Despite the Yuan’s value recently plummeting to an eight-year low, the Chinese economy has been rather stable in the second half of 2016, manufacturing PMI held above 50 (above 50 signals expansion); exports reached $196.8 Bln in November(from $176.2 Bln in January); and in industrial production growth averaged 6.14% Year over Year.

Together, these changes all represent a strong indicator of growth - and of bounce-back - and all thanks to the Yuan. Or more accurately, to the Yuan meltdown. Even as the Chinese Yuan shed more than 7.1% this year, it allowed China’s exports to rebound and stabilize industrial and manufacturing production. But all that stability comes at a stiff price, down the line.

While a weaker Yuan helps exporting sectors, it causes problems in China’s domestic economy. In it, an exceptionally weak currency has the same impact as monetary easing, creating an inverse relationship where, when the Yuan’s value is eroded, China’s housing bubble swells.

The more China’s housing bubble swells, the more its debt problem becomes acute. And, ultimately, the more painful its bust will be.

In fact, according to the latest estimates by the rating agency Fitch, China’s debt problem is so severe that roughly $2 Trillion of it is estimated to be bad debt: loans that are highly likely to default.

Expressed in fractions, China’s bad-debt burden represents roughly 20% of its total GDP. And a large portion of those loans are related to the housing sector.

To counter the Yuan problem, the People’s Bank of China (PBoC) is passively allowing inter-bank rates to jump, hoping that the move will tighten credit. At the same time, it’s also applying a more direct so-lution: using foreign reserves to keep the Yuan from weakening further.

So far, their efforts have been mostly unsuccessful. The Yuan keeps shedding value, and housing pric-es keep rising by more than 10% annually. And as the US Federal Reserve is at it most hawkish in years, those pressures are expected to escalate.

The Fed anticipates hiking interest rates not once, not twice — but three times in 2017, a move that we believe will keep pressure on the Yuan, and, consequently, fuel China’s housing bubble even further.

In the end, China will be forced to actively tighten policy and raise rates for the first time in more than five years, both to curb the housing bubble and to support the Yuan. But history shows that the PBoC tends to tighten slowly at first, due to the fear of causing an ugly bust of the housing bubble, and that will create still more challenges.

The PBoC would prefer to see the housing bubble gradually wane and thus avert a severe crisis. But the likelihood that the Chinese central bank will be slow to move will inevitably lead to more Yuan weakness, and thereby spur inflation and keep the housing bubble growing.

But eventually — possibly towards the end of 2017 — the PBoC will have no choice but to act aggressively by executing more rate hikes. This, in turn, will force the system to deleverage — compelling the housing bubble to burst and the bad debt to be squeezed out.

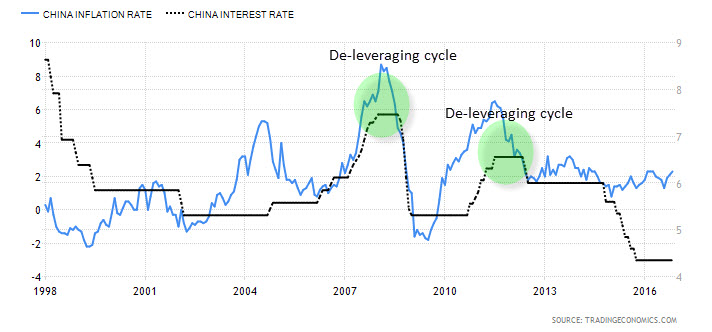

Usually this deleveraging happens when China’s interest rates climax. Such deleveraging has hap-pened twice before, as the following chart, comparing inflation with interest rates, shows.

Chart courtesy of Tradingeconomics

As 2017 progresses, the Yuan will continue to lose value, inflation will heat up and the boom in the housing market will continue. In reaction, the PBoC will start to aggressively tighten towards the end of the year, leading to a third deleveraging cycle, one that will hit China’s economy hard. Because bubbles such as these never burst quietly.

Look for my post next week.

Best,

Lior Alkalay

INO.com Contributor - Forex

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

It will be quite interesting as well important for whole world to watch China's Economy move, because many spiral effects on other parts of the world too, are possible.

At this stage, while making data studies of China, everything is depended on the correctness and reliability of respect data, as I fully doubt on this issue, so rather to focus on concerned data, one must observe and analyse other non-traditional method, and out of box evaluation, based on symptoms indicating theories.

Hefty debt, factories with much more giant capacities, Currency Gimmicks, Housing bubble, fragile situation of Banking Sectors, due to heavy bad debts, and so many economy related other key issues are linked with Chinese Financial and Economy sectors. US relationship is also in a questioned mode, so that may effect adversely, both on Trade and Treasury transactions.

Even any smaller imbalance will be more enough to creak-down everything. One can assume future probable situation on the logic that out of above list, one or two problems become also difficult to settle, so when all such issues come together, then and then what kind of out come and intensity thereof can be expected. War proven as a good weapon to shift mind of Citizen towards any other direction, and China may adopt such policy too.

I am interested in your views.

Comment well written , will quit likely see a huge problem before the end of 2017 !

Thanks for making inscrutable Chinese economy a bit more scrutable.