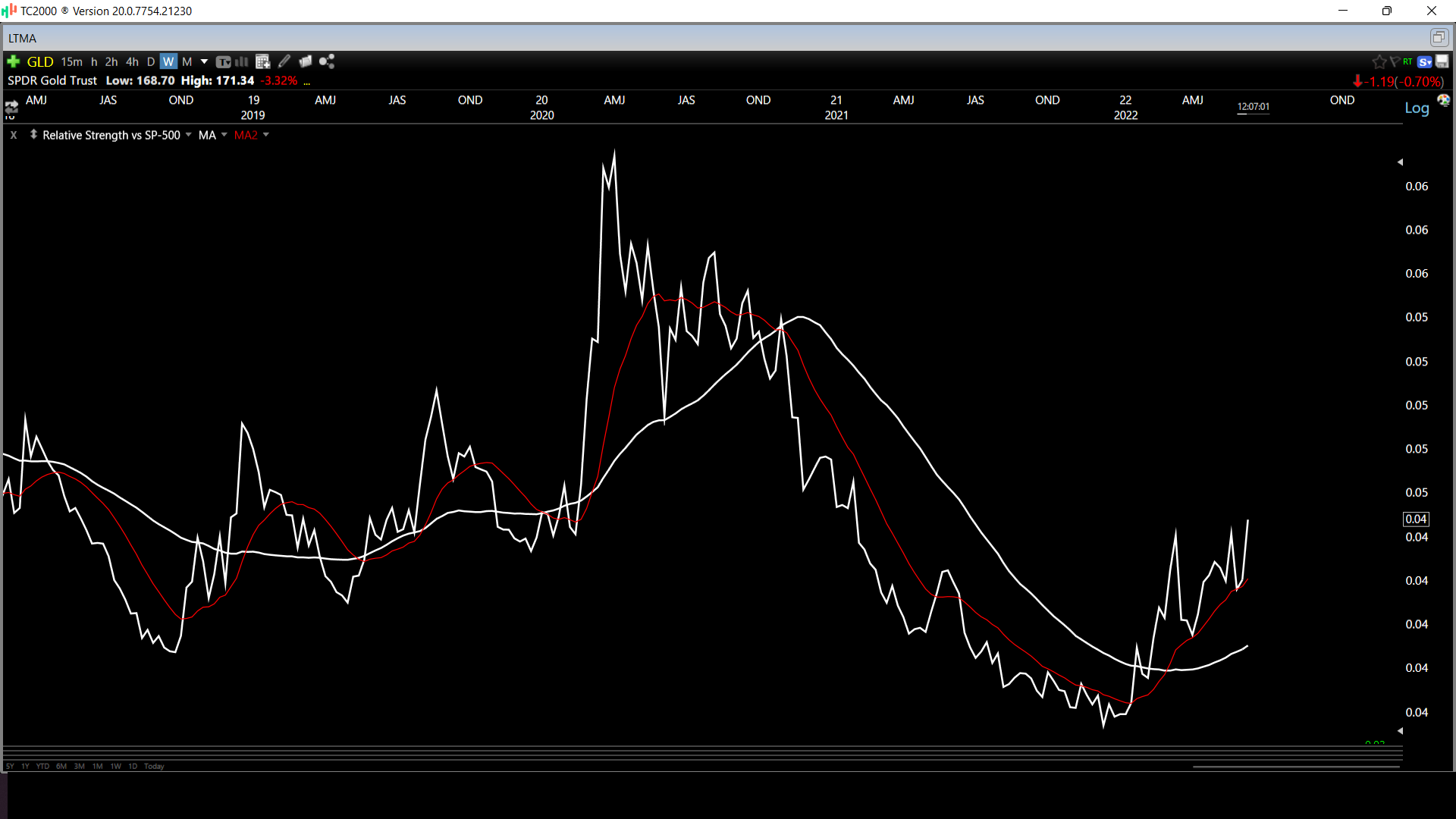

Disgust. Despair. Robbed. These are just a few of the emotions likely felt by investors in the Gold Miners Index (GDX), which are looking at the ETF trade at the same level it did over two years ago when the gold price (GLD) sat below $1,525/oz.

Worse, this pathetic performance has occurred in a period when the Federal Reserve has been its most dovish in years ahead of the past two meetings.

Now, staring down the possibility of two additional rate hikes, it's understandable that investors are on pins and needles, worried about the effect of additional rate hikes on gold and the miners. As the saying goes, though, it's always darkest before the dawn, and with sentiment arguably the worst in years, I believe this has presented some opportunities in the gold miners.

With the Federal Reserve's mission being to stamp out multi-decade inflation readings, they've adopted one of their most hawkish stances in years, planning to raise rates four times this year.

Conventional wisdom would suggest that does not make owning gold very attractive with an alternative (higher interest rates) suddenly available.

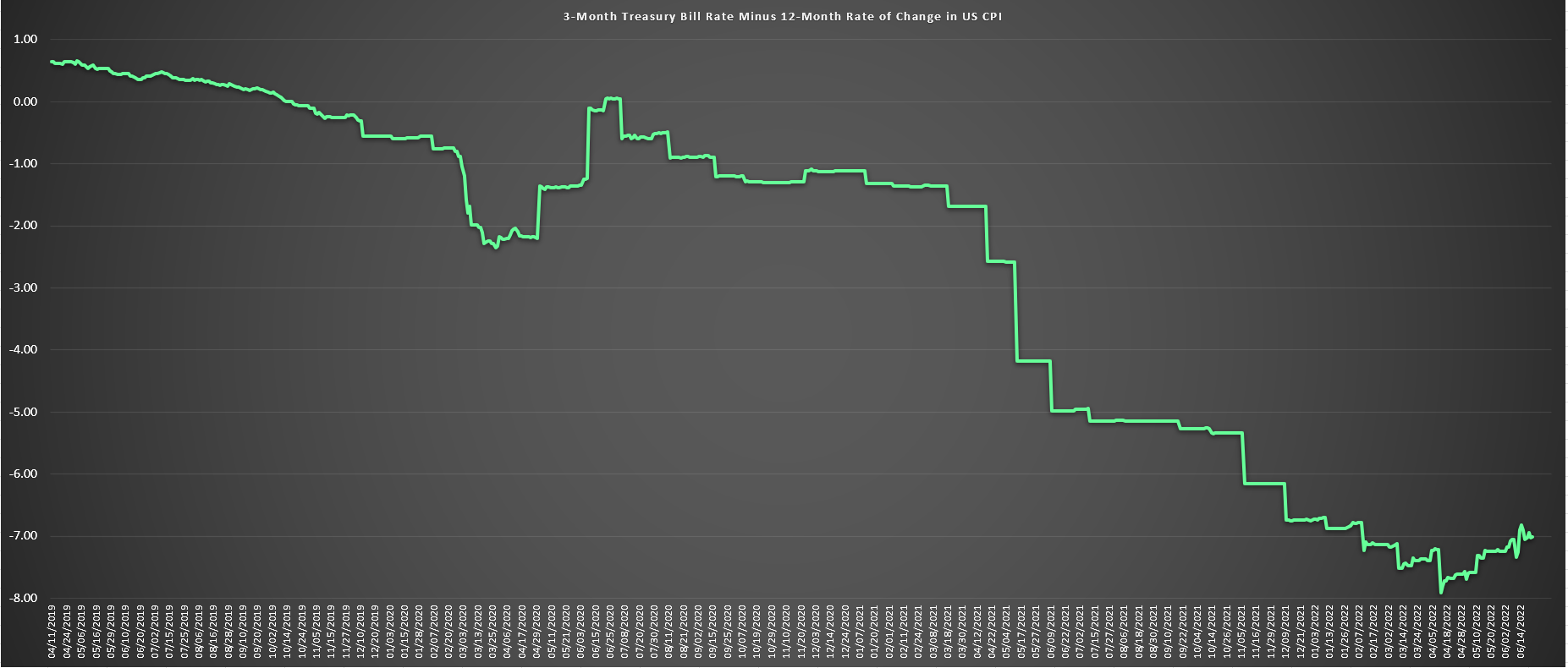

However, the more important metric to watch is real rates, defined as the three-month treasury bill minus the current inflation rate. When real rates are in negative territory, gold tends to perform its best, given that there is a cost to not owning gold.

Despite the recent rate hikes, this key indicator continues to sit deep in negative territory, hovering near (-) 7.00%. This means that even if investors are getting a better interest rate, it's being eaten away by inflation, it's which is likely to remain above 5.0%.

So, why gold miners? Gold producers mine and process gold for those unfamiliar, and they provide significant leverage to the gold price. Historically, owning them over the metal hasn't made much sense, given that they didn't pay dividends and had much higher beta to the gold price, and lacked growth.

However, for once in a decade, many of the best producers have low debt, are paying 3.5% plus dividend yields, and have growth. This makes them far more attractive than the gold price, getting leverage on the metal while being paid to wait.

Let's look at three names that stand out from a quality standpoint.

Agnico Eagle (AEM)

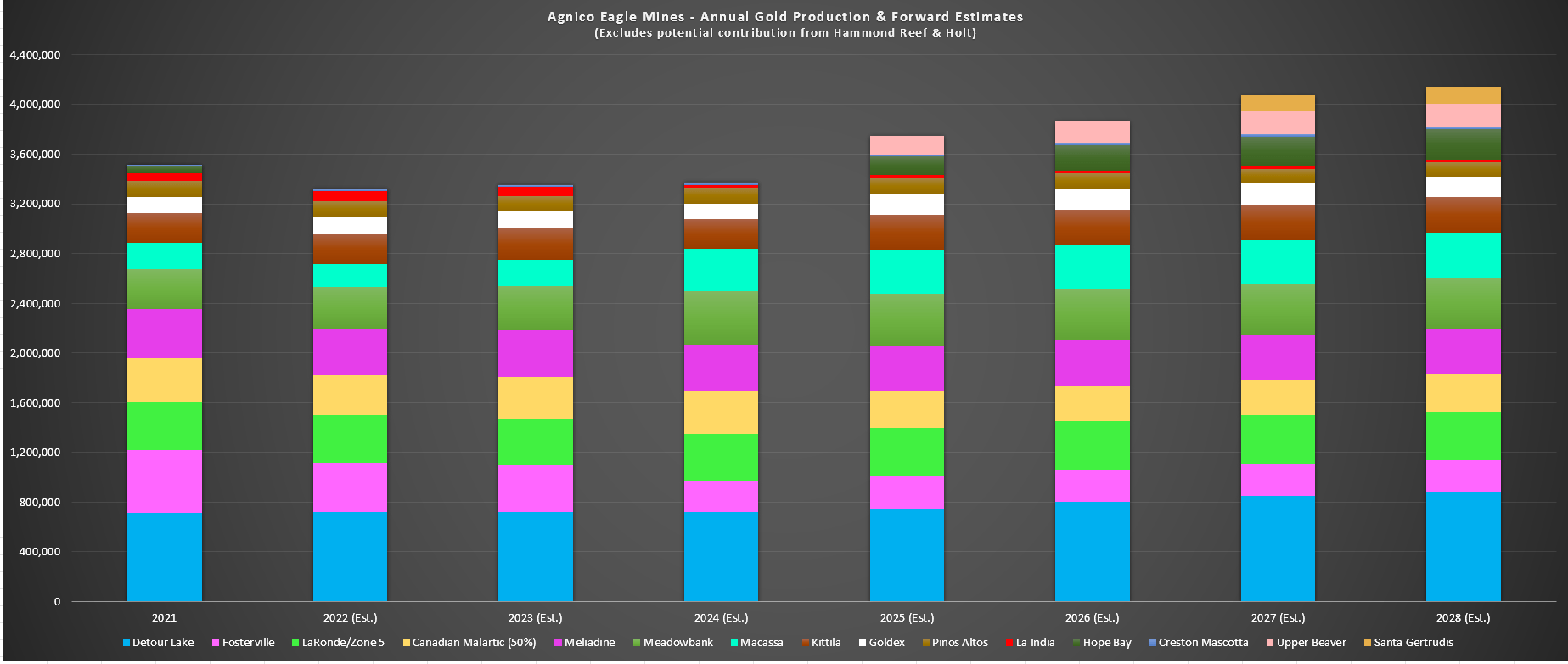

Agnico Eagle (AEM) is the third-largest gold producer globally, on track to produce 3.3 million ounces of gold in 2022 at all-in sustaining costs [AISC] below $1,030/oz. This makes it one of the highest-margin producers and the lowest-risk, given that it operates in the safest jurisdictions globally with 11+ mines.

Notably, AEM recently added two ultra-high-grade mines to its portfolio and the largest gold mine in Canada: Detour Lake. The company did this by merging with one of the best growth stories in the sector, Kirkland Lake Gold.

In most circumstances, I would avoid a large producer like Agnico Eagle, but the company has one key differentiator from its peers after its recent merger, which is growth.

To date, the company has not given any firm targets or long-term production guidance, but given the company's solid pipeline, which leverages existing infrastructure, I see a path to annual production of 4.3 million ounces of gold by 2029. This would represent 30% growth from current levels, 2500 basis points higher than its peer group of multi-million-ounce producers.

While most gold producers will rely on the gold price to increase earnings and free cash flow looking out over the next six years, AEM will not. Despite this growth, the company trades at its largest discount to net asset value in years, with

what I believe to be a fair value of $78.00 per share.

So, with the stock hovering below the $48.00 level, AEM is my favorite way to get gold exposure currently, especially with a 3.4% dividend yield.

Royal Gold (RGLD)

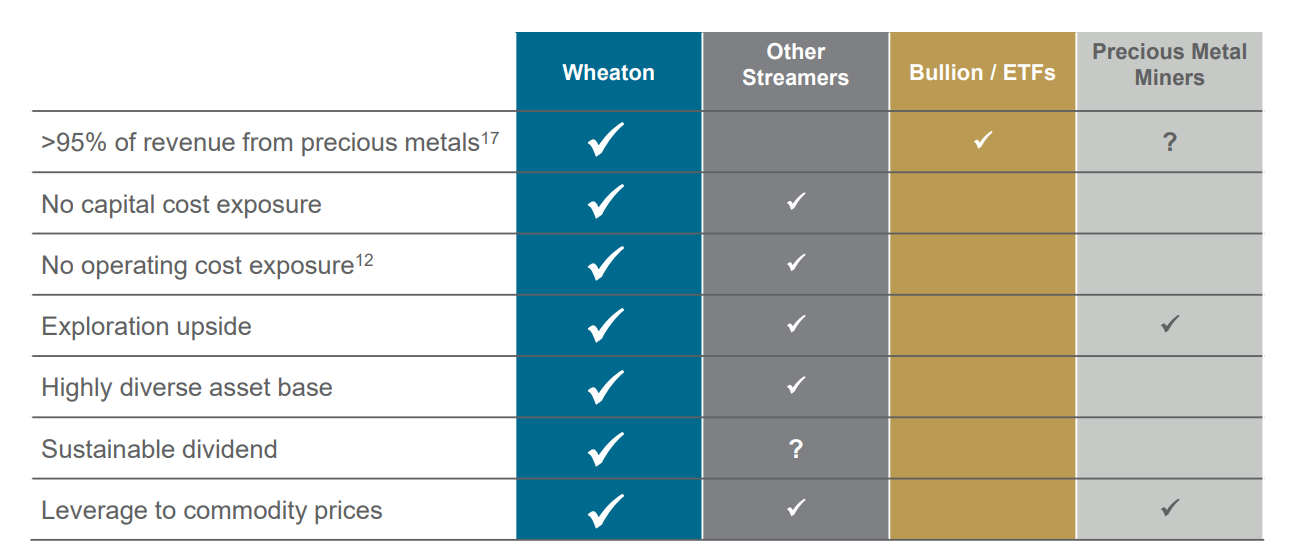

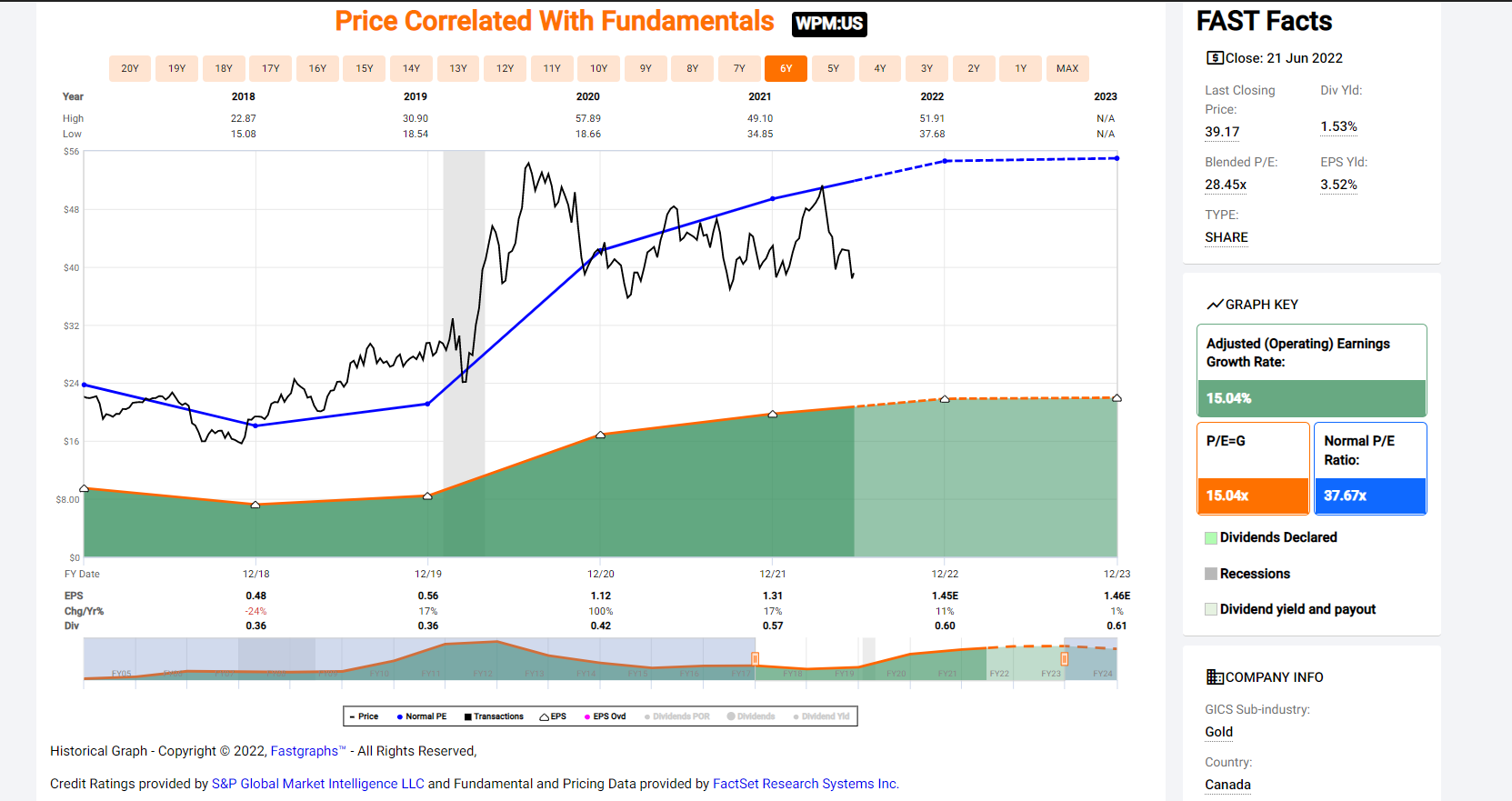

Another name that recently moved onto the sale rack is Royal Gold (RGLD), the third-largest precious metals gold/streaming and royalty company.

Unlike Agnico Eagle, Royal Gold makes an upfront payment to gold developers and producers, and in exchange, it receives a portion of the production over the project's life. This protects the company from inflationary pressures, which is essential at a time of rising costs like we're seeing currently.

Royal Gold reported attributable production volume of 88,500 gold-equivalent ounces [GEOs] in Q1 and is on track for up to 340,000 GEOs this year.

However, with a solid organic growth pipeline, there is a meaningful upside to this outlook over the next few years, with the potential for 410,000+ GEOs per annum, which is a change from the past few years when the company was in its investment phase and lacked growth.

Despite this attractive growth outlook and 80% plus margins, Royal Gold currently trades at just 25x FY2023 earnings estimates vs. its historical earnings multiple of 50x earnings (20-year average). Even using a more conservative multiple of 38x earnings, which is easily justifiable for a company with 80% margins and recurring revenue, I see a fair value of $162.20. So, with the stock currently sitting below $108.00, this looks like an attractive buying opportunity.

Karora Resources (KRRGF)

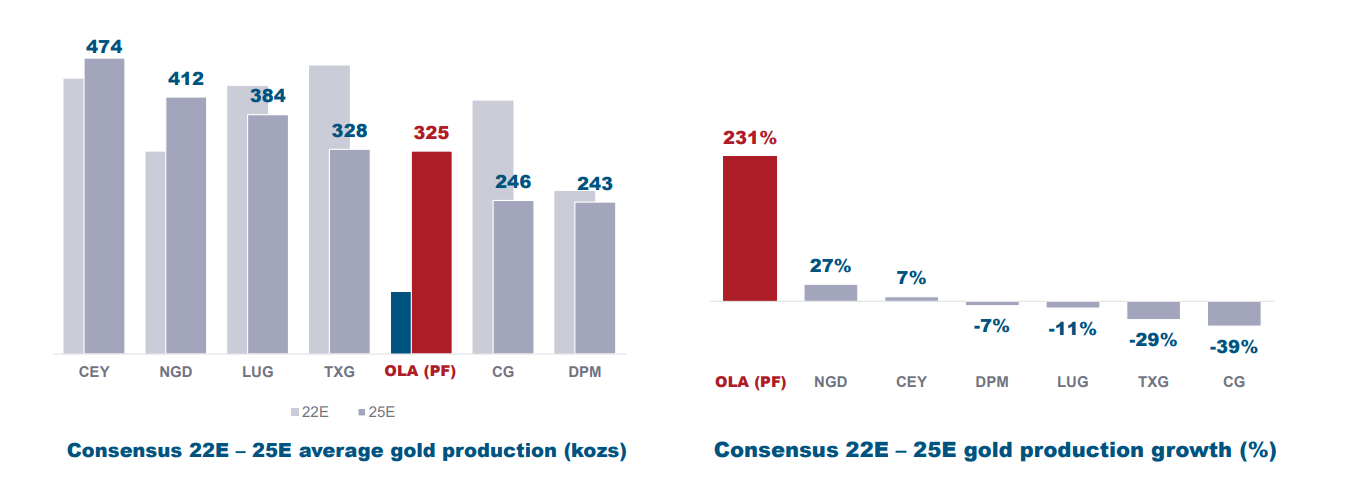

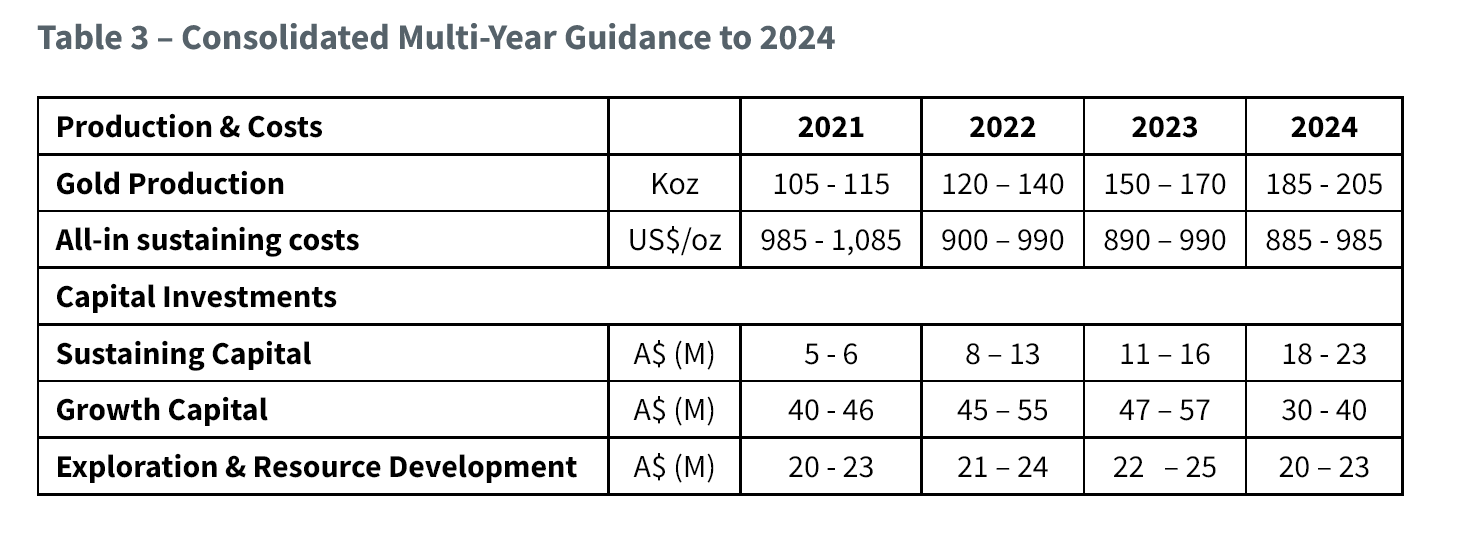

Karora Resources (KRRGF) is the riskiest name on the list, sporting a market cap of barely $400 million and being a sub-150,000-ounce gold producer in Australia. However, it also has the most upside by a wide margin and looks very attractive for a small bet.

The reason is that it boasts one of the most impressive organic growth profiles, on track to increase production from 120,000 ounces in 2022 to 220,000 ounces by 2026. The company expects to achieve this by adding a second decline at its Beta Hunt Mine and using additional processing capacity from a recent mill purchase north of the mine.

Like AEM, this will allow Karora to grow earnings and free cash flow meaningfully regardless of the gold price, with any gold price upside being a bonus. So, with the stock trading at less than 1.3x FY2025 revenue estimates, this pullback below US$2.60 looks like a gift.

Final Thoughts

The gold producers are a high-risk area of the market, but once every couple of years, there's a fat pitch, and they get sold down to levels where they trade at massive discounts to fair value.

After the most recent decline in the GDX, we have reached this period, and I see the potential for a 25% plus upside over the next 9 months in the sector while collecting a 3.0%+ dividend yield in names like AEM. Hence, I see AEM, RGLD, and KRRGF as attractive ways to diversify one's portfolio.

Disclosure: I am long AEM

Taylor Dart

INO.com Contributor

Disclaimer: This article is the opinion of the contributor themselves. Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information in this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.