Analysis originally distributed on November 10, 2016 By: Michael Vodicka of Cannabis Stock Trades

The results are in. November 8, 2016 will go down in history as a great day for the legal cannabis industry and the world.

Nine U.S. states had medical and recreational marijuana programs on the ballot. From those nine states, eight have voted yes.

On the recreational side, four out of five states have approved new initiatives.

- California: passed

- Massachusetts: passed

- Nevada: passed

- Maine: passed

- Arizona: failed

As you can see this list includes California, the world’s largest marijuana market.

On the medical side, all four states voted yes.

- Florida: passed

- Arkansas: passed

- Nevada: passed

- North Dakota: passed

- Montana: passed

Florida looked like a huge baller this election cycle.

Not only did it virtually decide the presidential election as a key swing state, it also decided to throw another log on the fire and legalized medical marijuana for good measure.

These results mark a watershed moment for the legal cannabis industry. I expect these additional legalizations to serve as a huge catalyst for the industry.

On January 1, 2017, 29 states, more than half the country, will have medical and recreational programs in place.

That will create new jobs, increase tax revenue and decrease crime.

I also expect it to be a powerful catalyst for marijuana stocks.

Cannabis Stocks are Down on the News

In light of the great news, some investors are surprised cannabis stocks are in the red Wednesday morning.

Remember, the market is forward looking. Investors were expecting good news on the votes and a lot of that has already been priced in over the last two months. That’s why the sector is up more than 150% in the last few months.

To get the latest analysis as soon as it is released, please subscribe to our free weekly newsletter.

I view any weakness in cannabis stocks as short-term and a speed bump in the long path higher.

Looking Forward, Here’s My Advice for the Next Week

Looking forward, I am expecting plenty of volatility in the cannabis sector.

Cannabis stocks have seen huge gains in the last few months leading into the election.

Adding fuel to the fire, legal cannabis is about to become one of the biggest headlines in the world heading into the end of 2016.

This is going to trigger tons of capital flowing in and out of cannabis stocks.

Trading volume will come from fund managers, long-term investors and short-term traders.

For 99% of long-term investors, which is what most investors should be, this is not the time to be aggressive with marijuana stocks. That time was earlier in the year when no one was paying attention and these stocks were trading for pennies.

Now is the time to be patient.

Long term, this investment is still in the first inning. If you haven’t invested, trust me, there will be plenty of opportunities ahead. If you’re dying to get in, start with a small amount of cash and look to buy on pullbacks and dips.

If the sectors falls 10%, or your favorite weed stock falls 20%, those are usually good times to be buying.

For those looking to dip your toe into the water or add to existing position, I am going to introduce what I consider a core holding in a diversified weed stock portfolio.

This industry leader is the largest legal cannabis company in the United States by market value. In 2015, it became the first publicly traded company to own a marijuana dispensary. Sales are on pace to hit a new record in 2016.

This Controversial Weed Stock is up 429% in 2016 – and Just Getting Started

Mention the name Terra Tech Corp. (OTC:TRTC) and you’ll get one of two reactions.

Investors either love it or hate it.

Investors love Terra Tech for a few reasons.

- It is the largest marijuana company in the United States by market value.

- In 2015 it became the first publicly traded company to own a marijuana dispensary.

- It is on pace for another year of record sales in 2016.

However, there are plenty of investors who loathe Terra Tech. The main reason?

Management approved a measure that would have allowed them to execute a reverse share split. This could have been potentially dilutive to shareholders.

Management eventually decided against the reverse split in September of 2016. Shares bounced higher.

But the experience left some investors with a distrust of management and a bad taste in their mouth.

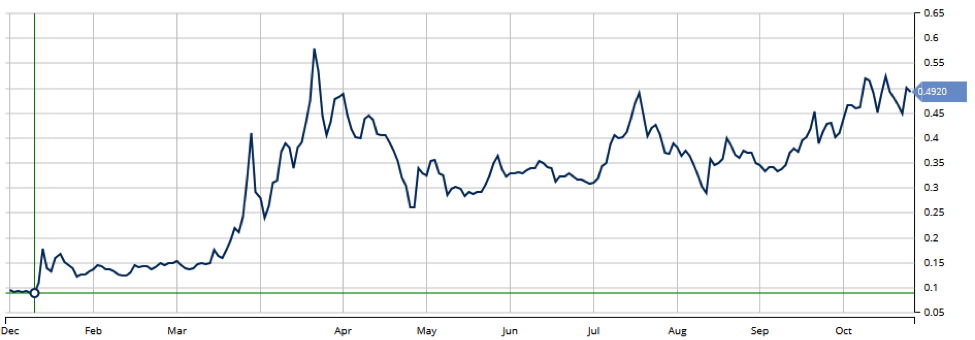

Despite the controversy, Terra Tech is having a monster year. Share are up 429% in 2016.

Looking forward, I am expecting shares to close the year at a new 52-week high.

Terra Tech has Tremendous Growth Potential

I believe Terra Tech is a core holding in a diversified weed stock portfolio.

There are plenty of things to like about Terra Tech. Here are the two most important.

Terra Tech has a shot at becoming the Starbucks of marijuana with its aggressive move into dispensaries. Dispensaries have been big winners in the marijuana game. They have shown strong revenue growth and sustainable high margins.

Terra Tech already operates three dispensaries with two more on the way.

That makes Terra Tech the early leader in the dispensary space.

Looking forward, I expect Terra Tech to continue opening new locations and building its chain.

The second thing I like about Terra Tech is that it sells its own products at these dispensaries.

Terra Tech sells a line of branded marijuana products under the name IVXX, otherwise known as 420.

One line is its cannabis oil cartridges.

Cartridges are a huge area of growth in the cannabis industry and I am expecting Terra Tech to capture growing market share with its branded products.

Potential Threats

Terra Tech is having a monster year. Shares are up 429%. Although I am expecting this company to prosper, investors are extremely optimistic and pricing in a lot of growth. If Terra Tech falls short of revenue and earnings expectations, I expect shares to take a hit.

Action To Take

Terra Tech is a core holding in a diversified cannabis portfolio. Although shares are up 429% in 2016, I am expecting more gains. Look for a pullback and buy anywhere below the 52-week high of $0.61.

If you’re looking for the next three cannabis stocks that could jump more than 100% in less than six months, sign up for the free Cannabis Stock Trades newsletter.

Enjoy,

|

Michael Vodicka |

Disclosure: Michael Vodicka owns shares of Terra Tech (OTC:TRTC)

The information contained in this post is for informational and educational purposes only. The trading ideas and stock selections represented on the Cannabis Stock Trades website are not tailored to your individual investment needs. Readers and members are advised to consult with their financial advisor before entering into any trade. Cannabis stocks carry a certain level of risk and we accept no responsibility for any potential losses. All trades, patterns, charts, systems, etc. discussed are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher.

Please forgive me I have never bought stocks before. But, I would like to buy stock in cannibias. Could you tell me exactly what I need to do? Thank you, for your understanding.

Sincerely,

Vicki Toth

Of course it did? It's all about the money, nothing else.

Agree the legal cannabis industry if establish for serve the human, not agree if someone use this cannabis for destroy human.