By Gary Tanashian

The story goes that our friends on Wall Street wink winked and nudge nudged with Alan Greenspan to cook up a massive bubble in credit and derived vehicles that eventually became malignant and spread toxic finance throughout the world. That is not a pretty picture.

Fast forward to summer, 2012 and we find Wall Street strategists wildly bullish on T bonds (in opposition to the Federal Reserve's desire to buy them) and seemingly standing in way of the great and powerful Fed's Twist operation. Are the Wall Street banks doing the public a service by showing the way to safety or are they simply holding up T bonds for the ransom of even higher prices than those denoted by today's record low interest rates?

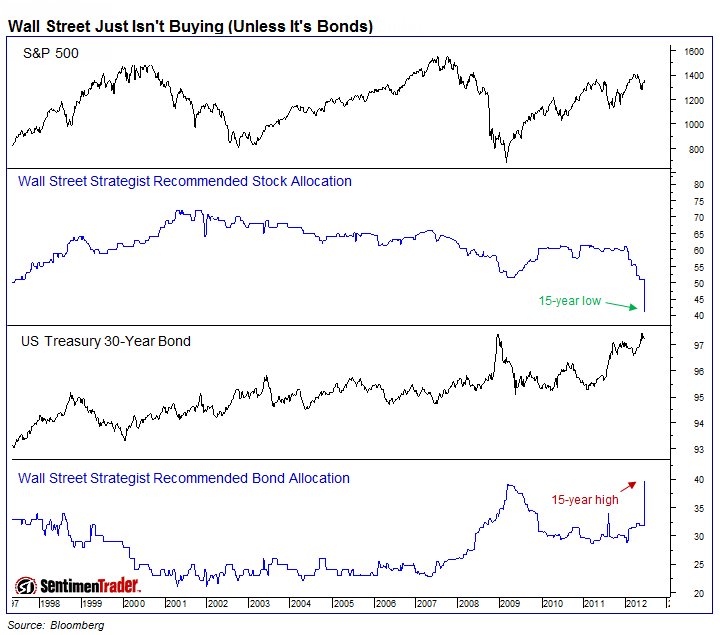

Here is a picture of Wall Street strategists' alignment courtesy of Sentimentrader.com.

While I would love for us all to sing Kumbaya and integrate Wall Street's needs with those of Main Street, it appears that the boys and girls on 'the street' are simply holding up a buyer that has made the purchase of these bonds the central theme of its monetary policy; a buyer that has to buy.

The current Fed operation is to buy long dated maturities, keeping rates low for critical areas of the economy while funding these buys by selling shorter dated maturities to 'sanitize' the operation, i.e. to keep it from increasing the money supply. In other words, selling short term bonds allows the Fed to avoid printing new money into existence to fund its long term bond buying operation.

In this context the stance of the Wall Street dealers makes sense. They are holding an (in my opinion, over valued) asset that a big buyer states to be critical to its strategy, whether by Operation Twist or any coming QE operation in which the Fed wishes to make its inflationary intents widely known to 'promote' inflationary asset price appreciation. They hold this asset dear, with the buyer backed into a corner.

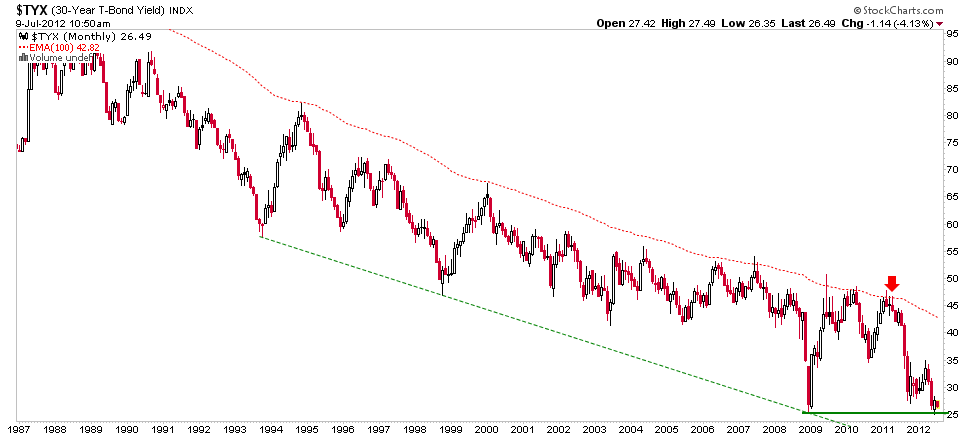

The timing of a 'QE' style inflation is unknown and complicated by the degree to which the public came to call for the Fed's head (so to speak) during the last inflationary cycle that ended a little over a year ago with T bond yields right at the boiling point (red arrow by our long term 30 year yield chart AKA the 'Continuum'):

As you can see, things are very different now, with bond dealers pushing another limit. In spring of 2011 bond king Bill Gross was short the long bond. Today big dealers are pressing longs. If this is a real deflation, look for the yield to drop to the unthinkable green dotted lower channel line. If it is a prelude to a coming inflation operation, expect the horizontal green support line to hold.

In recent newsletters we have been noting several anomalies and conflicting signals that can jam the radar of mere mortals (like this writer). Hence, the only sensible stance is to take what the market gives us and keep risk management in the forefront. July is seen as being a 'chop' month, after a healthy rally from the May bottom. The rally is intact with a series of higher highs and higher lows, but I would like to see some of the anomalies clear before pressing the bull case.

One of those anomalies is the amazing configuration currently in play in T bonds.

http://www.biiwii.blogspot.com

http://www.biiwii.com/analysis.htm

We've been Greenspammed!

Feeding the huge investment banks endless cash while the little guys are being starved, leaving real estate assets in shambles. This on top of millions of stateside industrial jobs vaporized by the lust for import.

Go figure!

Steve Starr - great summary!!!

The Fed has to buy bonds because nobody else will, and the choice is to default now -- or later. This is not a "flight to quality" unless you define quality as a nation with annual $1.5 to $2 trillion (as in 2 thousand billion dollar) deficits, with the GDP less than the national debt, with 70% of jobs in the service sector since the industrial base was exported (along with all the gold from Fort Knox), with one-third of households underwater on their home mortgages, close to 17% unemployment and 7-10% inflation (if you do the numbers honestly). With a national debt of what, $16 trillion, the US sure as hell can't afford to let the interest rates go up on THAT. Better to create endless trillions in interest rate swaps to prop up endless trillions in bond sales -- to be mostly bought before the auction by the Federal Reserve.

One more final observation . . . the US is the only large nation that does NOT own its central bank, i.e. the Federal Reserve. Why in hell are we paying "interest" on a debt for "borrowed" currency that our own nation should be in charge of issuing? Who gets the "interest"? Got any names and figures?

I'm still trying to figure out where QE1 and QE2 has helped out?