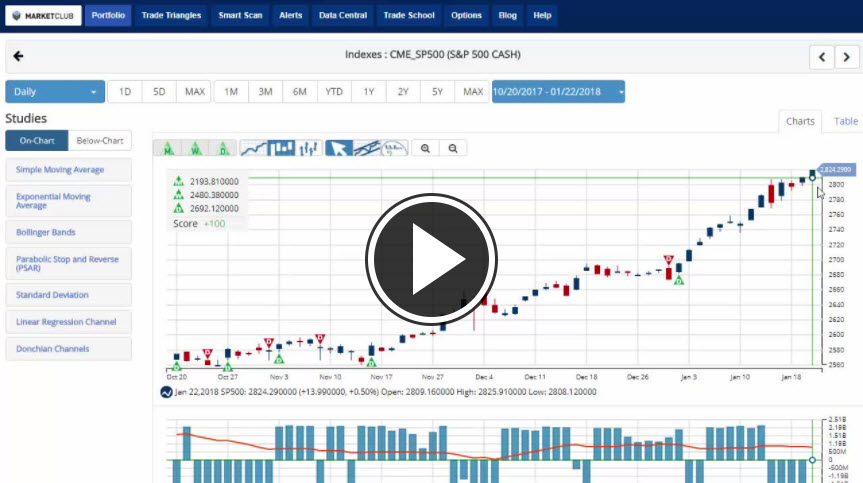

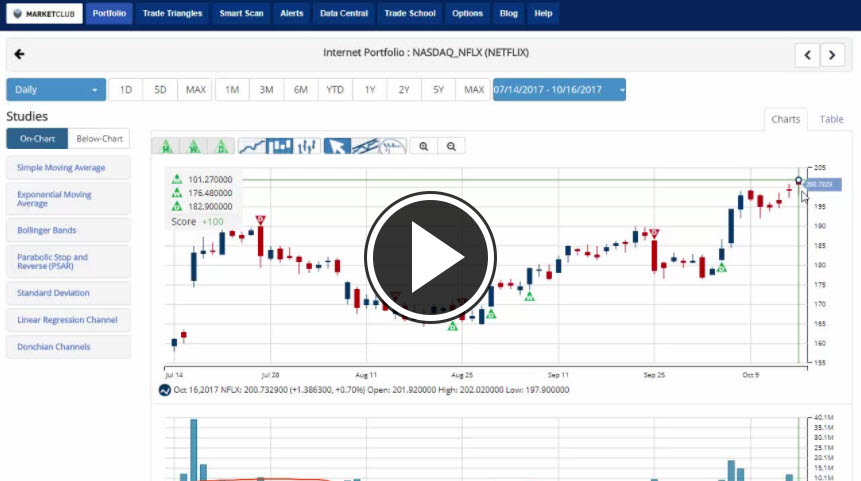

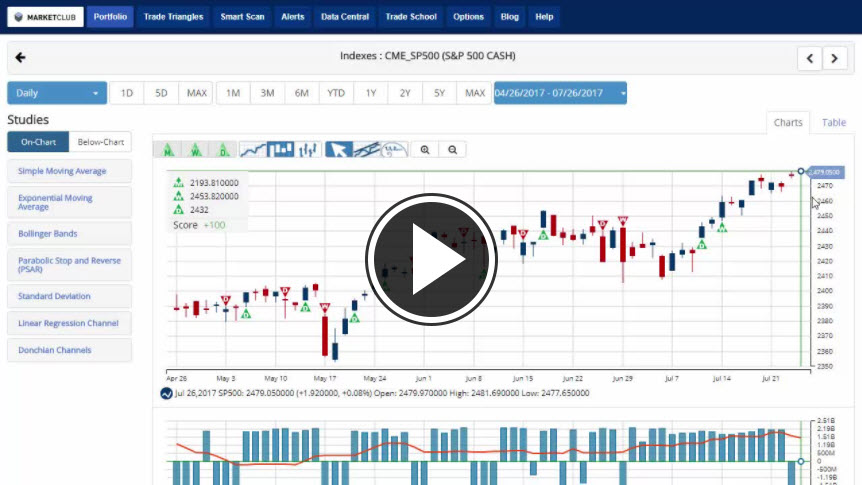

Despite only being three months into 2018, investors have been on quite a wild ride. The market started off the year as it ended 2017, on a tear higher, then the brief crash in early February, which led to a nice calm recovery during the remainder of the month just to run into what I’m calling “Whipsaw March” with the market jumping higher and lower by more than 1% nearly every other day. Not only have the major indexes been extremely volatile, but some of 2017’s biggest winners, big technology and especially the FANG stocks have seen their prices fall more than 10% in 2018.

Big pops that reverse fortune and the big drops that follow always cause investors to wonder what they could have done to protect themselves from the decline without completely abandoning their position.

The most straightforward and most effective answer to that situation is to rebalance your portfolio. Rebalancing is when you bring the percentage of your holdings back in line with each other.

For example, if you have a portfolio made up of 10 stocks and each represents roughly 10% of your portfolio, you would have a ‘balanced portfolio.’ Now if one of your stocks outperformed the others and ended up representing say 25% of your portfolio, instead of just 10%, then you would rebalance by selling some of your shares in that company until it represented 10% of your total portfolio. Continue reading "Why Rebalancing Your Portfolio Is Important"