There are over 2,700 companies scheduled to report quarterly earnings in May. That means potentially thousands of earnings-related price swings!

Drift Trader is ready to find them all, picking stocks that have the potential to run after surprise announcements.

Get new picks and earnings-seasons finds with a free subscription to Drift Trader. There is no time limit and you can use this free version for as long as you'd like.

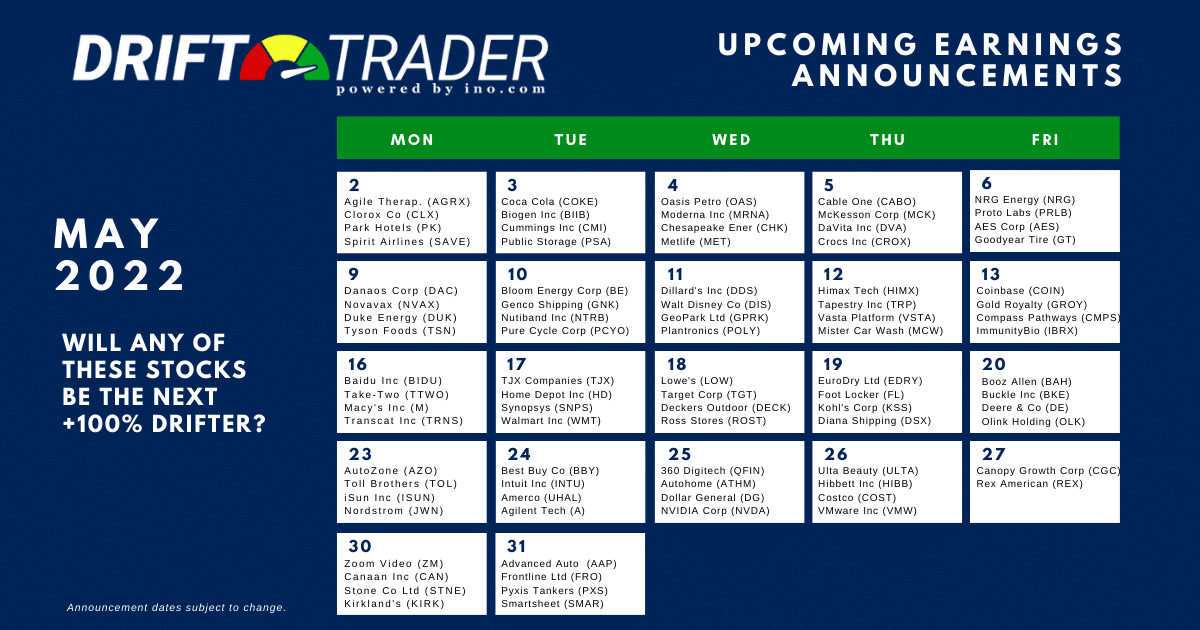

Most Anticipated Earnings For May 2022

Below are some of the most anticipated earnings announcements for May (click to download a printable PDF).

May 2 (≈150 announcements)

Agile Therapeutics (AGRX)

Clorox Co (CLX)

Park Hotels & Resorts (PK)

Otter Tail Corp (OTTR)

Spirit Airlines (SAVE)

May 3 (≈300 announcements)

Coca Cola (COKE)

Biogen Inc (BIIB)

Cummings Inc (CMI)

Public Storage (PSA)

Leidos Holdings (LDOS) Continue reading "Earnings Calendar For May 2022"