After a few years run where ARK Invests had at least one, if not three, of the top ten non-leveraged ETFs, 2021 appears to be the year ARK may be dethroned as the top ETF provider.

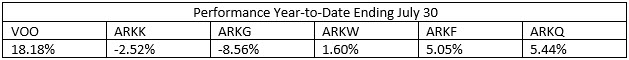

As it sits at the end of July, ARK’s top funds, the ARK Innovation ETF (ARKK), the ARK Genomic Revolution ETF (ARKG), the ARK Next Generation Internet ETF (ARKW), the ARK Fintech Innovation ETF (ARKF), and the ARK Autonomous Technology & Robotics ETF (ARKQ) are all substantially trailing the S&P 500 or the Vanguard S&P 500 ETF (VOO).

For years Cathie Woods and her team put up astonishing numbers and gave investors market-crushing returns. Some of this success was due to her big, bold calls on Tesla and other future technologies. First, however, these bold predictions, and then, of course, attracted a lot of attention when they came true.

They say success begets failure on Wall Street because once everyone figures out what you are doing, they emulate you, leading you to perform the same as the rest of the crowd. Which, to those on Wall Street, is the same thing as failing.

To that point, because of Cathie Woods's policy of transparency, ARK publicly posted their trades daily. Allowing both big and small investors to track, one day behind, exactly what she was doing. Now is this the reason her funds aren’t doing well? Most likely not, but it could be part of it.

Even Jim Cramer and his colleagues on CNBC’s morning pre-market show have walked through ARK’s trades from the prior day and criticized what she was selling and buying. I am sure they were not the only people who work in the finance industry that was doing this. (And I wouldn’t put it past Wall Street to figure out a strategy they could make money by trading against ARK.)

But, in reality, the most likely reason ARK and Cathie Woods aren’t performing well this year is that most of their fund’s holdings are focused in technology, an industry that has done well, but not as well as other industries as the ‘re-opening trade took hold. For example, the airline and travel industries, restaurants, casinos, and other businesses that were shuttered during the early months of the pandemic have come back to life in 2021, helping drive the S&P 500 higher.

The re-open trade has driven the market higher, and those trades just aren’t what ARK has focused on in the past nor seem interested in focusing on today.

Both long- and short-term ARK investors shouldn’t give up on their funds just because of a few poor months. Cathie Woods and her team have proven themselves over years of success that they are good stock pickers in the industries they focus on. Even the great Warren Buffett has had years where the market has beaten him, but over the course of a decade or, in Buffett’s case, decades, the market thrashing years far outweigh the years when the S&P 500 gets the best of them. And it's in those market-crushing years that the compounding effects of investing really show why these investors are worth sticking with through the ups and downs.

Matt Thalman

INO.com Contributor - ETFs

Follow me on Twitter @mthalman5513

Disclosure: This contributor did not own shares of any investment mentioned above at the time this blog post was published. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.