The Federal Reserve, the only central bank in the G7 economies and China to raise rates and the only central bank to lead a tightening cycle, is also the only central bank to get it right. As counter-intuitive as that may sound, higher rates in a world of negative rates and massive monetization is the only viable solution to stimulate growth. To understand the irony, we must delve into credit markets and assess what’s broken.

Cheap Credit Expensive Growth

One of the arguments espoused by critics of monetary stimulus, whether it’s negative interest rates or quantitative easing, is inflation. But in reality the real cost of a ultra-loose monetary policy is the exact opposite—deflation; prices in most of the world and, in fact, in most products are either falling or stagnating. The reason is that when the policy is ultra-loose inefficient sectors of the economy are kept artificially afloat. As long as interest rates are close to zero failing sectors can keep on piling debt and thus contribute less and less to growth while leaving less available capital to the more efficient sectors that really need to grow.

One of the clearest examples of how an inefficient sector provides insufficient value comes from the energy sector. The ultra-loose monetary policy allowed the oil shale industry to grow, resulting in competition with the Saudis on cheap oil which ultimately pushed oil prices south. Under a higher interest rate environment, many of the smaller, inefficient shale producers would likely not survive while producers that employ green energy solutions would. That is but one example of how a low-interest rate environment keeps the energy sector from becoming “greener.”

So how can we know when an abundance of credit no longer produces enough value? The best tool is comparing debt to growth. If the debt burden to GDP grows, it means that for every $1 of debt less growth is generated. And that means, as mentioned above, that many inefficient sectors in the economy that have no growth potential in them are accumulating debt. So, what needs to change to redistribute capital into growing sectors? Higher rates—higher rates make it difficult for inefficient sectors to accumulate debt while allowing more efficient sectors room to grow.

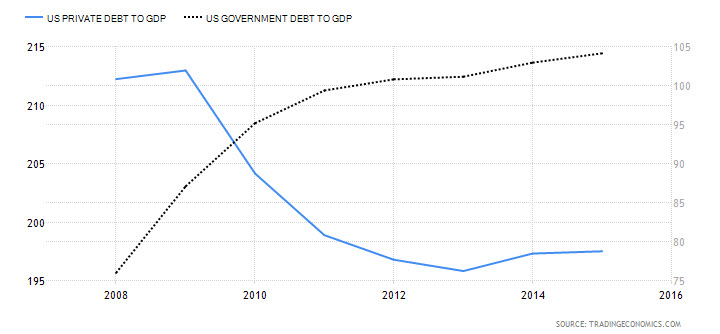

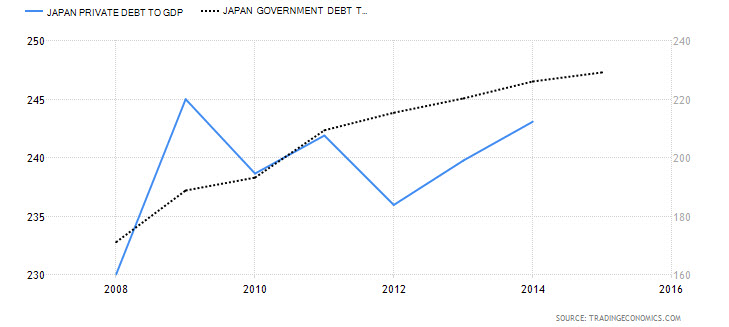

When we look at the data and compare, for example, the debt accumulation in the US to that of Japan we see a very interesting picture. Until around 2012-2013 government debt to GDP grew roughly at the same pace in the US and Japan. But as the Fed started to back away from stimulus, first by talk, then by cutting quantitative easing, and eventually by raising rates, the government debt to GDP ratio rose at a slower pace than in Japan. When we compare the debt burden of the private sector the contrast is even clearer; debt to GDP of the US private sector plunged while in Japan it stayed about the same.

Chart courtesy of Tradingeconomics

In other words, higher effective rates in the US meant that for $1 of GDP growth less debt was required. Meanwhile, in Japan, where monetization of debt has intensified, and rates are now negative, for every $1 of debt less and less growth is generated in Japan. That’s because less efficient sectors in the Japanese economy are kept afloat.

Chart courtesy of Tradingeconomics

This leaves us to conclude that as the Fed raises rates, less efficient sectors in the US economy will clear the way for more efficient sectors and unleash long-term growth potential. The Fed is very much aware of this fact, and that is why the Fed is pressing forward with rate hikes despite external economic pressures from weak global growth.

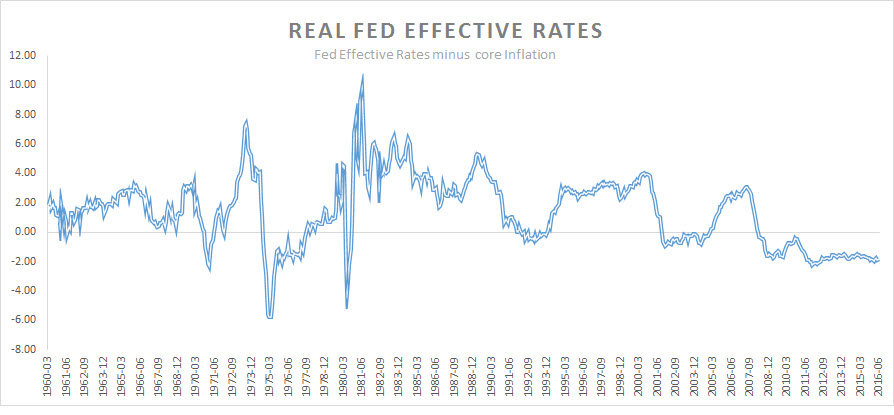

Normalizing Rates, the Dollar

So how far are we in this process? Perhaps the best illustration is when we compare the effective Fed Funds rate to inflation. When the effective Fed Funds rate is higher than the rate of core inflation (which excludes food and energy), it means that real rates (rates minus inflation) are positive, which is considered normal. So for the process to be complete or close to complete, real interest rates in the US at least have to return and become positive and stay positive. The chart below, which measures the difference between the effective Fed Funds rate and the annual core inflation rate, demonstrates that real rates in the US are still well below 0%. This means that the current tightening cycle still has far to go, and while it tightens, higher rates will allow the US economy to move back to its average long-term growth rate of 3%-3.9%, and the US Dollar will continue its long-term bullish cycle.

Chart courtesy of Federal Reserve Bank of St.Louis

Look for my post next week.

Best,

Lior Alkalay

INO.com Contributor - Forex

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Raise the Fed rate...watch the stock markets crash...guaranteed. Anyone who doesn't KNOW this [the Fed does, that is why they only threaten to raise rates] is ignorant.

But hey let's just go ahead and raise it 50 basis points and get the inevitable over with.

Did the author forget the U.S. govenment can't sevice its debt load at a higher rate?

@David- The stock market is a risk asset and has been artificially over-valued for awhile now. There will be plenty of willing buyers at fair market value, it's the way the system is supposed to work. If we stop trying to mess with the natural business cycle and capitalism in general, we would be far better off. ZIRP has brought forward vast amounts of future consumption, and it's why it's not working anymore.

Yes I agree. But the Fed is now stuck. "Unwind" what they haves done now and the whole U.S. economic system will collapse, not just the stock markets. Pension funds. Liquidity stops just to name two.

It's going to collapse anyway; and it is going to be awful, but the decision was made some time ago to run it until it breaks rather than collapsing it now.

Debt = money, no doubt, but when did we decide that increased debt is equivalent to real economic growth? Financialization is a farce that will destroy far more lives than it helps.

Ridiculous article. Higher rates are anti-growth, period. There is no need to "return to the norm" any time soon. When the Fed raised rates to counter inflation in the 1970's, and reagan subsequently went on an wild and wasteful spending spree on needless military items, the Fed kept interest rates historically high until the MID 90's.

Of course in a world where up is down and scientific evidence is a "hoax," here insanity is leadership, well, why not? Raise those rates! Pull the reins in on modest growth! Tank the economy again. The stock market will suffer, yes, but that will be only the icing on the cake of human stupidity.

a rate raise would leave the poor and middle class in trouble but would profit only the rich. The zero rate policy did not fill its promisses of getting the economy back on its tracks but protected the whalthies and the rich from facing a crash in the economy they would have had to deal with in pains and bankrupcies ...nothing new under the sun

Many, seemingly intelligent analysts and others have said the Federal Reserve cannot raise rate much, as it would throw a monkey wrench into the stock markets, and the costs of servicing US Government debt would skyrocket. It does seem to me that when things are well outside the norm.....in this case historically low interest rates throughout the world, that they must revert to a more normal state. Possibly, we are no longer living in "normal" times, but I would hate to bet on it.

Then maybe the fools in Congress will be forced to deal with this problem instead of kicking the can down the road. A reasonable interest rate of 2%-3% is not out of line. I would much rather see a slow dwindling of this bubble instead of an explosion, or do you want to see 2009 on steroids?

A real point is to see is if the USD 'd continue to be a World Reserve Currency, like it enjoyed for , 7 decades , with long overdue normalization of Real Interest rates to above zero !

Normalizing rates they say...at the pace the Fed is going with raising 25 basis points once every two years and having only raised once in the past 8 years...really?

Agree - only winners are those with too money and nowhere to go. Bernie Sanders had it right!

Ha, the only concrete example (for the private sector) given in the article is the oil sector. Plain and simple, what primarily drove shale oil exploration/recovery was 100 dollar-a-barrel oil, not low interest rates. Flawed reasoning as usual by "experts". If the US government is really using your reasoning to make economic decisions, we are surely all in big trouble.

I agree. And the big drop in energy prices was like a giant boost for the whole world economy.