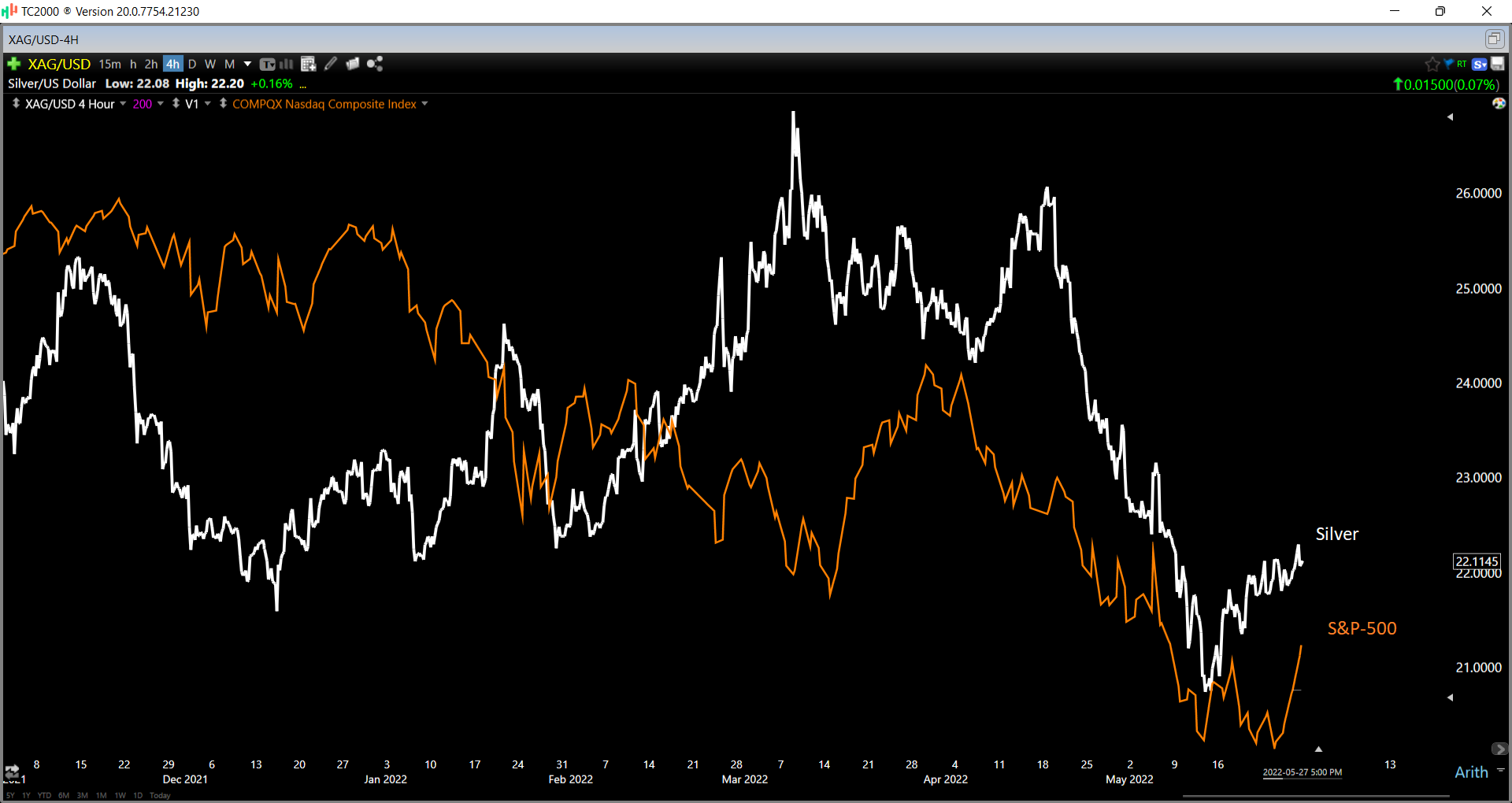

While the gold price has managed to hold onto most of its Q1 gains amid the market turmoil, the silver price has not fared nearly as well. In fact, the metal is sitting at a (-) 5% year-to-date return after briefly being up 16% for the year at its March highs. This retracement in the silver price has put a severe dent in margins for silver producers, explaining why the silver miners have significantly underperformed the metal. However, with the Silver Miners Index (SIL) now down nearly 50% from its Q3 2020 highs, this negativity related to weaker margins looks to be mostly priced in, suggesting it’s time for investors to be open-minded to a bottom in the higher-quality names. Let's take a look at a few of the top names sector-wide below:

Many investors prefer to invest in SIL or the physical metal when it comes to gaining exposure to silver, but neither the ETF nor metal pay dividends and the former is full of poorly run companies with razor-thin margins. For this reason, investing in SIL is even worse than investing in the Gold Miners Index (GDX), where at least the latter has a decent portion of solid companies which balance out the laggards. Given the low quality of SIL, the best way to invest in silver is by selecting the best names sector-wide, and three names that stand out are SilverCrest Metals (SILV), Pan American Silver (PAAS), and Skeena Resources (SKE).

Beginning with SilverCrest Metals (SILV), the company recently announced that the construction of its Las Chispas Project in Mexico is complete, and it is aiming to ramp up to commercial production (full capacity) in Q4 2022. This is an incredible achievement given the continued supply chain headwinds, inflationary pressures, and the COVID-19-related headwinds that have contributed to absenteeism. Most importantly, though, the company managed to complete construction ahead of schedule and on budget, making SilverCrest a population of one in the past year. In fact, we've seen many producers that are not only slightly behind schedule but also more than 50% above their initial budgets.

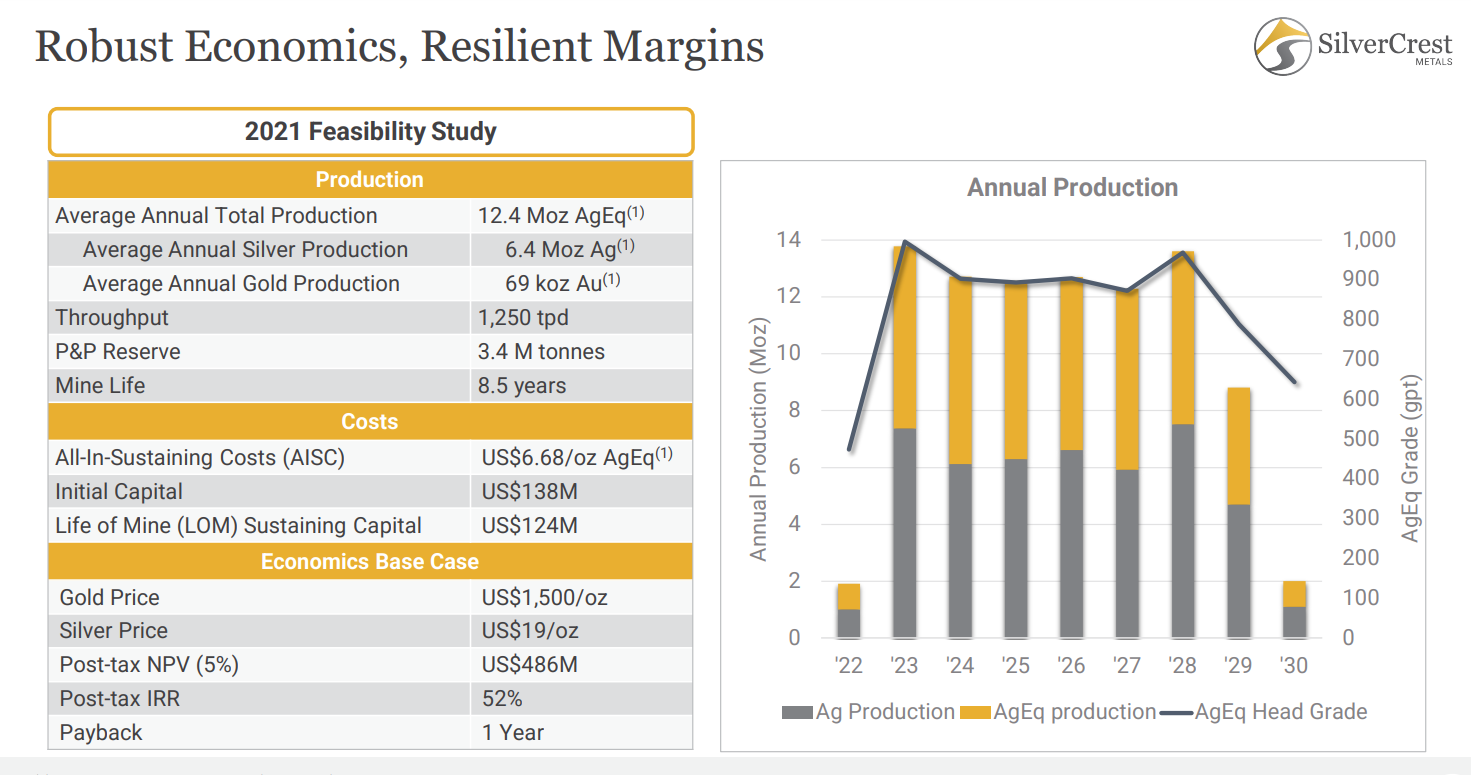

The above chart shows the 2021 mine plan at the Las Chispas Project, and the projected results were phenomenal. This is because Las Chispas is expected to be one of the top-10 highest grade projects globally on a gold-equivalent basis, with grades coming in at 12 grams per tonne gold equivalent. The high-grade profile of this asset is expected to translate to up to 65% margins at a $22.50/oz silver price, with operating costs likely to come in below $7.75/oz. Typically, producers with high margins command premium valuations. So, given SILV's track record of over-delivering on promises and its organic growth potential, I would expect a material re-rating in the stock in the next 12 months. Based on what I see as a conservative fair value of US$9.70 per share, I would view pullbacks below US$6.90 as buying opportunities, where a meaningful margin of safety would be baked into the stock.

The second name to watch is Pan American Silver (PAAS), a diversified gold and silver producer with operations in Canada, Mexico, Peru, Argentina, and Bolivia. Since the 'silver squeeze' in Q1 2021, Pan American has seen a more than 45% decline in its share price, with this related to lower margins due to a weaker silver price and inflationary pressures. Compounding matters, the company has struggled with workforce availability, with its operations in South America impacted severely by COVID-19, leading to elevated absenteeism. However, the company noted that it's seeing a meaningful improvement in staffing levels post-Omicron, and this should lead to higher production levels in 2023.

Unfortunately, while the market has been laser-focused on its operations, this has overshadowed the exciting news coming out of Mexico at its largest mine, La Colorada. Over the past year, improved ventilation rates have led to higher production at La Colorada, but the major news has been the continued growth of La Colorada Skarn. This high-grade polymetallic deposit lies below the current La Colorada mine workings and is a game-changer. In fact, given the skarn's grades, we could see a significant mine life extension and an increase in production at this mine at lower costs. Hence, it's surprising that the company is paying so little attention to this great news and throwing this sector leader out with the bathwater.

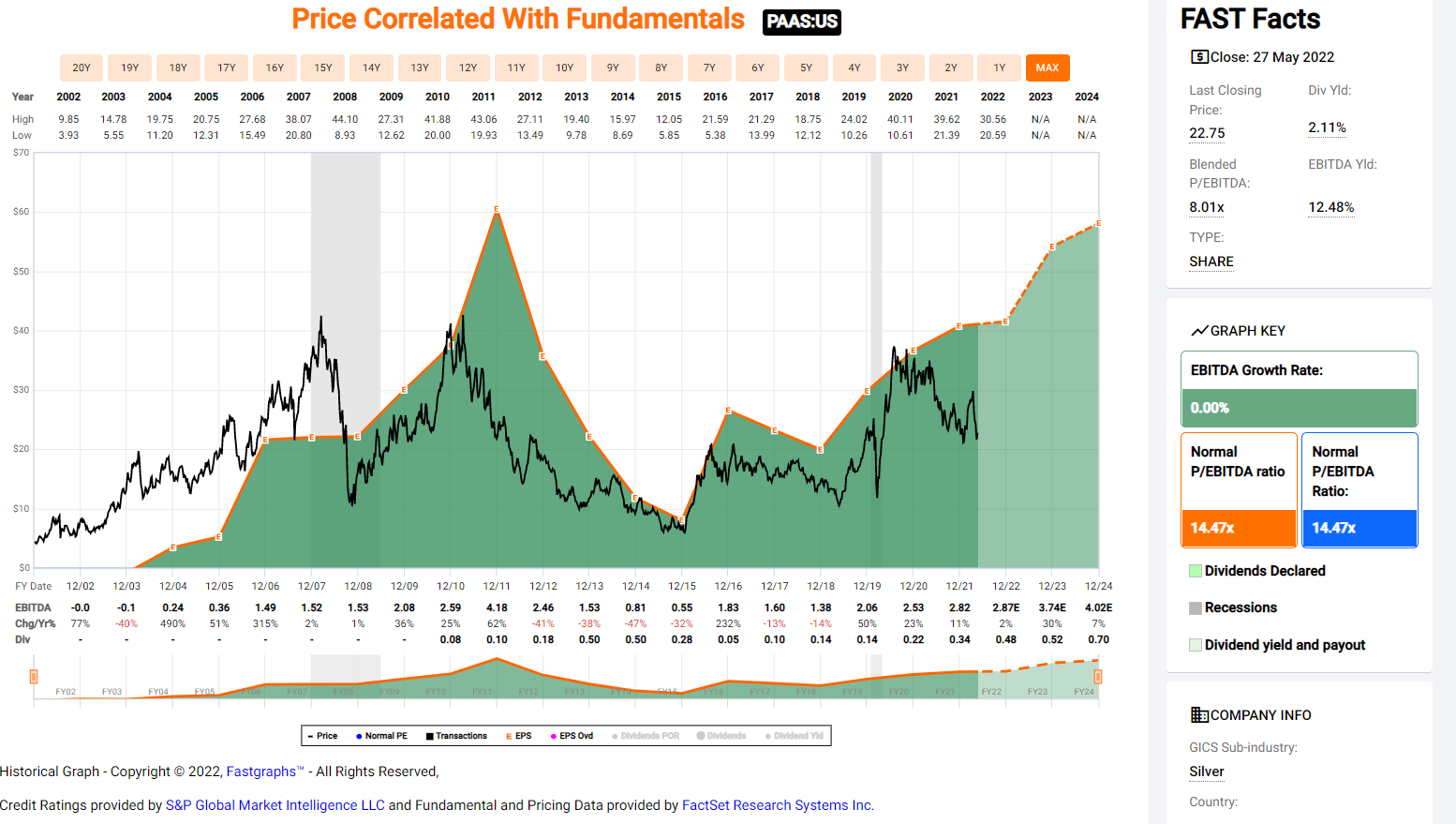

Looking at PAAS's valuation above, the stock has rarely been this cheap, trading at less than 6x FY2023 EBITDA vs. what I believe to be a fair value of 8.0x EBITDA and a historical valuation of more than 14x EBTIDA. Based on 8.0x FY2023 EBITDA estimates, I see a fair value for the stock of $29.60, translating to a 30% upside from current levels. Given this attractive valuation, if the stock were to see further weakness and re-test its recent lows near $20.50, I would view this as a buying opportunity.

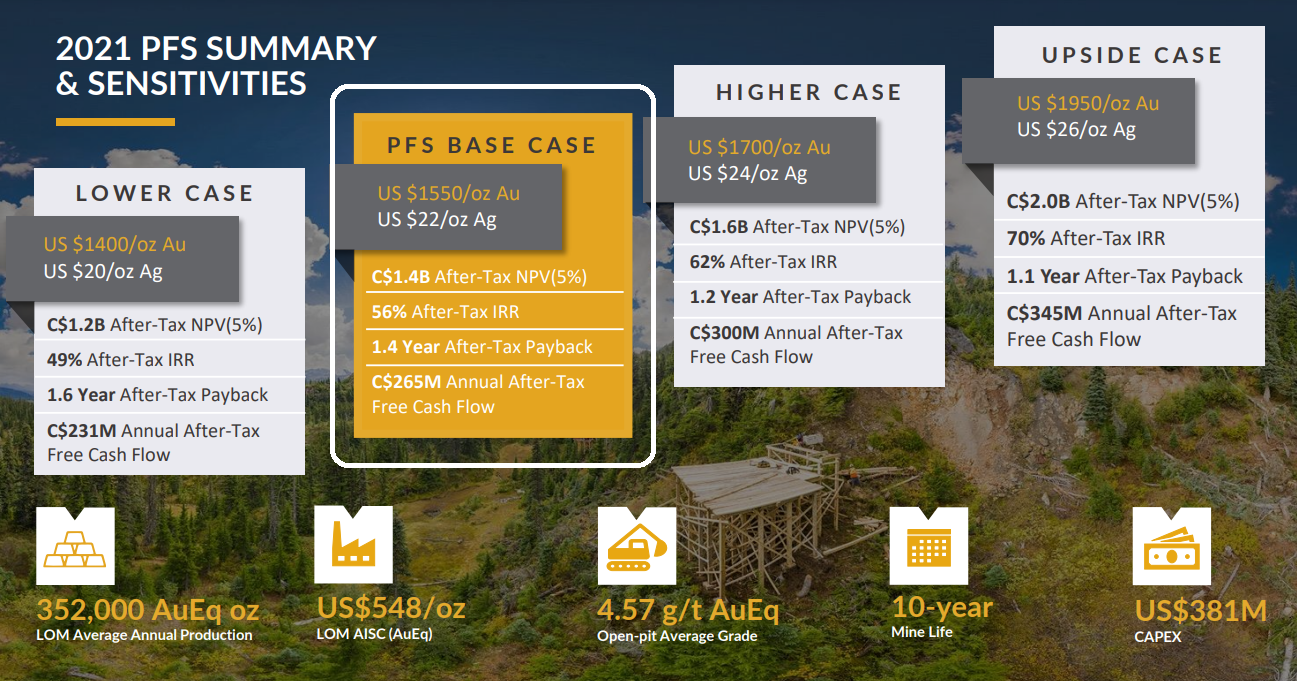

The final name on the list is very speculative, but it arguably has the most upside of the three if it can execute successfully. This company is Skeena Resources (SKE), a development-stage company with a massive gold and silver resource in British Columbia, Canada. According to the company's most recent Feasibility Study, the company expects to recover 2.5MM ounces of gold and 70MM ounces of silver, or 3.5MM gold-equivalent ounces [GEOs]. Notably, due to the high grades, relatively low throughput rate, and existing infrastructure, the operating costs and internal rate of return [IRR] are industry-leading at $548/oz of gold, with an IRR of 56% at a $1,550/oz gold price and $22.00/oz silver price.

The stock has come under pressure recently, down 30% year-to-date, with more than $250MM shaved off its market cap. The weakness is related to a dispute on a portion of material outside of its current mine plan (that does not affect project economics) and the fact that most developers have seen material increases in costs to build their projects. This has likely created some anxiety around Skeena's ability to build this project for less than $400MM, in line with its previous estimates. However, with the stock trading at barely 0.60x P/NAV even at conservative metals prices, I would argue that much of this negativity is starting to get priced into the stock. So, if SKE were to dip below US$6.05, I would view this as a buying opportunity.

Disclosure: I am long GLD, SILV

Taylor Dart

INO.com Contributor

Disclosure: This contributor held a long position in KGC at the time this blog post was published. This article is the opinion of the contributor themselves. Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information in this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.