Options can provide an alternative approach to the traditional buy and hold strategy. Buying call options can add value to one’s portfolio via leveraging a small amount of cash while defining risk with unlimited upside potential. Simply put, buying a call option is bullish in nature as the buyer is positioning the trade with the thesis that the underlying shares will increase in value. When one buys a call option, she is buying the right to purchase shares at a specific price on a specific date in the future for a nominal price. In this scenario, the buyer thinks the shares are undervalued hence why she is willing to buy the option now to secure the right to purchase shares in the future at a higher price. If the shares approach the specific price or rise above the specific price before the expiration date, then the underlying option becomes more valuable. This more valuable option can now be sold higher than when she purchased the contact to realize gains. Regarding percent, call options can be very profitable and scaled as needed. The risk in buying call options is capped based on the amount of the option itself thus downside risk is defined, and upside potential is great. Here, I’ll discuss buying call options along with my approach, strategy and real-world outcomes.

Anatomy of Buying Calls

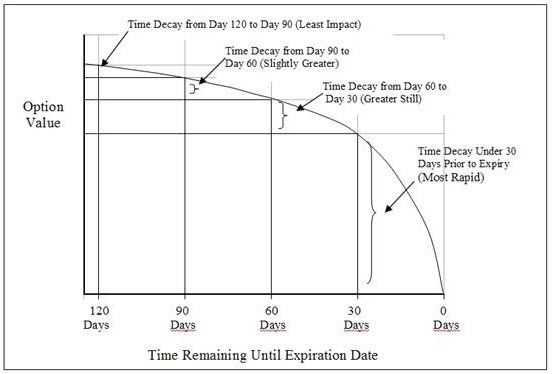

I rarely buy call options however in opportunistic scenarios the risk-reward is very favorable given a decent time horizon. Nominal amounts of cash can be deployed in opportunistic scenarios to capitalize on sell-offs in high-quality stocks. Buying calls can be implemented as a means to leverage cash on hand without committing to purchasing the underlying shares of the company with the end goal of capitalizing on share appreciation via the option contract. The option price is determined by two variables, time and intrinsic value. The amount of time until expiration of the contract determines the time value, the longer the contract will translate into more time value in the contract (Figure 1). Generally speaking, if the underlying stock falls in value (moving away from the strike price), then the option will decrease as a function of time value. Alternatively, if the underlying stock appreciates (moving towards the strike price), then the option will increase in value as a function of time value. As the stock moves away or towards the strike price, the underlying stock is less likely (decrease in option value) and more likely (increase in option value) to reach the strike price, respectively hence the change in option value.

Intrinsic value isn’t applicable here until the underlying security breaks through the agreed upon price (strike price) before expiration. Every penny that the stock appreciates beyond the strike price is a penny of intrinsic value that increases the value of the contract. Any increase in the stock price will result in an increase in the option value regardless.

Figure 1 – Magnitude of time value decay over time adopted from Time Decay

Facebook Example

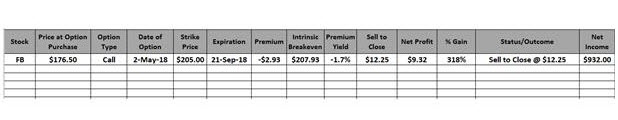

Facebook Inc. (FB) had been in a very public data sharing scandal-induced sell-off shedding 22% and tumbling from $195 to $152. The stock fundamentals are out of scope for this piece but suffice to say Facebook is one of the cheapest large-cap growth stocks as compared to others in its cohort, and thus the sell-off presented an opportunity for buying a call option. Once Facebook began to regain its positive upward trajectory, I purchased a call option when the stock traded at $176.50 on 02MAY18 and selected a strike price of $205 with an expiration of 21SEP18. This option was structured with a long time span and high enough strike to accommodate for any major strength of the underlying stock. The option was $2.93 per share, and since options trade in blocks of 100, the total option cost was $293 to have the right to purchase Facebook shares at $205 by the expiration date of 21SEP18.

As Facebook continued its upward momentum towards the $205 strike price, the option gained in value as the time decay was in my favor with roughly 2.5 months remaining before expiration. Facebook broke through the strike price in a meaningful manner breaking out to $209 per share, so I sold the option for $12.25. This now $12.25 option provided sufficient time value and ~$4 of intrinsic value thus I decided to exit my position by selling-to-close the option contract and realized a 318% or $932 profit ($12.25 - $2.93).

Figure 2 – Facebook call option purchase example

Strategically Buying Calls

Buying calls can also be utilized in cases where a company shows a compelling long-term buy that has been de-risked. A compelling long-term buy criteria would align with a company that’s demonstrating growing revenue and accelerating earnings with a strong balance sheet. The de-risked criteria is comprised of a low P/E and PEG ratios relative to its cohort and entering correction territory (roughly 20% sell-off) due to a singular event that doesn’t materially impact the business dynamics. Given the above backdrop, the risk-reward profile is ostensibly in the option buyer’s favor as demonstrated by my empirical example above with Facebook. If the shares move in your favor (in this case the shares appreciate in value) the call buyer has optionality where she can exit the position with ample time premium on her side for a sizable realized profit.

Conclusion

Buying call options can add value to one’s portfolio via leveraging a small amount of cash while defining risk with unlimited upside potential. Simply put, buying a call option is bullish in nature as the buyer is positioning the trade with the thesis that the underlying shares will increase in value. Buying call options in opportunistic scenarios yields a risk-reward profile that is very favorable given a decent time horizon. Nominal amounts of cash can be deployed in opportunistic scenarios to capitalize on sell-offs in high-quality stocks. Buying calls can be implemented as a means to leverage cash on hand without committing to actually purchasing the underlying shares of the company with the end goal of capitalizing on share appreciation via the option contract. Buying calls should be utilized in cases where a company shows a compelling long-term buy that has been de-risked. A compelling long-term buy criteria would align with a company that’s demonstrating growing revenue and accelerating earnings with a strong balance sheet. The de-risked criteria is comprised of a low P/E and PEG ratios relative to its cohort and entering correction territory (roughly 20% sell-off) due to a singular event that doesn’t materially impact the business dynamics. Given the above backdrop, the risk-reward profile is ostensibly in the option buyer’s favor as demonstrated by my empirical example above with Facebook.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares of FB and is long FB. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.