Today I'd like everyone to welcome back Bill Poulos from ProfitsRun. Bill is launching a new forex product, Forex Profit Accelerator, and to put him to the test I wanted him to come and teach us a little more about the necessary patience needed to be a successful, yes SUCCESSFUL, forex trader. Your comments are ALWAYS welcome and needed as you help us learn more about our guest bloggers. So take a look at the article below, let the comments fly, and check out this video by Bill and let him know what you think in the comment section! See streaming video.

====================================================================

Today I want to talk about the necessity of both patience and rules when trading the forex. Trading without rules (or without a trading method) is frequently a key factor in the failure of many forex traders. Without rules, a trader has no boundaries, and while at first glance the idea of ‘freedom’ from boundaries may seem a good thing, I believe that it is not.

Here are a few examples why I say that.

Without a clear set of rules to follow, the forex trader must make every ‘call’ or every decision throughout the trading process. This creates an immense amount of pressure on the trader to get every decision correct – whether it’s identifying a trade opportunity, getting in on the trade, protecting a trade position or exiting a trade.

In addition, a forex trader may find themselves frustrated or angered by a market that moves against him, or by the lack of perceived opportunities in the market, or by a trade which, once exited, runs on to create ‘lost’ profit.

The heart of the problem for the trader like this is not having a clear set of rules to help guide their trading. And the mistakes that most often occur out of this occur from a lack of patience and failing to follow their rules (one leads to the other) are:

- Traders whose trading rules do not yield ‘daily’ trading opportunities

- Traders without patience who rush to enter or exit a trade

I believe most traders overtrade the Forex market. They need the action – it’s almost like a drug – and without a daily trade to be taken, they seem to suffer withdrawal. But to capture longer term moves in the forex market requires patience and timing (not timing the market, mind you, rather, timing in terms of when to enter a move). Without that patience to wait for a trend to develop, traders are rushed to find ‘any’ position – this frequently leads to breaking the rules of their trading method and bad trades.

Similarly, many traders, relieved to have a trade turn ‘profitable’ will rush to the exit doors with their small gain – only to watch the market continue in an uptrend. Although I will never tell a trader they’ve made a mistake taking a profit, I will always point out the better ways under which they can take profit and potentially profit even more. But in this case, the lack of patience to draw maximum pips from the market is frequently caused by not having a set of rules to follow when exiting the market to maximize profit potential.

Let me share a recent trade experience, and show how having patience and following the rules of your trading method can help you to defeat the emotional side of trading and grab the most potential profit from the market.

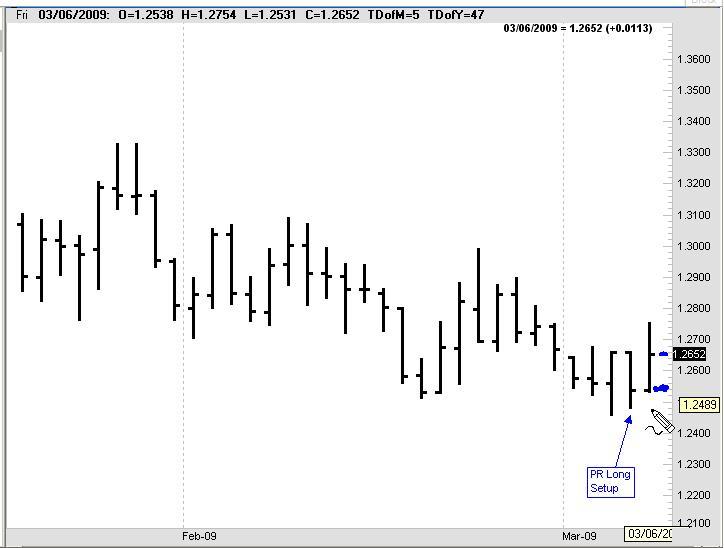

Recently a trade developed in the EUR/USD pair, which was picked up by one of my own trading methods called the Pip Reversal method. The trade would have triggered a buy position on this currency pair on March 6th at approximately the 1.2575 mark.

On March 6th, that trade would have turned profitable by nearly 200 pips – in just one day – but the trading rules of this method are what I want to focus on for you today.

In most cases, what I would see are traders exiting their position completely and taking their profit – and that’s certainly not a bad thing. But what many traders miss would be what I call “mega-moves” in the forex markets – and when traders don’t adhere to the rules of their trading programs, they typically will miss these moves.

An Exit Strategy that I use calls for exiting ½ of the position at a pre-determined price level equal to 1 ATR. On March 6th, that would have yielded 179 pips. But my strategy then calls for letting the second ½ of the position run, in the event the market is involved in a major move, and then capitalizing on the move with trailing stops. Keep in mind, many different exit strategies exist, and it’s very important that you find one that works best for your style of trading. In my case, I prefer to let a part of my position run as long as possible once I’ve been able to take some profit out of the market. What happens, however, is most traders would exit their ENTIRE position at this point – and that’s ok – but as we’ll come to see, these traders can often times miss out on substantial moves because they don’t have the patience to let the market run, or they fear giving back a strong gain for an even stronger gain.

By running an increasing level of trailing stop losses, however, this particular trade, which took nearly two weeks to complete, would have culminated in an unusual, but substantial move on March 18th, amounting to nearly 900 total pips.

At this point in the trade, I have a whole new set of exit options: I can take complete profit or, I can set a new level of trailing stops.

Either way, the potential gain in this trade for any trader was substantial – but many would have missed it because on previous days, when the markets had smaller moves, or backtracked, here’s what I see most traders doing:

- They panic and exit the trade too early

- They set their stop losses so tight, they virtually guarantee they’ll be stopped out

This is why the rules of any trading method are so important. Traders make such mistakes because they allow their emotions to get the better of them, rather than letting the ‘rules’ of their method define their trades.

So stick to the rules of your trading method – whether it’s how to identify a trade opportunity, when to get in on a trade, when to get out, or how to protect your trade – your method should guide you in all aspects of your trading opportunities and instill the patience and discipline that you undoubtedly need to succeed in the markets today.

Bill Poulos

Nice info..i'm also experienced some of the pressure in Forex trading before...but if we have a stategy and stick to our plans, there's nothing to worry about...thanks for the article..:)

Great article. He makes some really interesting points such as trading with pressure if you do not have a plan and trying to trade everyday because it is the forex market.

These are problems which market club helps to solve.

Thanks,

David

I posted a comment here this morning (my time) pointing out a weakness with the above article by Mr Poulos.

Why has my message not been posted here?

Does Market Club delete posts by members, even if the criticism is properly researched and not offensive in any way?

Is Market Club only interested in promoting its colleagues and cronies in a mindless way unwilling to publish any valid criticism, at the expense of its subscribers?

Market Club members are the real losers here, not being able to read about my experiences with the Forex Profit Accelerator method and hopefully Mr Poulos's response to my message.

Average True Range - an indicator most platforms have or you can google it.

Bill Poulos is a very smart man and I have been using Forex Profit Accelerator and Forex Income Engine for some time, with mixed results.

However I wish to take issue with Mr Poulos for using the example above, of a "Pip Reversal" long trade on the EUR/USD pair on 6 March.

Mr Poulos stresses the importance of having and strictly following the "rules".

Setup condition B for entering a Pip Reversal trade is that ADX must be above 16 at any time during the previous 2 weeks. In this case, counting back 10 bars (2 trading weeks?) from the possible setup day, the ADX was 15.9 and was heading south.

I recognized that there was a trend reversal likely, but did not enter the trade because according to my count, setup condition B was not met.

I would like an explanation from Mr Poulos himself on this apparent anomaly.

In answer to the query by Terrie about the meaning of ATR.

ATR means Average True Range which is a useful indicator which allows the setting of realistic and achievable profit targets which are an important part of the Forex Profit Accelerator, and Forex Income Engine methods.

"price level equal to 1 ATR"

What's an ATR?