Few sectors have been hit as hard as the Retail Sector (XRT) over the past nine months, with the ETF finding itself down 45% from its highs at its June lows.

This shellacking should not be a huge surprise, given that the group was coming up against impossible year-over-year comps in Q1/Q2 2022. This was related to the benefit of government stimulus on sales in the year-ago period, with margins also under pressure due to labor inflation and higher shipping costs.

The index is now finally lapping this unfavorable period, but it’s dealing with another issue: worries about a global recession.

While few sectors are hit harder than retail in a recessionary environment, all businesses are not created equal, and many can weather the storm much better than their peers.

This is especially true of the businesses that lean more towards staples than discretionary or those companies that benefit from a trade-down environment, with these being off-price retailers.

If the sector is destined for lower prices once a recession is confirmed (which looks like a high probability), it’s understandable that some investors aren’t in a hurry to invest. However, I believe two names stand out as cheap with high-quality businesses that should outperform the group.

Let’s take a closer look below:

BJ’s Wholesale (BJ)

BJ’s Wholesale (BJ) is a mid-cap membership-only warehouse company in the Retail Sector which operates over 230 clubs across the United States.

The company’s business model is similar to that of Costco (COST), but it has considerably more whitespace, present in only 17 states and not yet in Canada.

It differentiates itself from Costco and Sam’s Club in that it has smaller pack sizes, a more comprehensive selection of SKUs across fresh and deli, and boasts a smaller club format. To date, this business model is paying off and is loved by consumers, amassing 6.5MM members with $2,000 in annual spend per shopper and a ~90% renewal rate.

While BJ’s has a significant discretionary component in categories like Patio/Outdoor, Furniture, and TV & Electronics, it’s much safer than a business like Best Buy (BBY) in a period of weakness among consumers.

This is because it also has a large staples component (Grocery, Baby & Kids, Pet, Tire Service) that insulates it from a pullback in consumer spending much better than businesses that tilt more discretionary or rely almost solely on discretionary purchases.

That point is evidenced by the company’s strong results, with BJ’s posting revenue growth of 16% in Q1 2022. In my view, if one must own a retail name in an environment where recession risk is elevated, this is easily a top-5 name, and the stock’s current valuation reinforces this view.

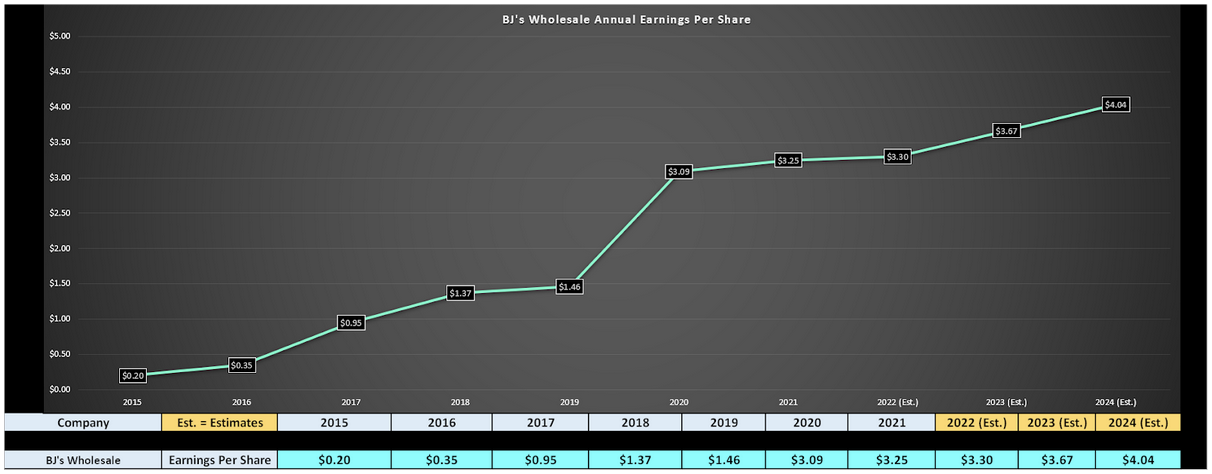

As shown above, BJ’s trades at roughly ~19x FY2023 earnings estimates, a massive discount to Costco, which has historically traded at 28x earnings and currently trades at 27x FY2023 earnings estimates.

While Costco deserves to trade at a premium for its long history, BJ’s has a more attractive long-term growth profile given its considerable whitespace and could easily command an earnings multiple of 23.

Based on FY2023 earnings estimates of $3.67, this places its fair value at $84.40 per share. From a current share price of $69.50, this doesn’t quite meet my criteria of a 25% discount to fair value. However, given BJ’s attractive business model, I believe investors should watch the stock closely for any dips below $64.00 per share to scoop up the stock.

Burlington Stores (BURL)

Burlington Stores (BURL) is a large-cap off-price retailer with over 870 stores across 46 states, with its sales predominantly in the Men’s apparel, Women’s apparel, and Home categories.

The company’s business model is unique in that it offers merchandise at significantly lower prices than other retailers, taking advantage of cancellations or supply chain disruptions to building up its inventory.

Notably, it offers the same items as traditional retailers at 60% off, making it a “treasure hunt” destination for shoppers looking to get quality apparel at massive savings.

Unfortunately, the company had a rough Q1 earnings report, revealing that sales were down 12% year-over-year to $1.93BB vs. $2.19BB in the year-ago period.

While these are not the results we’d expect from a high-quality business in a non-recessionary environment, it’s important to note that the headline figures looked much worse than the actual results. This is because Burlington was lapping very difficult comps from the year-ago period, coming up against 20% comparable store sales growth in Q1 2021.

The company had estimated the federal stimulus benefit at up to 15% of this growth, and it was also lapping the wardrobe refresh period post-COVID-19 lockdowns. Given these tough comparisons, the company had no hope of lapping its Q1 2021 results positively.

However, the company did shoulder some of the blame, coming into February and March with low inventory levels after anticipating some softness on a comparative basis, but getting stung by late receipts, which created gaps in its assortment, putting a severe dent in sales.

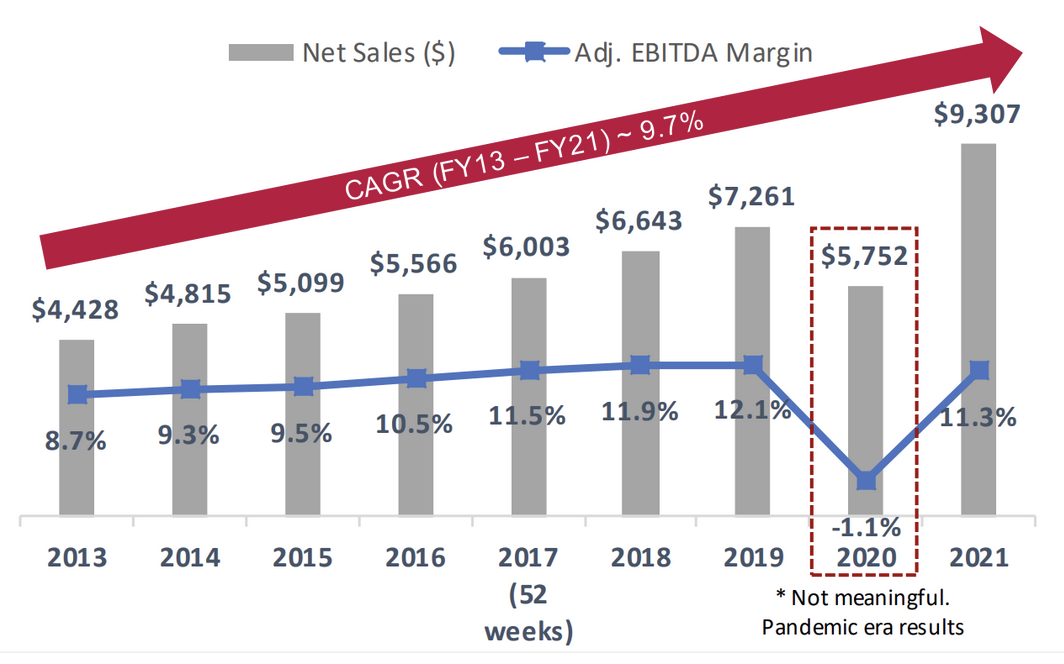

While this was a major misstep, this is a company that has grown revenue at a nearly 10% compound annual growth rate since 2013 while also growing its EBITDA margins. So, I would not get hung up on a single quarterly miss, even if it was partially self-inflicted.

Besides, the company’s new Burlington 2.0 storage (tighter inventories, smaller store footprints) has been hugely beneficial, but this is just one quarter where the company got a little too cute with inventories, and it backfired.

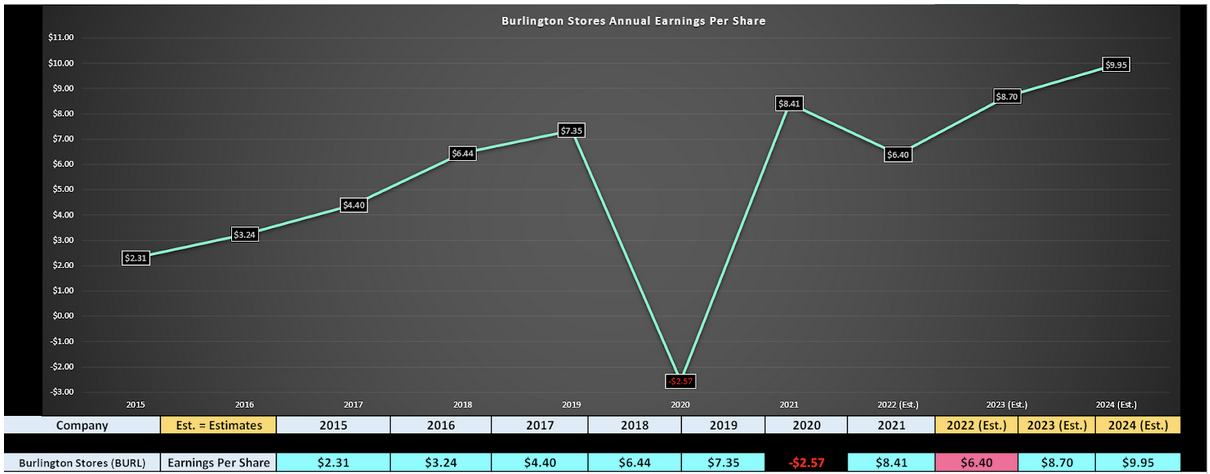

One thing that might be creating anxiety among investors is Burlington’s FY2022 annual EPS estimates, which show that annual EPS is expected to drop from $8.41 in FY2021 to $6.40 in FY2022.

However, it’s important to note that this is merely an aberration in the long-term trend, with FY2023 and FY2024 annual EPS estimates sitting at $8.70 and $9.95, respectively.

Based on what I believe to be a fair and conservative earnings multiple of 24 (historical multiple: 27), this places BURL’s fair value at $208.80, pointing to over 40% upside from current levels. So, with the stock offering a 33% discount to fair value at $40.00, I see this pullback as a decent area to start an initial position in the stock.

There are many areas of the Retail Sector that are best to avoid, and a few companies will be on life support if we do head into a recession, given that they have struggled to stay on trend or adapt to consumer habits.

However, Burlington and BJ’s are not in this category and are what I would consider two of the top ten names in the sector. So, if this market weakness continues, I would view pullbacks in either name as buying opportunities.

Disclosure: I have no positions in any stocks mentioned at the time of this article.

Taylor Dart

INO.com Contributor

Disclaimer: This article is the opinion of the contributor themselves. Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information in this writing.