Over the past few weeks, the Yen has been softer against its European peers, e.g. the Euro and the Pound Sterling, as risk appetite gradually made a comeback. Yet against its American peer, the US Dollar, trade has been rather subdued. The Dollar and Yen, the world's most sought after safe haven currencies, move generally in tandem. Because investors have had some difficulty choosing the front runner between the two, it has resulted in a sideways moving USD/JPY pair. The combination of a soft patch in the US economy and uncertainty over Japan's economic future has also made it difficult for some market movers to assess the next trajectory for the Yen. Yet, in either case, that is still a mere projection with no tangible evidence (yet) to tilt sentiment either way, in favour of the Yen or in favour of the Dollar. However, that might soon change; moreover, the reaction in the USD/JPY could be abrupt, swift and for some, devastating.

Abe Rolling the Dice?

Of course, the one spark to this potential volatility that could suddenly ignite centers around none other than Shinzo Abe, the Japanese Prime Minister and the father of "Abenomics." Abenomics has been described as a combination of fiscal balance and aggressive monetary easing intended to spur economic growth. As I illustrated in my last article on Japan, much more easing from the BOJ is required in order to revive inflation and restore growth in Japan. And that is largely due to the sheer size of Japan's public debt which vastly surpasses the private sector. Abe, well aware that the current trajectory of Japan's ballooning debt is unsustainable, has been making plans to gradually terminate the budget deficit. That deficit, now running at an annual pace of more than 6% of GDP and the highest in the G7, warrants immediate planning and attention in order to avoid future insolvency of the Japanese sovereign.

Yet, one must wonder if this isn't turning into a crap shoot, and if Abe isn't rolling the proverbial dice one too many times in the hope of a big "win." After being badly burnt as a result of raising the sales taxes too early and too steeply, the Prime Minister shifted his strategy on debt to a different one. Unfortunately, while it is more popular (and thus comes with less potential backlash) it is also far less reliable. According to media sources, among them the London Financial Times, the Japanese Premier is working with his team to draft a multi-year deficit reduction plan that is based on increased tax revenue from higher growth. According to reports by the Financial times, the projection Abe's team is counting on is for a fiscal balance by 2020. That projection is so "upbeat," in fact, that during the years 2018 to 2023 Japan would presumably grow faster than the US so that it could attain fiscal balance. And if that wasn't enough, given this alleged fiscal layout, the BOJ is projecting that it will be successful in achieving 2% inflation during that respective period. All of that is, to put it mildly, a bit of a stretch. The fact is there is a potentially huge margin for error, mostly on the downside.

Is the BOJ Cornered?

With such an ambitious plan supposedly in the works, it seems that the BOJ may be boxing itself into a corner. With the country dependent on high growth and normalizing inflation for its fiscal order, there is tremendous pressure laid on the proverbial shoulders of the BOJ to achieve those targets – even though the BOJ is considered an autonomous entity. This could mean that the BOJ might be forced to rapidly expand its current stimulus measures which, of course, is warranted considering Japan's debt, but won't necessarily achieve the ambitious target Abe's team is aiming for. However, whether it succeeds or not, the BOJ may need to turn more aggressive and weaken the Yen, which, as the chart illustrates below, is tied in a tight range.

Chart courtesy of Netdania.com

Volatility around the Yen

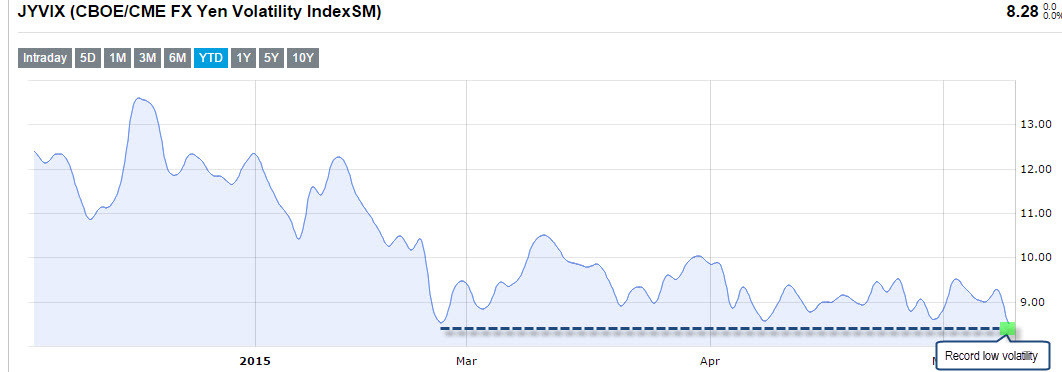

With all of this in mind, BOJ Governor Kuroda is set to speak this Friday about Japan's monetary policy. Considering all of the foregoing there is a chance the BOJ might need to release a statement about more stimulus. As seen in the chart above, the pattern suggests some breakthrough is set to occur, either way. Moreover, as seen below in the chart, Yen volatility is at a record low; bear in mind that the last time the Yen was this low it resulted in a sudden surge in volatility. Because of the charting pattern and given the upcoming Kuroda speech with expectations of more stimulus, the cyclical volatility of the Yen does seem to be on a path for a quick bounce. And here lays the risk; despite my view that in the mid to long term the Yen should continue to weaken, volatility goes both ways. Whether the BOJ disappoints or not, be ready for an ignition that could abruptly break the USD/JPY range of the past weeks. Therefore, provided you are in it for the long term, be prepared for high volatility in the coming weeks as trade around the Yen is in perfect alignment to be choppy and volatile.

Chart courtesy of Chicago Board Options Exchange

Look for my post next week.

Best,

Lior Alkalay

INO.com Contributor - Forex

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.