It’s been a choppy start to the year for the major market averages and while many large-caps have begun new uptrends, several small-cap names remain stuck in the mud, unable to gain much upside traction.

In some examples, this underperformance is justified with many businesses not being worth owning and or having weak balance sheets.

However, there are a few small-cap names with solid business models and decent balance sheets generating free cash flow, and contrarian investors are being presented with an opportunity to invest in these stocks at a very reasonable price, especially given that they have robust growth plans.

In this update, we’ll look at two stocks worthy of adding to one’s watchlist:

MarineMax (HZO)

MarineMax (HZO) is a small-cap name ($600 million market cap) in the Retail-Leisure Products industry group, and is the world’s largest lifestyle recreational retailer of boats and yachts plus yacht concierge and superyacht services.

The company was founded in 1998 in Clearwater, Florida, and has grown through strategic acquisitions to now control a footprint of 125 locations globally, including 57 owned and operated marinas and 78 dealerships.

Some of the company’s recent acquisitions include BoatYard.com and Boatzon, Fraser Superyacht Services, MidCoast Marine Group LLC, and IGY Marinas.

Understandably, many investors might not be that interested in owning a business that derives its revenue from recreational boat and yacht sales during a period where consumers are pulling on their spending and in what appears to be a recessionary environment with increasing layoffs.

However, it’s important to note that MarineMax has improved its mix over the past several years so that just ~73% of FY2022 revenue came from new boat sales, with the other 27% including parts/accessories, finance/insurance, brokerage, service/repairs/storage, and used boat sales.

It’s also worth noting that although 73% of revenue from new boats is still quite significant especially if we saw sales pulled forward in the pandemic, MarineMax does skew towards more affluent consumers vs. lower-end consumers that have been hit the hardest.

In the company’s most recent Conference Call, the company noted that it has “a pretty resilient wealthy client it’s lending to”, suggesting that while the macro environment is impacting buyers, MarineMax is more insulated than it might appear on the surface.

So, why even bother with a volatile small-cap name that relies primarily on new boat sales in a tough macro environment?

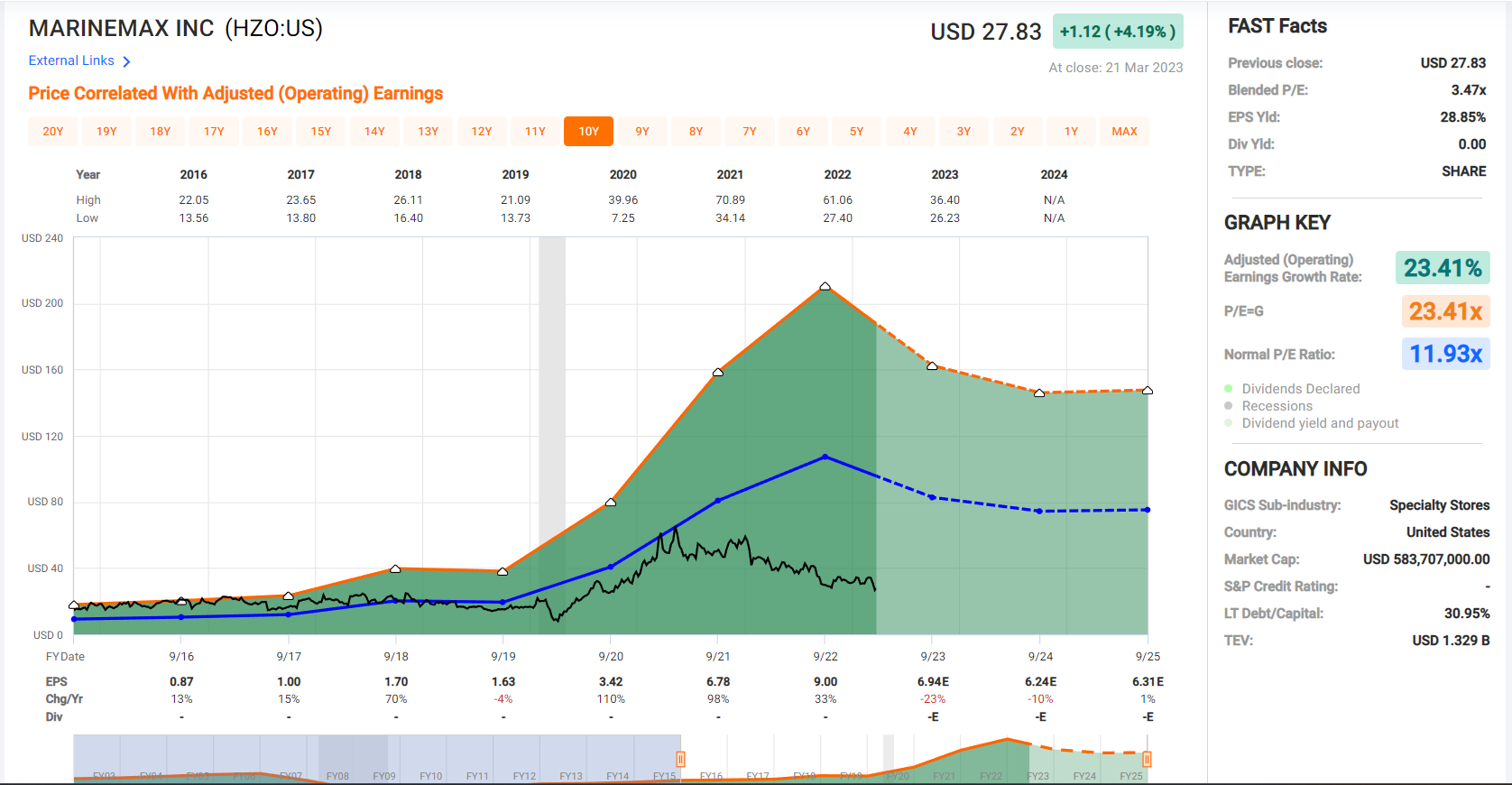

Although MarineMax could see continued downward pressure on earnings and annual EPS is expected to decline from a peak of $9.06 (FY2022) to $6.94 in FY2022 and $6.24 in FY2023, the stock is trading at just ~4.5x FY2024 earnings estimates which are expected to mark trough earnings at a share price of $28.00.

Not only is this one of the lowest earnings multiples for any publicly traded non-commodity stock based in North America, but the current PE ratio is over 60% below its historical multiple of 11.9x earnings.

Even if we use a 40% discount to this multiple to adjust for the more difficult macro environment (7.1x earnings vs. 11.9x earnings), I see a fair value for the stock of $44.30 per share, pointing to 59% upside from current levels.

Obviously, investing in sub $1.0 billion market cap names is not for the faint of heart and there is a higher risk to owning a name that some funds may not touch due to its relatively low daily average volume.

For this reason, I believe in sizing the position conservatively at less than 3.0% of one’s portfolio.

That said, while HZO may be volatile and may be higher risk than the average mid-cap or large-cap name, I see the risks as quite low given that it’s down ~50% from its highs and trading at its lowest valuation in years despite just coming off a record FY2022 with 300 basis points of gross margin expansion and 15% revenue growth.

The Joint Corporation (JYNT)

The Joint Corporation (JYNT) is a micro-cap stock ($250 million market cap) in the Medical-Services industry group that has been one of the best-performing stocks since its IPO debut before its recent 80% correction.

This was evidenced by an ~800% rally from its high in 2015 ($12.99) to its recent all-time high made last year of $111.06, driven by strong unit growth across its system and steady growth in revenue per share.

For those unfamiliar with what the stock does, it is a chiropractic franchisor and operator in the United States with a private pay, non-insurance cash-based model.

The company has grown from eight clinics in 2010 to over 830 clinics as of year-end 2022, with an ~85% franchised model.

The company collects a 7.0% royalty on sales from franchised clinics and a national marketing fee of 2.0% of gross sales. It also receives a fee of ~$40,000 for each franchise sold directly for single-franchise purchasers, making this a very attractive business model.

Since FY2015, Joint Corporation has grown its annual revenue from $13.8 million to $101.9 million, making it one of the highest growth stocks in its industry and across the entire market.

In the same period, it’s enjoyed a 1100 basis point improvement in gross margins (90.4% vs. 79.6%). Finally, it has increased its annual EBITDA to over $10 million despite a relatively modest footprint to date and revenue base.

Unfortunately, while this growth has been impressive and the stock massively outperformed during the bull market off the March 2020 lows, this performance has reversed and the stock has found itself over 80% off its highs.

The culprit for this underperformance is that the stock was priced for perfection heading into the peak for the major market averages in Q4 2021 at 20x sales, an insane multiple even for a high-margin business like Joint Corporation.

However, since then, the stock has reverted to a much more reasonable valuation of ~2.0x FY2023 sales estimates ($130 million) and less than 1.8x FY2024 estimates.

This is a significant discount to its historical revenue multiple of 4.1, even if this is a less attractive environment for owning risky stocks when one can scoop up a risk free ~4% return in treasury bills.

So, why own the stock here?

While Joint Corporation is quite volatile, management is confident that it’s in the earlier innings of its growth story with the potential to grow to well over 2,000 clinics domestically.

This would push annual revenue to well over $300 million, making Joint Corporation one of the cheapest publicly traded franchisors if it stays at these depressed levels. Plus, the stock is finally becoming oversold, setting up a buying opportunity from a technical standpoint.

Based on what I believe to be a conservative multiple of 3.0x forward sales and FY2023 estimates of $8.50, I see a fair value for JYNT of $25.50, pointing to 52% upside from current levels.

So, if the stock were to head back towards its recent lows near $14.50, I would view this as a buying opportunity.

While several names in the large-cap space are on the sale rack currently, with Enbridge (ENB) being one attractive name that’s offering one of the best yields in the market and trading in the lower end of its 2-year range, I am always happy to add some small-cap exposure to my portfolio to add additional torque.

The key, however, is that these businesses are trading at a deep discount to fair value and offering a margin of safety to adjust for their higher volatility and increased risk given that they’re much smaller companies.

Today, two names that stand out are JYNT and HZO, and the recent pullback has set up low-risk buying opportunities in both names.

So, if I were looking for a way to diversify my portfolio with two names offering growth at a reasonable price, I see JYNT and HZO as solid buy-the-dip candidates below $28.00 and $14.50, respectively.

Disclosure: I am long HZO, ENB

Taylor Dart

INO.com Contributor

Disclaimer: This article is the opinion of the contributor themselves. Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information in this writing.