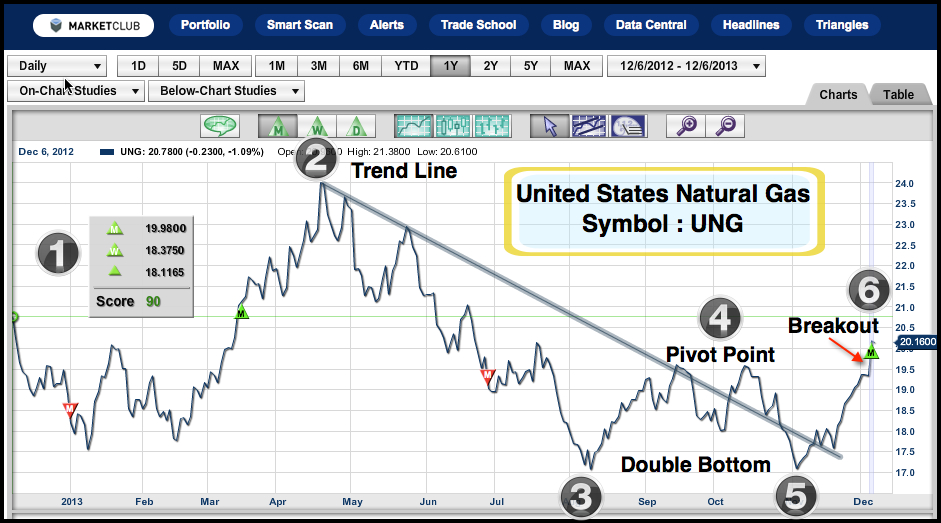

1) Trade Triangles Positive. (2) Trend Line. (3) First Bottom of Double Bottom. (4) Pivot Point. (5) Second Bottom of Double Bottom. (6) Breakout. Upside target zone for UNG $23-$24.

![]() Loading ...

Loading ...

Be sure to add your comments below. Thanks, the INO.com Team

If lucky, a pullback of less than 50%...then maybe to 26. I haven't done a point and figure chart yet for more exact measurements. This is my first time also I think.

The second test of the of the descending trend line (2), with a stop under the wave 2 pivot, would have you in the the early stage of wave 3.

Good spot Adam, thank you for teaching all of us.

C. Davies,

That’s great information,thanks for sharing your information with everyone.

Appreciate your kind words.

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

With the continuing and growing opposition to coal fired electricity the demand for natural gas will continue to rise. In Australia the conversion of vehicles to gas has reached the point where every service station retails self serve gas.

It should be remembered that a large part of the reduction in gasoline usage has been the result of more efficient engines to meet emission standards, the next step may well be to lower emission gas engines.

I also agree with the above comments regarding the establishment of loading terminals which will tend to bring the US price in line with world prices.

Bob,

Thanks for contributing to the conversation, much appreciated. The information you shared is great info for everyone to be aware of.

All the best,

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

A good buy on a pull back since it has run up so much. A great day trade. A buy on the weekly triangle would have been a better trade to hold through the MO triangle. UNG< BOIL< UDAZ on my radar.

Thanks for sharing Sarah. I'm keeping and eye on UNG and Boil as well. However I feel that the volume is low on BOIL. I like the volume on UNG a lot better.

Cheers,

Jeremy

opps meant UGAZ...not UDAZ

This classic double bottom looks very bullish to me. The issue of supply and demand is minor since there is essentially a practical unlimited demand if export is not curtailed.

Charles,

I like your thinking. Thanks for sharing with everyone.

All the best,

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

my simple understanding of Elliott Wave suggests that between 2 - 3 is a five wave structure and between 3- 6 is probably a three wave. That implies the trend is still down and it will turn very soon to resume the down trend

Hmmm ... Buy, set stop just under the double top with no more than 2% of one's investment money - adjust the number of shares accordingly. Monitor/adjust stop until stopped out or you get an obvious sign for trend change ... we all have favorites ... a red triangle?

Johnny,

Could not have said it any better, thank you for sharing your ideas with fellow members.

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

I believe that the price of LNG will fluctuate with the seasons for a few yeas, and then, will depend on supply and demand. This is my 1st post.

Frank,

Welcome. Appreciate your feedback and input.

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

I believe that the price of LNG will fluctuate with the seasons for a few yeas, and then, will depend on supply and demand.

Frank,

Thanks for contributing to the conversation, much appreciated.

All the best,

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

Another positive factor is the volume on 5 Dec 13 when the monthly green triangle occurred. It was 2.4 times the 50 day average.

Both your system and mine are telling me the UNG is a buy and fixing to go up. However there stands a chance that it will test the low again. You ask why I simply have that hunch.

James,

Thats always a probability, but I believe it is a very low probability.

Cheers,

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

Based on the chart and the latest unemployment numbers, UNG looks like it's bullish.

Chet,

Appreciate your feedback and input.

All the best,

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

Natural Gas prices are not about to start climbing for quite a while, we will see 3 - 5 years of low prices with it slowly trending upwards near the end of this period.

Oilace,

Thanks for contributing to the conversation, much appreciated.

Every success,

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

Double bottoms with upside breakouts don't always lead to continuation patterns to the upside. Just look at GDX (on a daily chart) in late 2012 for an example.

Chalezer,

You are right, there are no guarantees in trading, only odds, and the odds look good for this ETF.

All the best,

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

The Commitment of Traders" "Net Positive" values for "Commercials" has been mapping out a long-term accumulation pattern for Natural Gas futures for some time now. This is as good a time as any for this market to shift higher in price on a long term basis, with the "Large Speculators" component of the Commitment of Traders beginning to drive this market higher; and the "net-buyers/longs" of the Commercials to begin to shift toward "net-sellers/short"; and the Large Speculators to do just the opposite.

David,

That’s great information,thanks for sharing your knowledge with everyone.

Every success,

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com

I believe in 2014 and 2015 we will see a convergence of three events that will have the ability to push the price of NG much higher.

The following are the three events:

1) The implementation of EPA emissions standards that will require coal fired electric generation plants to convert to NG or shutter the facility.

2) The coming online of Cheniere Energy's LNG export facilities that will export vast amounts of LNG to Europe, Asia and India.

3) The introduction of the Cummings Westport LNG and CNG engines for large commercial trucks.

Regards.

Dale,

I like your thinking. Thanks for sharing with everyone.

All the best,

Adam

Adam Hewison

President, INO.com

Co-Founder of MarketClub.com