Build-A-Bear Workshop, Inc. (BBW) operates as a multi-channel retailer of plush animals and related products.

The company operates through three segments: Direct-to-Consumer, Commercial, and International Franchising. It runs around 346 locations managed by corporate and 72 franchised stores in Asia, Australia, the Middle East, Africa, and South America.

On November 30, the company announced record fiscal third quarter results. Its total revenue increased 9.9% year-over-year to $104.48 million, beating the consensus estimate by 1.8% and registering the seventh consecutive quarter of revenue growth.

Sharon Price John, BBW President and Chief Executive Officer, attributed this solid performance to momentum and consistency in business with solid brand interest from consumers. She expressed her confidence that the company is on track to deliver the most profitable year in its 25-year history.

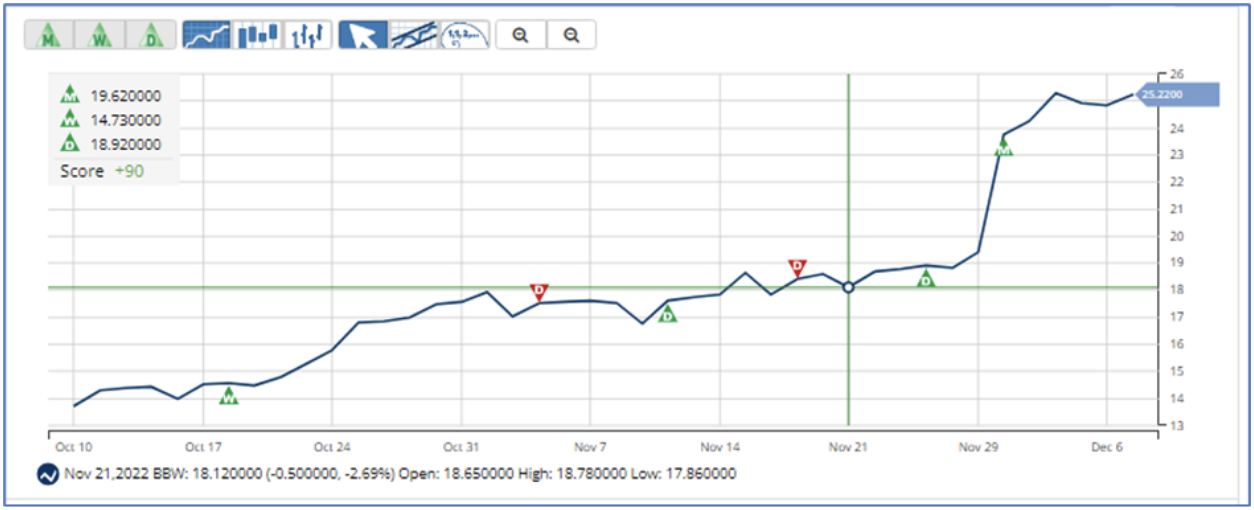

Mirroring the above sentiment, the stock has gained 45.3% over the past month to close the last trading session at $25.17 despite the broader market remaining volatile on concern over the Fed’s potential rate hikes to bring inflation down to its 2% target.

BBW is trading above its 50-day and 200-day moving averages of $17.33 and $17.28, respectively, indicating an uptrend.

Here is what may help the stock maintain its performance in the near term.

Solid Track Record

Over the past three years, BBW’s revenue has exhibited a 10.5% CAGR, while its EBITDA has grown at a stellar 99.4% CAGR. The company has increased its EPS at a 55% CAGR during the same period.

Robust Financials

Despite the negative currency impact of $2.5 million, BBW’s total revenues increased 9.9% year-over-year to $104.5 million during the fiscal third quarter, ended October 29, 2022.

This growth was mainly driven by sales from corporately-managed retail stores more than offsetting a decline in consolidated e-commerce demand (orders generated online to be fulfilled from either the company’s warehouse or its stores).

During the same period, BBW’s consolidated gross profit increased 9.5% year-over-year to $54.33 million, while its net income increased 25.9% year-over-year to $7.46 million. As a result, its quarterly EPS increased 41.7% from the previous-year quarter to $0.51.

Attractive Valuation

Despite solid financials and upward momentum in price, BBW is still trading at a discount compared to its peers, thereby indicating further upside potential. In terms of forward P/E, the stock is trading at 8.74x, 29.5% lower than the industry average of 12.40x.

In terms of the forward EV/EBITDA, BBW is currently trading at 6.24x, which is 32% lower than the industry average of 9.18x. Its forward Price/Sales of 0.79x also compares favorably to the industry average of 0.84x.

Favorable Analyst Estimates for Next Year

Analysts expect BBW’s revenue for the fiscal ending January 2023 to increase 11.9% year-over-year to $460.37 million. The company’s revenue is expected to increase 5.4% to $485.43 million during the next fiscal year.

Technical Indicators Look Promising

MarketClub’s Trade Triangles show that BBW has been trending UP for each of the three time horizons. The long-term trend has been UP since November 30, 2022, while the intermediate-term and short-term trends have been UP since October 18, 2022, and November 25, 2022, respectively.

The Trade Triangles are our proprietary indicators, comprised of weighted factors that include (but are not necessarily limited to) price change, percentage change, moving averages, and new highs/lows. The Trade Triangles point in the direction of short-term, intermediate, and long-term trends, looking for periods of alignment and, therefore, strong swings in price.

In terms of the Chart Analysis Score, another MarketClub proprietary tool, BBW scored +100 on a scale from -100 (strong downtrend) to +100 (strong uptrend), indicating that the uptrend will likely continue. Traders should protect gains and look for a change in score to suggest a slowdown in momentum.

The Chart Analysis Score measures trend strength and direction based on five different timing thresholds. This tool takes into account intraday price action, new daily, weekly, and monthly highs and lows, and moving averages.

Click here to see the latest Score and Signals for BBW.

What's Next for Build-A-Bear Workshop, Inc. (BBW)?

Remember, the markets move fast and things may quickly change for this stock. Our MarketClub members have access to entry and exit signals so they'll know when the trend starts to reverse.

Join MarketClub now to see the latest signals and scores, get alerts, and read member-exclusive analysis for over 350K stocks, futures, ETFs, forex pairs and mutual funds.

Best,

The MarketClub Team

su*****@in*.com