Editor’s Note: Our experts here at INO.com cover a lot of investing topics and great stocks every week. To help you make sense of it all, every Wednesday we’re going to pick one of those stocks and use Magnifi Personal to compare it with its peers or competitors. Here we go…

Bank stocks have dropped and markets are still spooked after last week’s collapse of Silicon Valley Bank, and it’s unclear how far the fallout will reach.

But amid all the talk of how many other banks are in trouble, the effects on a related industry has gotten very little attention.

We're talking about the mortgage-backed bond markets. See, according to an article from the Financial Times' Alphaville team, Silicon Valley Bank is still sitting on a $50 billion book of MBS (mortgage-backed securities). It is likely government regulators that have taken over Silicon Valley Bank will need to dump those bonds to help cover the cost of giving depositors all of their money back.

That possibility caused mayhem in the U.S. mortgage market on March 10, as investors rushed to get ahead of getting squashed by the bank’s potential MBS dump. Therefore, mortgage spreads sharply widened on that day as Silicon Valley Bank circled the drain.

So today, we're going to use the Magnifi Personal investing AI to compare the most important MBS-trading companies and see if there are any opportunities here - or if the risk is too high.

Doing this was simple. we asked Magnifi Personal to “Compare AGNC, STWD, and BXMT” and it did all the work.

To have the investing AI run similar comparisons for you, or to dive deeper into this one and compare other banks or REITs, we’re offering 90 days of free access to Magnifi Personal - just click here!

This ability to have an investing AI pore over reams of data for you in seconds and spit out an easy-to-understand comparison of two or more stocks is an invaluable tool in deciding where to invest next.

I highly recommend you try it out. Click here to see how you can do it today, free-of-charge.

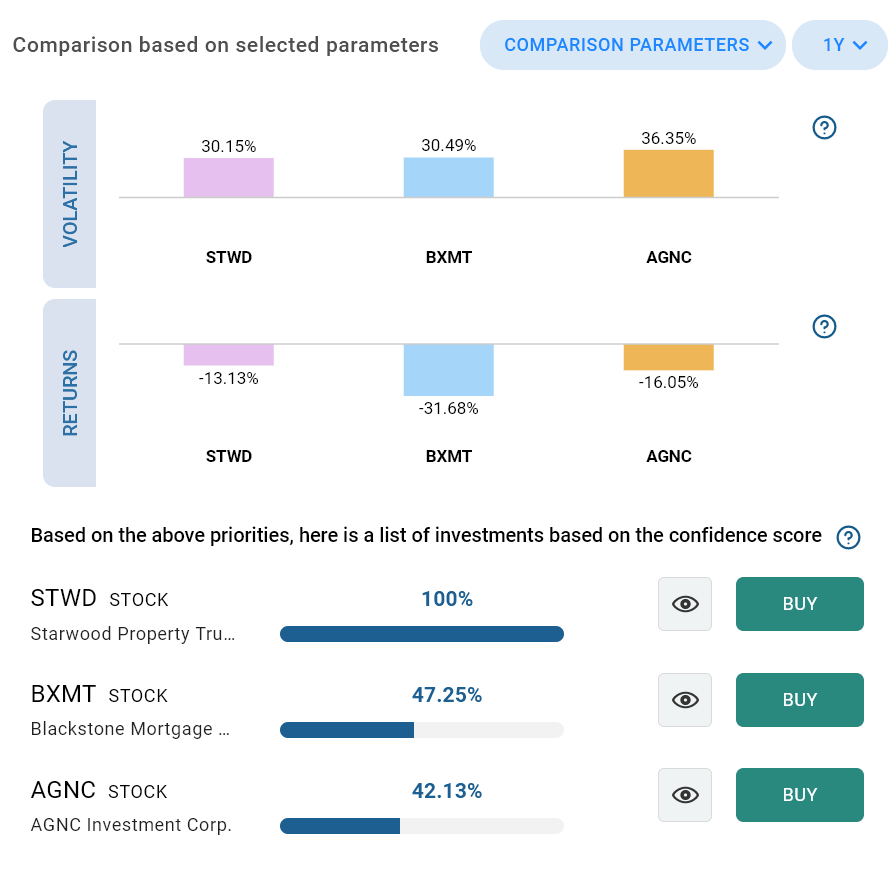

Here’s what Magnifi Personal showed me after we asked it to in “Compare AGNC, STWD, and BXMT”:

This is an example of a response using Magnifi Personal. This image is not a recommendation or individual advice. Please see bottom disclaimer for additional information, including INO’s relationship with Magnifi.

As you can see, Starwood Property Trust Inc. (STWD) comes out on top, with lower volatility and better returns. And that’s despite the recent chaos in mortgage-backed securities caused by Silicon Valley Bank's collapse.

Now, we picked these three particular stocks for a reason. All three are so-called mortgage REITs, or MREITs. While mortgage spreads widening last Friday wasn’t a concern for most investors, MREITs were already “feeling the heat” when Silicon Valley Bank blew up, and could be “incinerated” if we have more days like March 10.

That’s because MREITs differ from traditional real estate investment trusts in that they buy individual mortgages and MBS instead of actual property. They do hedge out their duration risk, something Silicon Valley Bank didn’t do well.

However, that leaves the MREITs purely exposed to mortgage spreads. And keep in mind that MREITs are very big players in mortgages, since they use a lot of leverage to invest in what is normally very boring, low-return bonds.

That’s a potentially big problem.

With a lot of leverage, it might not take many more days like March 10 before some MREITs start facing issues. If that were to happen, they too might have to sell off their MBS portfolios, like Silicon Valley Bank may have to.

That in turn would put even more pressure on the rest of the MREIT sector, potentially forcing them to liquidate as well, and so on. I suspect this was a major reason why the U.S. government acted so quickly and forcefully.

The three stocks we picked were mentioned in the Financial Times article I mentioned earlier as among the largest MREITs around: AGNC Investment (AGNC) with $51.7 billion in assets; Starwood Property Trust (STWD) with $28.3 billion in assets; and Blackstone Mortgage Trust (BXMT) with $26.8 billion in assets.

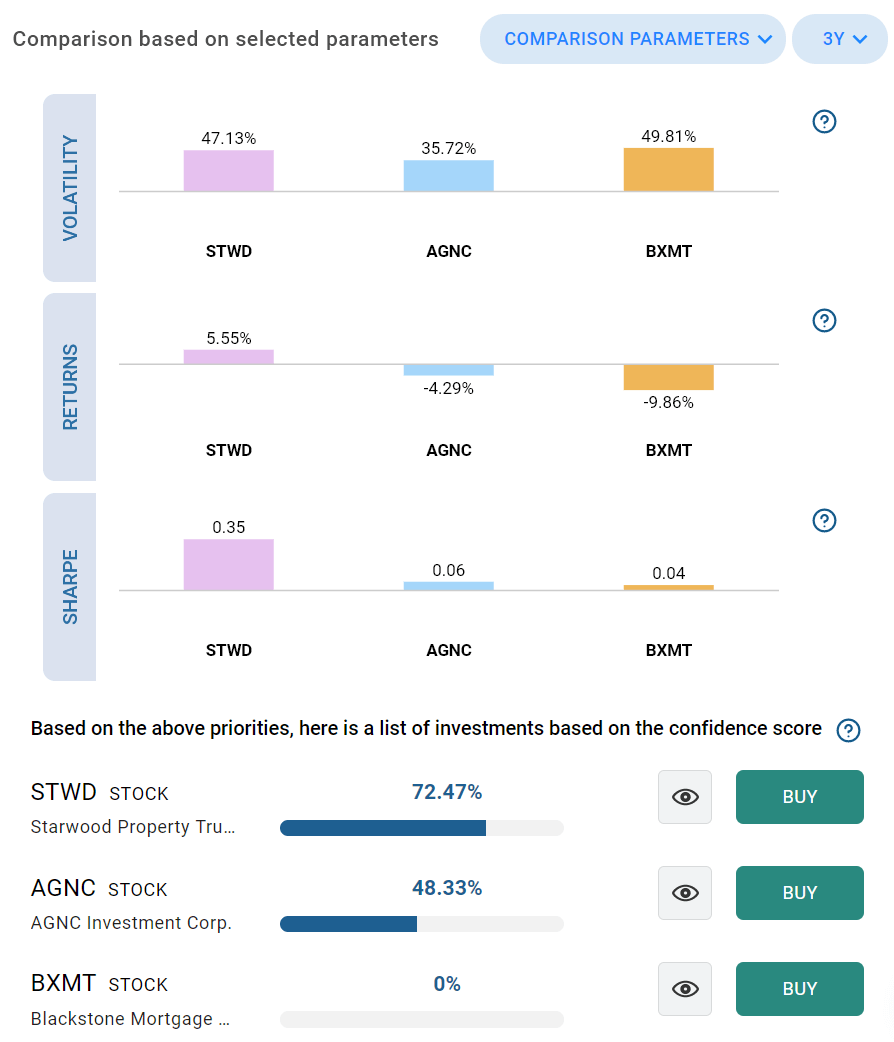

With the power of the Magnifi Personal AI at our fingertips, we can get a lot more granular than just looking at one-year returns and volatility. For example, you can ask Magnifi Personal to extend the time frame to three years and add their Sharpe ratios, a measure of whether any extra return is outweighed by extra risk, to the comparison.

This lets you see how they fared over the whole pandemic period, which caused massive turbulence, and whether any extra returns are worth any extra risk.

This is an example of a response using Magnifi Personal. This image is not a recommendation or individual advice. Please see bottom disclaimer for additional information, including INO’s relationship with Magnifi.

Starwood again comes out on top. It might even be a good investment to consider, for those brave enough to wade in before the Silicon Valley Bank fallout clears out.

This research is just a starting point, of course. Magnifi Personal can easily compare these or any other stocks on many more criteria, such as dividend yield, margins, and much more. You can also ask it for competitors to these stocks, a list of similar stocks, and so on. Explore all the options, or have the Magnifi Personal investing AI start a new research journey for you today - simply click here get free access for 90 days!

In volatile times like these, this kind of in-depth and quick investing research is invaluable.

Latest from Magnifi Learn: Financial markets can seem intimidating at first glance. Between the jargon and the potential to lose some of your hard earned money, it’s easy to get overwhelmed. With a little knowledge you can gain the confidence to get started investing.

INO.com, a division of TIFIN Group LLC, is affiliated with Magnifi via common ownership. INO.com will receive cash compensation for referrals of clients who open accounts with Magnifi.

Magnifi LLC does not charge advisory fees or transaction fees for non-managed accounts. Clients who elect to have Magnifi LLC manage all or a portion of their account will be charged an advisory fee. Magnifi LLC receives compensation from product sponsors related to recommendations. Other fees and charges may apply.

Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk.

Mutual Funds and Exchange Traded Funds (ETFs) are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.