Back in January, I had predicted that the Fed was on the cusp of postponing its decision to raise rates and that they might, in fact, perhaps as soon as early March, require investors to exercise even greater patience. As we await next week’s inflation data, Janet Yellen’s testimony and US growth figures, it would seem that investors have gradually become “acclimated” to just such a scenario, hence the plunge in yields on 1-year US Treasury bills to 0.19% as of this morning. That means that investors are pricing the Fed’s next rate hike to be as late as next year. For anxious Dollar bulls ahead of next week’s release of US inflation data and the Fed Chief’s testimony, this could serve as a warning sign. Should Dollar investors start to be worried?

What Drives the Dollar?

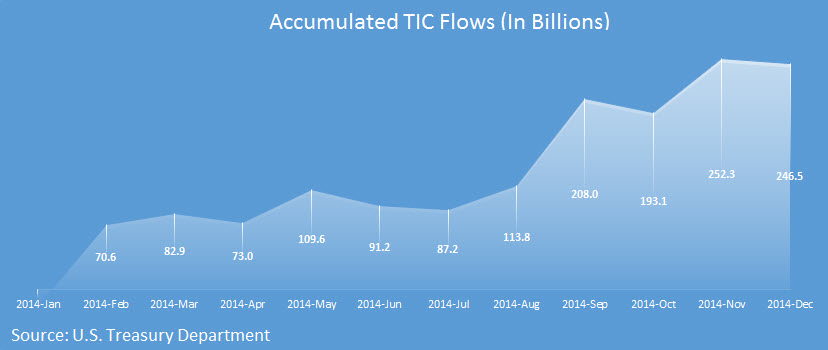

As seen in the chart below provided by the US Treasury Department, the US has experienced massive inflows of roughly a quarter trillion Dollars from long-term foreign investors in treasuries and securities. Yet, when breaking down those levels, a rather clear understanding emerges; the force driving those inflows are foreign demand for US bonds and notes amid US superior yields. Even after the latest decline in US yields, US 10-year bonds were yielding 2.05%, while the equivalent German bonds were yielding a mere 0.38%. And since bonds and notes are the major driver of inflows, it is likely that the yield differential is what’s holding Dollar demand. This yield differential is, of course, a result of the divergence between US monetary policy and that of the ECB. And what drives this massive divergence? Of course, it is the inflationary outlook that, thus far, has deviated between the US and the Eurozone.

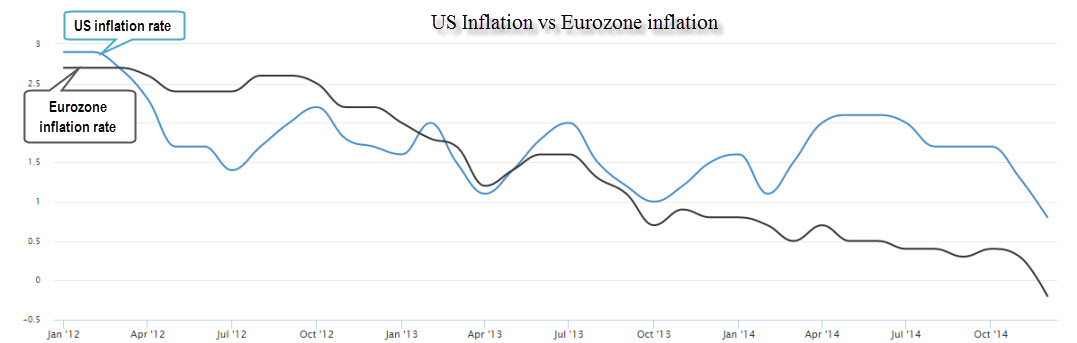

Chart courtesy of Tradingeconomics.com

As seen in the inflation chart below, US inflation is still much higher than that of the Eurozone, with the US inflation rate at 0.8% vs a -0.2% in the Eurozone, a 1% difference. While this current difference is still substantial, it has narrowed quickly, as the gap was 1.6% just a few months ago. Next week, both the US and the Eurozone are set to release inflation data which could either be positive for the Dollar or negative, depending, of course, on the outcome. If, next week, the inflation gap between the US and the Eurozone narrows further it could change a certain “assumption” in investors’ minds; that is, it could lead investors to conclude that US inflation is likely to “catch up” with the negative or deflationary levels of Europe and this could ignite the yields on US Treasuries to narrow the gap with the Eurozone’s sovereign bonds. And as one might expect, this could put a dent in Dollar appetite and ignite the long awaited profit taking that many contrarians have called for.

The Big “If”

But there is also a very big if which makes counter Dollar positions more risky now than usual. While weak retail sales may indeed point to another plunge in inflation, the chance that the gap will hold, or even widen, remains highly probable. For instance, if US inflation plunges to 0.6% and if Eurozone inflation meets analysts’ expectations and plunges to -0.6%, the gap could widen to 1.2%, which would create another boost in demand for US bonds and, you guessed it, a Dollar rally. After all, while it may be true that retail sales are weak bear in mind that US unemployment hasn’t been this low in many years and that might just be enough to allow US inflation rates to hold.

Selling Dollars a Bad Idea?

This brings us, of course, to the bottom line; there is a very good chance that US inflation will close the gap with the Eurozone and take another nose dive which would ignite a long awaited Dollar sell off which, consequently, makes a current Dollar short bet very lucrative, i.e. when the Dollar is high. Yet while this may have been a natural conclusion of mine, just when the Dollar is high and vulnerable, the fact is the current climate makes the risk of shorting the Dollar a “questionable” bet. That’s because the current climate creates all too many hurdles for the Euro. Let’s say that the gap is maintained, and assuming Yellen maintains a rate hike bias, the Dollar could very easily surge even higher. But, if the gap is narrowed, the appetite for the Euro could be derailed by various factors such as the chance that Greece will exit the Euro, or the fact that while the Fed could postpone rate hikes it’s unlikely that the Fed would make a U-turn and begin another round of QE. Therefore, while the response to a broadening or even a stable inflation gap could be very much bullish for the Dollar, investors, amid the current risks, may surprise and be indifferent to a narrowing gap. In other words, while the chance of a Euro rally is there, it seems disproportionately low compared to the chance of a Dollar rally making a short Dollar bet which, at this point, is more risky than usual. To put it simply; the long awaited Dollar correction will eventually come, but at this point, given the current risks, it might be better to be safe than sorry.

Look for my post next week.

Best,

Lior Alkalay

INO.com Contributor - Forex

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Agree,i have the euro and the dollar in my sights

Don't like to get in too early. My gut tells me the

dollar has another leg up.We'll see

Once again,I agree with your conclusion. Your points and argument are clear and concise. Well done!

Thank you Rainer! Appreciate your feedback.