Today, I'm going to be looking at two stocks and their recent Trade Triangle signals.

Netflix (NASDAQ:NFLX)

Netflix, Inc. (NASDAQ:NFLX) provides Internet television network service that enables subscribers to stream TV shows and movies directly on TVs, computers, and mobile devices in the United States and internationally.

Netflix had a recent Trade Triangle exit signal at $359.04 on 1/6/14. The very next day this stock dropped like a brick and shaved 5.58% off the value of this company. That’s why Trade Triangles matter.

Want to analyze Netflix Inc.(NASDAQ:NFLX) or another symbol? Try our Free Stock Trend Analysis Report.

BLACK CHART NUMBERS

1. Weekly Trade Triangle entry signal @ $334.50

2. Trade Triangle information

3. Weekly Trade Triangle entry signal @ $359.04

4. Netflix down 5.58% in one day.

To summarize, I expect Netflix to be on the defensive in the near-term, unless I see otherwise in the Trade Triangle technology.

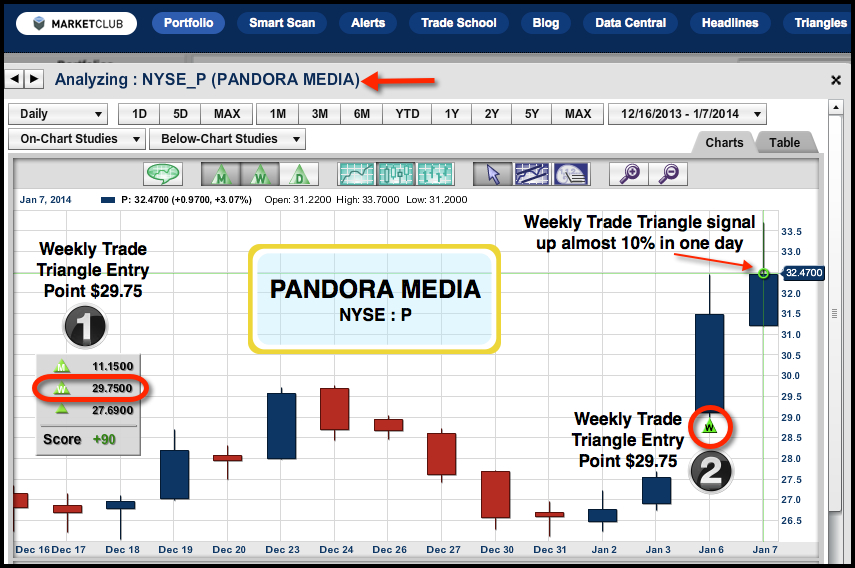

Pandora Media (NYSE:P)

Pandora Media, Inc. (NYSE:P) provides Internet radio services in the United States. The company allows listeners to create up to 100 personalized stations to access unlimited hours of free music and comedy, as well as offers Pandora One, a paid subscription service to listeners.

Pandora Media had a recent Trade Triangle entry signal on 1/6/14 at $29.75. The very next day this stock skyrocketed up and added almost 10% overnight to the value of this company and to the bottom line of MarketClub members world wide. That’s why Trade Triangles matter.

Want to analyze Pandora Media Inc.(NYSE:P) or another symbol? Try our Free Stock Trend Analysis Report.

BLACK CHART NUMBERS

1. Weekly Trade Triangle entry signal @ $29.75

2. Weekly Trade Triangle entry signal @ $29.75

3. Pandora up almost 10% in one day after signal

To summarize, I expect Pandora to remain positive in the near-term, unless the Trade Triangle technology issues an exit signal.

I hope you found this spotlight on MarketClub’s Trade Triangle technology informative and helpful to you.

Every success using Trade Triangles in 2014,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

on the real-time chart...are we going to look and wait till the end of the day to see if green or red triangle will showÉ (ex. weekly and monthly)

Should one always use the green Weekly trade triangle as an entry signal?

Hi Ginny,

Here is our suggested way of trading stocks using our Trade Triangle technology.

TRADING RULES: How the Trade Triangles work in Stocks.

Use the monthly Trade Triangle to determine the major trend and initial positions. Use the weekly Trade Triangles for timing purposes.

Let me give you an example: if the last monthly Trade Triangle is GREEN, this indicates that the major trend is up for that stock. You would use the initial GREEN monthly Trade Triangle as an entry point. You would then use the next RED weekly Trade Triangle as an exit point. You would only reenter a long position if and when a GREEN weekly Trade Triangle kicked in. You would then use the next RED weekly Trade Triangle as an exit point, provided that the GREEN monthly Trade Triangle is still in place and the trend is positive for the stock.

Cheers,

Jeremy

Thank you so much, Jeremy. Appreciate the good info.

ginny