From time to time, we here at the Traders Blog will feature a person or product that stands out in the trading world. Today that trader is Chris Irvin of the Wizard.com. Chris will be sharing part of his "Go Moment" trading strategy. Be sure to comment below with your thoughts and questions.

From time to time, we here at the Traders Blog will feature a person or product that stands out in the trading world. Today that trader is Chris Irvin of the Wizard.com. Chris will be sharing part of his "Go Moment" trading strategy. Be sure to comment below with your thoughts and questions.

Hello traders, I am Chris Irvin, Senior Instructor at The Wizard. For the past eight years I have been doing what I love to do - communicating the intricacies of the financial markets to those who desire to improve their trading skills. I was never a broker, although I previously spent time with a trust company as well as being a registered representative, so all of my market insights have come from my personal experiences as an active trader for over a decade. My goal is to break down difficult concepts and communicate them in an understandable and possibly humorous fashion. I have traveled across the United States, Australia and Canada to help thousands of people become more successful traders. Hopefully, this blog will help you!

Many traders struggle with being decisive. You know, pulling the trigger. Why? Mostly because they are never sure about why they are doing what they are doing. The more a trader gets hooked by the “Trading Bug” the more information they feel like they need to consume. Information overload can cause many traders to become paralyzed with uncertainty. When it comes right down to it, a trader only needs to know two things – when to get in, and when to get out.

If I am making it sound like trading is easy, I apologize. Trading is definitely not easy, especially if you don’t have a solid trading plan. A good trading plan will tell you exactly what triggers should cause you to enter a position as well as exit the position. If you don’t have a solid, easily executed trading plan you will never be a decisive trader.

Trading the “Go Moment”

Here is an example of my favorite trading strategy. I call it the “Go Moment.” Let me lay out a little background for you. Foundationally, I believe that:

- Trading with the trend is the safest way to trade - If a stock is in great demand, the trend will be up. Consider the trend as the path of least resistance. The traders that decide to trade against the trend will constantly feel like they are running on a treadmill, never getting anywhere; like they are driving the wrong way on a one way street; like they are swimming upstream. You get the point, right? Understanding that trading with the trend is the safest way to trade is a huge step towards becoming a successful trader.

- Trading Breakouts gives the greatest upside potential – Breakouts are the starting point for future volatility. This volatility is the catalyst to large price swings. This is where the money can be found.

With those two concepts on the front burner, we need to discuss our rationale for the “Go Moment” trade. It is logic! Logic works for me. Logic makes sense. Here is what I mean.

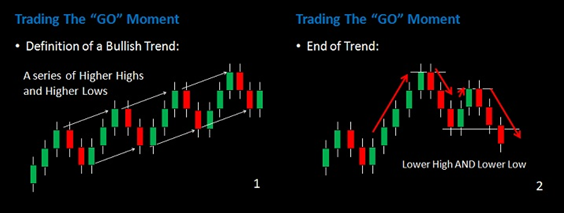

The Definition of a bullish trend is – a series of higher highs and higher lows. As long as a position continues to reach higher highs and does not set a lower low then I am going to stay in that position. If a lower low is established I will exit the position. Why? Because nowhere in the definition of a bullish trend does it say anything about a lower low. If you set a lower low, by definition, your trend is over and you should get out. It is logical!

Initially, to trade a “Go Moment” opportunity we need to find a stock with a strong trend. (For this example I will be referring to a bullish trade.) We need to find a stock that has retraced and is now moving back up in the direction of the original trend. As it breaks to a new high we enter the position. Immediate after entering the position we need to place our stop loss. The stop loss needs to go just beneath the point that we would have to logically say the bullish trend is over. That would be at the most recent retracement level, also known as the “swing Low.” The risk in the trade is the difference between the entry price and the stop loss.

The beauty of the “Go Moment” strategy is that it makes complete sense. It is logical and when a strategy is logical it helps take the emotion out of the trade so you can be a more decisive trader.

Let’s look at potential “Go Moment” trades for this week.

Step 1. Determine the Market Trend

The first step in trading is to determine the overall market trend. We never want to trade against the “Big Picture.” My trend indicators tell me that we are bullish and have been so since the beginning of December.

Step 2. Find Breakout Candidates

For my “Go Moment” scan I wanted to find stocks with a high probability for a breakout to the upside, so I searched for candidates with strong long term and short term trends. I also wanted to see that the stocks were showing increasing volume. My initial scan returned with 159 potential candidates so I narrowed the search by volume to determine where the institutional money was headed. The number that I used was a minimum of 1,000,000. I also limited the search to stock above $5.00. This reduced the list to eight.

Step 3. Determine the Ideal “Go Moment” Entry

Within the scan you can see that all the candidates are within sectors and industries that are bullish (represented in green text), and they all have very bullish long and short term trends. You will also notice that the breakout prices are clearly listed as well as the stop loss price and the target prices (50% and 75%).

The small “V” next to the “last trade” price lets us know that whether the volume for that day is above average (green) or below average (red).

Remember, the “Go Moment” strategy is based on a breakout above the specified price. Will all of the stocks break above the “Go Moment” entry? I doubt it, but that is okay. We are not looking to get into every trade. “Go Moment” traders must be patient and wait for the right trade to come to us. Once the price point has been broken we act, but not until!

Next week, Jan. 30th, I will update you on all of these candidates and talk about how they worked out.

Regards,

Chris Irvin

Trade platform comments

The trend trade breakout strategy has many challenges from what time frames to follow and how to evaluate all of the thousands of markets choices for opportunities. It can be done on your own but time is such a precious asset to a trader that a trading tool to automate the process is truly valuable.

For many years, I was manually determining the market trend and breakout prices. Then I ran across an article in the Dallas Morning News which reviewed a trading tool called The Wizard that did both.

I subscribed to The Wizard and tested it out for a couple of months. In finding the trends of the market, it is very accurate. Not only does it give market direction, it also breaks down the trends for specific industries, sectors and individual stocks, ETFs, futures and currency pairs.The value of a trading tool is measured by success and ease of use.

The Wizard updates every night for daily breakouts and on Friday night for the weekly information. A quick scan using my filters generates what I need for the week ahead. Just place the entries and stops on the trend trading breakout candidates… it’s just that easy.

Their breakout prices are what I was really impressed with. The great thing about The Wizard is that you can quickly scan the entire market for potential breakout candidates, which saved me many hours every day trying to find the trade opportunities.

The Wizard is currently running a couple of great offers on the tool. They are waiving their initial set-up fee (which can save you up to $400), so all you have to pay is the $99 monthly subscription fee. There’s also a 30-day money back guarantee with the product, allowing you to test the product out for a month. They also are giving away their Market Trend Indicator for free. This tool tracks the trends in the major indices.

To receive either of these deals, just go to The Wizard and in the upper right hand corner is the sign-up for the free Market Trend Indicator and under the “Products” tab is where you can receive the “no set-up fee” offer.

If you’d like more information on The Wizard, send an email to bi**@th*******.com and they will answer any questions you may have.

Disclaimer: Trading stocks involves a substantial degree of a risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results.

I think this is one of the most vital info for me. And i'm glad reading your article. But wanna remark on few general things, The web site style is perfect, the articles is really excellent : D. Good job, cheers

Very helpful post, thanks for sharing. But could you please explain the 50% and 75% target prices - in the case of BMS, how did you arrive at 31.05 and 32.16 respectively?

Thanks so much for this excellent post!

I subscribe to both Market Club and The Wizard and find that the two services compliment each other very nicely.

I find that the weekly Market Club triangles and the daily Wizard pre-buys/sells often occur within just a few days of each other.

This "double confirmation" system usually gives me a lot more confidence that 1. I'm on the right side of the trade 2. at the right time AND 3. with stops and profit targets that make sense and that I'm comfortable with.

Thanks so much to both Market Club and The Wizard for your excellent services.

Ichimoku is the best trading signal system.

Oh, how so?

Very helpful! Informative, straight forward, and user friendly. Thank you. I look forward to seeing more.