The last FOMC meeting for 2016 has concluded, and the outcome is a slightly more hawkish tone than investors initially expected. The Fed has hiked the federal fund’s target rate by 25bps to 0.75% for the second time in two years. However, this hike was largely in line with the consensus expectations.

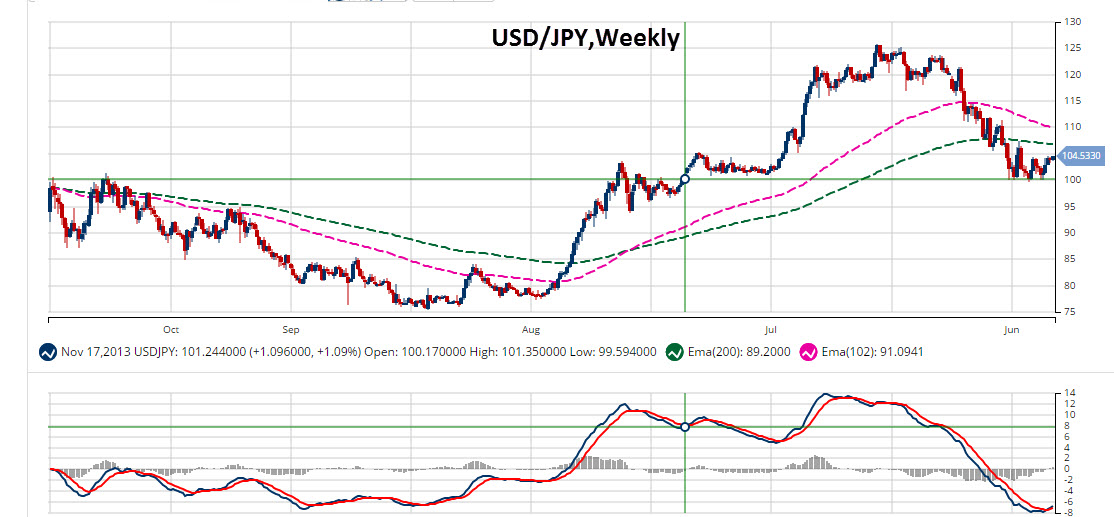

What caught investors by surprise was the revision of the Fed’s projection for rates in 2017. A revision that demonstrates that the median of estimates by the Federal Reserve members point to not two rate hikes, as in the September meeting, but three. Experience suggests that investors should take the Fed’s revision with a pinch of salt. After all, it was only this year that we witnessed the Federal Reserve revise its rate projections down, a move that followed an increase earlier in the year. And yet, judging by the reaction of Treasuries and the dollar, this revision is taken with some gravity. In fact, it paves the way for another dollar higher. The question is why? Continue reading "Fed Paves The Way For Broad Dollar Rally"