Today's guest blogger comes from the popular MYSMP.com site and it's creator Kunal Vakil. Kunal is a man who is plugged into the market literally!! I asked him to give his unique perspective on the market...and it's symmetry.

===========================================================

First off, I want to thank Adam and Trader's Blog for allowing me to post my materials on Trader's blog.

Today, I want to share my thoughts on the S&P 500 and where I see it heading before this bear market is over. And, yes, we are in a bear market. Not only has the Dow Jones already fallen 20% off its highs of last year with the S&P 500 nearly there as well, but the price action in the broad markets has been that of a bear market. It is typical to see sharp sell-offs and ferocious bear market rallies which make even the bears capitulate, all before the market begins a move lower again. Big volume down, and low volume up. This is precisely what we have seen since the top at 1576.09 on the S&P back in October of 2007.

Now, let's talk about the culprit a little. We know that the banking index has been decimated with the exacerbating write-downs and credit quality issues due to the unscrupulous practices of many bankers and loan brokers. Many banks have lost over 50% of their value, and the beating continues. As we review the daily charts of the major banks, one can easily see a pattern that is definitive of a bear market, lower highs and lower lows. From looking at these charts, it is my firm opinion that the worst is not over yet. We are probably half way through the write-down cycle. Now what does this mean for us as traders?

Well, here is what I am watching very carefully. I want to see some of the major banks (ie. C, LEH, MER, MS, GS, FNM, FRE) start to show signs of strength relative to the entire market. I want to start seeing them make higher lows and higher highs. I want to see a base building process develop within these stocks. I want to see volume lighten up to the downside and increase to the upside. When these developments start to take place, we can start to look for long entries in these stocks. Is the US banking sector going to fall to 0? NO!, but don't try and catch a falling knife, stay patient. Remember, Cheap can always get cheaper...and it has.

Moving back to the S&P 500, I want to now walk you through a few charts that will illustrate where I think this market is headed by the Sept./October timeframe. This period historically provides some dynamite buying opportunities and it looks like this year wont disappoint.

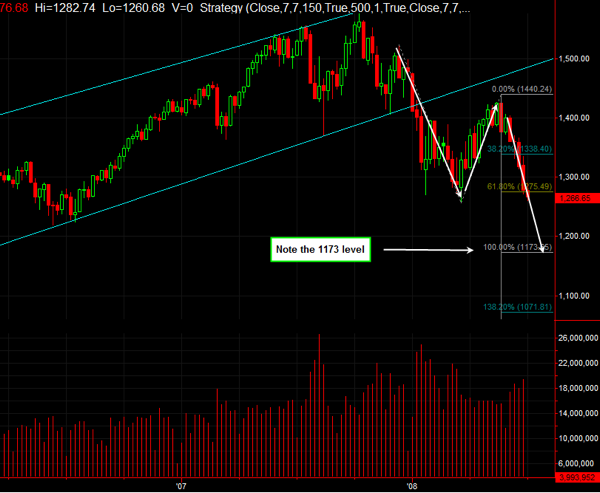

On longer term charts, especially index charts, Fibonacci retracements and extensions offer good points of support and resistance. Here you can see that the S&P has a major support area at the 1171 area. I will show you why this is a very important level.

Our next chart is another weekly chart of the S&P, however, this time notice the Fibonacci extension. Notice the initial move off the top and the subsequent rally off that reaction low created an extension target between 1353 to 1248. Notice how the 1.382 and 1.618 levels held the two lows set in January and March and the market showed its weakness by extending down to the lower end of that zone.

The next chart shows you the current extension that we are watching now. It starts with the December 2007 highs going down to the March lows and the retracement up is at the May highs around 1440. Now, notice the extension targets. The 100% extension takes us down to 1173.65, very close to the 50% Fibonacci retracement level in our first chart.

One final point in terms of symmetry that I want to make here. Back in 2003 when we were looking for a breakout in this market, the 1165 to 1175 range was a key pivotal area we watched. It represented the neckline of a massive W bottom, which some would call an inverted head and shoulders. This area is going to provide massive support on the way down.

All things considered, I am looking for another 100 point drop in this index before I can see a true bottom being put in. Remember, you want to watch the leaders on the way up and the way down. The banks have been providing that leadership and are showing no signs of letting up. Therefore, we are not bottom picking here. The speculative soul in me believes that the shoe is going to drop with one of the big banks out there. Time will tell but until then, be safe and protect your downside risk.

All the best,

Kunal Vakil

MYSMP.com

On the whole, quite informative!

That is the best summary I've read of the market with facts backing up your opinion's. Kunal - you should be very proud of yourself - an excellent report. One thing that know one seems to have considered - the investment cycle - boom bust of shares, property and fixed interest cash. I cannot remember when property and the share market have fallen sharply at the same time and oil's woe's add to the perfect storm. All the markets could have a stronger connection this time - we all live in houses, drive cars and buy shares last when we can afford too. Baby boomers also have large control over the market - if they start to get concerned a run on the market could happen if they convert to cash - well you get my drift. Look on the bright side, we still have gold & forex and smart people can make money in any market.

This is a perfect trading market, buy intraday big pull backs in names like fcx, mon,btu, cnx, lnn.....[4 to 6% ] , and sell the reversals , works like a charm.

I tend to disagree with Don. The bottom is NOT here...Like Curtiss mentioned, we're just getting through the 3-year ARMS right now. The 5-year ARMS are coming soon, and this is the nasty part...of which there are about 2-3 times more 5-years ARMS than there are 3-year ARMS. Foreclosures are going to continue going up... I agree with Kunal, one of the major broker/dealers is going to kick the can before the financials even begin to start to settle. Who's it going to be??? I have 3 targets on my scope...and who is going to be the victor when this is all said and done, and reap the rewards??? I have 2 targets on my scope...

Who wanted to barf after the close Wednesday? Even my marketclub darling stocks got hammered.

Waiting for financials to bottom will miss the bottom in the broader market - the financial sector will not lead the market this time around -- there is absolutely no reason it needs to, however, finacials will soon moderate and no longer be the heavy drag that they have been ... that is all that is needed for this market to rally in the days ahead, next week. Too much emphais has been put upon the money center institutions of NYC ...analysts there are just out of touch with the real economy across the rest of the US, which is quite a bit stronger than the financial sector (that's why the Dallas Fed wanted to raise rates at the last meeting).

The XLF ( S&P financial ETF )is riding a hair above its 10-11-2002 low and the BIX ( S&P bank index ) has already broken its 2002 lows. A careful analysis shows that it took the financials to bottom and then rally back in 2002 for the rest of the markets to rally.Will history repeat itself......likely yes ! We have not yet seen evidence of a bottom for these financials, so why try to catch a falling knife when you can wait for the turnaround and buy the pullbacks.

A bullish case for the DUG ( ultra-short oil and gas ETF ).A positive divergence is evident in the macd....daily charts from April 22 till today.....huge green volume bars vs red volume bars during that same time period,also known as accumulation.Even the hourly chart is showing the same features which could mean that the hour is near for the tyranical rise in oil.Today, we started to see a breakdown in OIH and ACI and KOL,could OIL be next? Is the SMART MONEY rotating into something else? Thankyou Mr. Kunal Vakil for a very clear view of where the market may be heading.

I tend to agree with Kunal moreso than Don --

Hearing Henry Paulson this morning speak of Bank failures days after I see a full page add from the FDIC touting the past stability of our banks (With a subliminal message being created in the add by showing a $100,000 GOLD NOTE!!) makes it clear to me that there are major happenings on the rising front. By the way, let us not forget all of the 5 year ARM's out there. The bottom is not here and now -- don't beleive it for a minute. Maybe we'll check back with Don in a year...

All of the above analysis, while sounding quite technical, actually hinges upon an overly subscribed assumption that the US financial system is 'only' half way through a period of writedowns. With Europe following the US, and yet major European banks saying today they will need no more capital, the above view on the US now seems unlikely. Even if some smaller, regional US banks fail (not a sure thing), that might only equate of 10% of recent writdowns. Also keep in mind the Housing/Foreclosure mess first hit the US markets in August of 2007. We're about to lap those negative numbers, and year-over-year comparisons will soon become easier.

The bottom is here and now ...wait for lower at your own risk.