Exxon. And that’s just a partial list.

SDY holdings are also spread around many of my favorite defensive sectors, including Consumer Defensive (19%), Utilities (10%), and Healthcare (8%). That means that even as a defensive play, it has just about all the bases covered.

To add icing on the cake, the price to earnings (P/E) ratio of the SDY is 18.1. That makes it an undervalued play compared to major defensive sectors including Consumer Goods (P/E 20.4), Utilities (P/E 23.2), and Healthcare (24.1). The SDY is also a value play compared to the S&P 500 (P/E 19.2).

Dividends and value – nice!

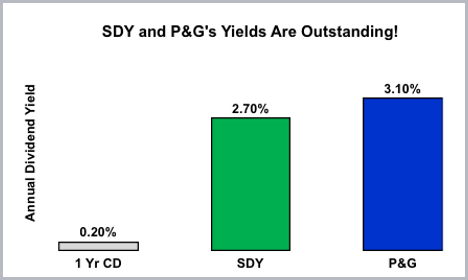

In addition to any potential appreciation in the price of SDY, holders of the ETF are paid a dividend of $2.05 per year. Compared to a recent price of $77.00, that's a dividend yield of 2.7% per year. That's a solid return, especially when compared to the current interest rate environment.

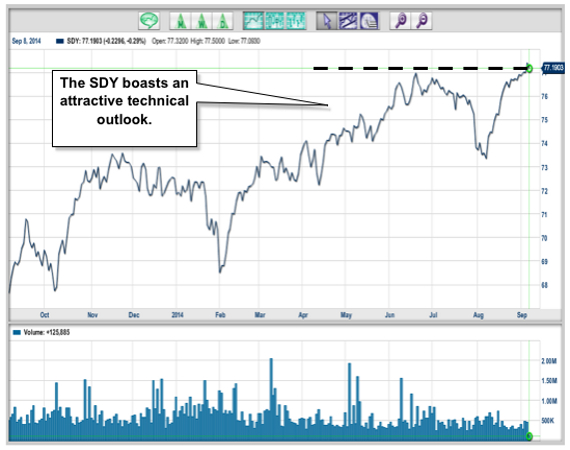

Technically, the news of SDY is positive. Take a look...

As you can see from this chart, the SDY broke above resistance at $74 in April and then powered higher. It's struggling now with the $76 to $78 range (the dotted line on the graph), but pullbacks have been reasonable and it's gathered new energy quickly. A break above this range should be in the offing soon. And then, watch out!

I could go on, but I think I've made my point. The SDY is a great place to start your dividend play.

Now, let’s turn our attention to my stand-out dividend stock.

Procter & Gamble: A Dividend Investors Paradise!

Take a cruise around just about any grocery store, convenience store, or big box retailer, and you're bound to be engulfed by brands produced by Procter & Gamble (PG). From Gillette razors to Charmin tissue to Pampers diapers, this consumer products giant is synonymous with American and global buying habits. In fact, the company's products serve over 5 billion consumers world-wide.

Huge!

Started over 176 years ago in 1837 by candle maker, William Procter, and soap maker, James Gamble, Procter & Gamble now boasts a mind-boggling 25 brand product lines that each generate over $1 billion in annual sales.

That’s right, A whopping 25 brands that each bring home $1 billion in sales. Talk about product strength!

The company generated $83 billion in sales during fiscal year 2014. Operating income, or income from the company's core activities, was $15 billion. The bottom line was about $4 a share.

Good numbers for certain, but that's not the best part.

Procter & Gamble pays $2.57 per year in dividends to each share of P&G stock. Compared to a recent price of $83.00, that translates to a dividend yield of 3.1%. That's a great return, especially when you consider that the average yield on a one year CD is a meager 0.20%!

In fact, throw together the yields on our ETF (SDY), P&G and the CD I mentioned and it's clear a picture is worth a thousand words...

The dividend payout from P&G isn't likely to go away anytime soon. In April, 2014 the company announced a handsome 7% increase in the dividend, marking the 58th consecutive year of dividend increases!

Bottom-line: With the market making just about everyone nervous, it's a good idea to keep some defensive plays ready to go in your arsenal. The dividend ETF SDY and the consumer products giant Procter & Gamble are great places to start.

I hope you enjoyed this report,

Wayne Burritt

Market Research Contributor

INO.com, Inc.

---

Wayne has over 29 years of experience in financial writing, investment analysis, and business development. Before starting Burritt Research, Inc. Wayne was a senior equity research analyst and editor for Weiss Research, a nationally acclaimed independent research and advisory firm. He directed all fundamental and editorial aspects of a variety of domestic and international option and stock services. Prior to his tenure at Weiss, Wayne was an equity analyst, marketing and trading specialist for Pan-American Financial Advisers, a boutique investment management firm. He provided security analysis, marketing support, and trading services for a large portfolio team engaging institutional and high net worth clients. Wayne also produced and starred in the critically acclaimed stock market radio show Inside the Market while at Pan-American Financial. Wayne has also held positions as Managing Director, Senior Credit Analyst, and Controller. He holds an MBA from Golden Gate University and a BA in English and Philosophy from Indiana University.

---

MarketClub is owned and operated by INO.com INC (hereafter referred to as “INO”). INO is not a registered broker dealer or a registered investment advisor. No information accessed through the INO.com website or any newsletter constitutes a recommendation to buy, sell or hold any security in any jurisdiction. Please consult a broker before purchasing or selling any securities viewed or mentioned herein. INO has made every reasonable effort to ensure that the information and assumptions on which these statements and projections are based are current, reasonable, and complete. However, a variety of factors could cause actual results to differ materially from the projections, anticipated results or other expectations expressed in this release. INO makes these statements and projections in good faith, neither INO nor its management can guarantee the accuracy of some of the content in this release containing for-ward-looking information within the meaning of Section 27 A of the Securities Act of 5/27/33 and Section 21 E of the Securities Exchange Act of 6/6/34 including statements regarding expected continual growth of the profiled company and the value of its securities. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1 995 it is hereby noted that statements contained herein that look forward in time which include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward looking statements or announcements mentioned in this release. Any investment in a company profiled by us should be made only after consultation with a qualified investment advisor and review of the publicly available financial statements and other information about the company profiled in order to verify that the investment is appropriate and suitable. Information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete.