In February 2023, the US economy produced 311,000 jobs, surpassing market expectations of 205,000, and revised down from 504,000 in January. This indicates a labor market that remains tight, with an average of 343,000 jobs added per month over the previous six months.

This is another upbeat NFP report following last month's even stronger data. The Fed now has more ammunition to potentially raise rates by 0.5% at their next meeting.

Let's take a look at how the market reacted to this report.

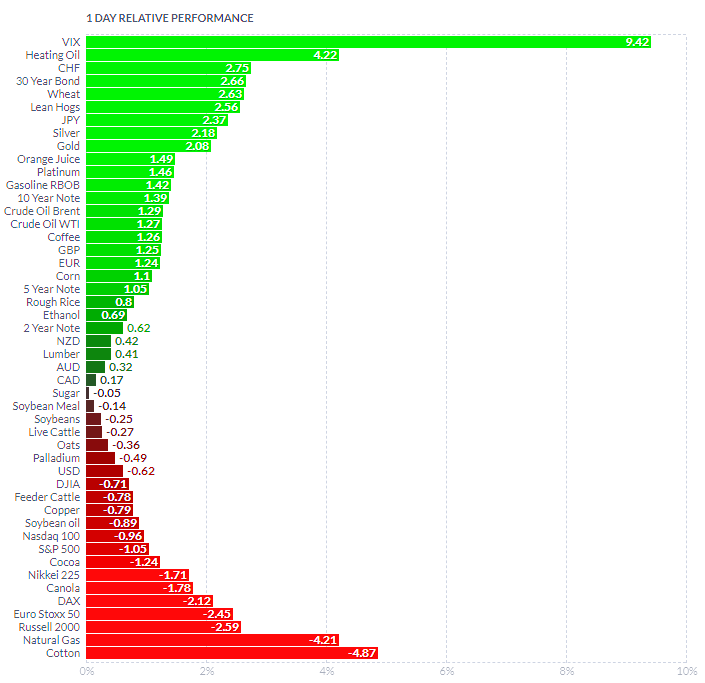

The top three winners last Friday, when the jobs report was published, were VIX, which gained +9.42% in just one day, heating oil futures, which rose by +4.22%, and the Swiss franc, which increased by +2.75%.

On the other side of diagram, the top three losers were cotton futures, which fell by -4.87%, natural gas, which dropped by -4.21%, and Russell 2000 index futures, which declined by -2.59%.

The VIX, often called the "fear index," is a real-time index measuring the expected volatility of the S&P 500 over 30 days. It rises when investors are anxious and falls when they are confident. Strong growth indicates increased uncertainty, caused by various factors like economic or political instability, interest rates, or investor sentiment. A high VIX can suggest a market correction or downturn.

Another situation where a 3-letter acronym is involved is the case of SVB or Silicon Valley Bank, which is one of the largest banks in the US and holds the top position in Silicon Valley in terms of local deposits.

US regulators closed down Silicon Valley Bank last Friday due to a rush of customer withdrawals totaling $42 billion - a quarter of its total deposits - in a single day. The bank's failed attempt to raise new capital raised concerns about its future as a technology-focused lender. With $209 billion in assets, the bank's closure makes it the second-largest bank failure in US history after Washington Mutual's collapse in 2008.

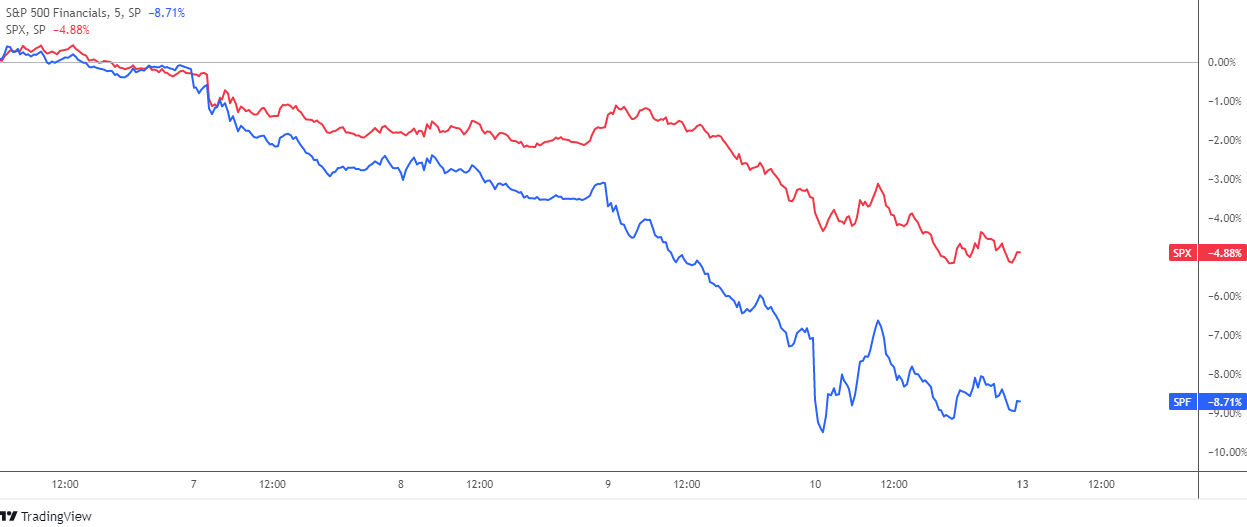

Last week, banking stocks (blue line) suffered a significant decline, losing nearly 9%, and subsequently pulling down the broader index (red line) by almost 5%. This substantial drop in the banking sector played a significant role in driving up the VIX.

Here goes the “50 Cent” story. One month ago, Barchart tweeted that "50 Cent" is back. No, not the rapper. The trader who became famous years ago is likely back with a huge volatility bet.

It is possible that a trader known as "50 Cent" is positioning themselves to profit from market volatility. This is typically done by purchasing Cboe Volatility Index options, which typically cost around 50 cents.

Barchart assumed that on Tuesday February 14, 2023 someone bought 100,000 $VIX May expiry 50 strike calls for $0.50. And two days later, another 50k contracts were bought for $0.51.

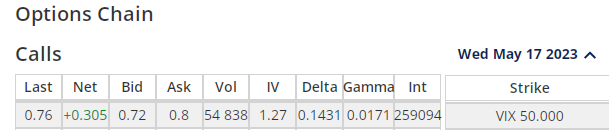

Let us look in the table below to see the current price of those call options as of last Friday's close.

The current market price stands at $0.76, reflecting a substantial increase of 52% compared to the purchase price of 50 cents in February.

Intelligent trades!

Aibek Burabayev

INO.com Contributor

Disclosure: This contributor has no positions in any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.