Good day, MarketClub Members! So, what do I mean when I say 3 for 3?

1: Let's start with Apple, Inc. (NASDAQ:AAPL) - The Trade Triangle technology indicated that the trend was heading lower and Apple was most likely to report disappointing earnings. That is exactly what happened when Apple reported its earnings after the close on 1/26/16. Apple opened lower the next day giving members another winner and profits up to 92% on options trades.

2: Next I recommended that a sidelines position was warranted in Amazon.com, Inc. (NASDAQ:AMZN) as the Trade Triangles were mixed indicating that there was no strong reason to take a position. The trading hours before the close showed Amazon up over 9%. Reality kicked in after the earnings announcement as Amazon gave back all of its earlier gains justifying the sidelines position.

3: Alphabet, Inc. (NASDAQ:GOOG) - Yesterday a weekly Trade Triangle turned green aligning with the monthly Trade Triangle indicating a long position was warranted. Members were rewarded as Google jumped $40 in after-hours trading giving members another winner.

3 stocks to watch today after they release their earnings after the close are:

1: Yahoo!, Inc. (NASDAQ:YHOO) - The outlook for earnings is disappointing. The Trade Triangles indicate a short position is warranted for this stock.

2: Chipotle Mexican Grill, Inc. (NYSE:CMG) - Neutral. The Trade Triangles are mixed, indicating a position on the sidelines is warranted for this stock.

3: Gilead Sciences, Inc. (NASDAQ:GILD) - The outlook for earnings is disappointing. The Trade Triangles indicate a short position is warranted for this stock.

All 3 companies release their earnings after the close today, so be sure to have them on your radar screen.

Today I will also be analyzing crude oil. Is it headed again below $30? Gold may have run its course for now, but the trend remains positive.

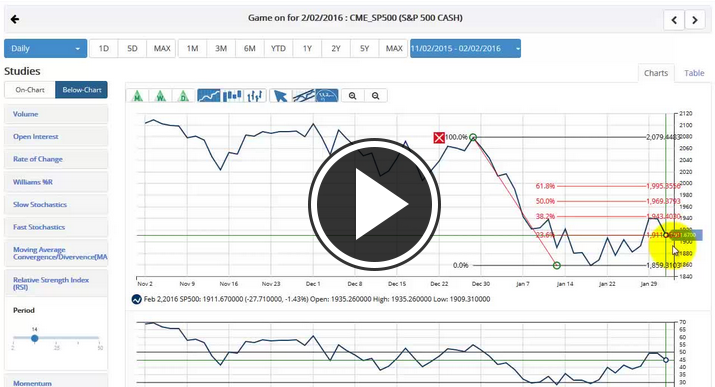

I will also analyze the 3 big indices and give you the support and resistance zones for each one.

Stay focused and disciplined.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

When I read Adam's comment: "Gold may have run its course for now, but the trend remains positive.", I thought, "No way! He's completely wrong again and gold is likely to make its break higher soon." Two days later, on Wed. Feb. 3, gold and the miners began their big move up.

Now, on Feb. 11, Adam says: "I have been bullish on gold since the beginning of the year and today's sharp upward move came as a very pleasant surprise. The first buy and major trend change came in on 1/05/16 at $1,081.55 on spot gold. The last daily buy came in on 1/20/16 at $1,094.29. It is difficult to predict how far and how high gold can go especially after a day like today. Gold is at the top end of a downward channel which may halt the upward climb. For now, I'm going to sit back and enjoy the ride and use the Trade Triangles to manage my position."

No offence to Adam, but I have learned to realize that he is often completely wrong on gold and now I even use his advice as a 'counter signal' to do the exact opposite from what he suggests. I do however agree with his comment now that gold is at the top end of a downward channel, so it may pause at the current level for a while before breaking through the channel to the upside. Good luck to everyone, and remember to think carefully about what the 'experts' say.

I am a Market Club member. Where would I have gotten the option trade on AAPL before its big move? Is there an trade alert that goes out? Is there a place on the Market Club website that I should be checking for trades?

Thanks.

Hi Michael,

You should be checking the Member Blog within MarketClub. Adam posted the idea of the trade on 1/26/16there.

I would suggest checking the blog everyday for Adam's posts. Typically we post each day between 11 AM and 1 PM EST.

Best,

Jeremy

I'm not sure what good this is when the information/email isn't re dived until after the statements have actually been released?! No chance to take a position.

Hi Simon,

All the trades were posted by 1PM the day of earnings giving you time to take action before the market closed. Case in point, the Apple trade was posted here at 11:30AM on 1/26/16. Plenty of time for you to take action and get in the trade.

Best,

Jeremy