“The following is an excerpt from Tim Snyder’s “Weekly Quick Facts” newsletter. Tim is an accomplished economist with a deep understanding of applied economics in energy. We encourage you to visit Matador Economics and learn more about Tim. While there, you can sign up for his completely free Daily Energy Briefs and Weekly Quick Facts newsletters.”

As we continue the gasoline discussion from last week, economists are fielding questions, from most of the conservative media, regarding just what needs to happen to change the trajectory of retail fuel prices in the U.S.

Last week, alone, I did 12 radio interviews and gave a lunch address to the Petroleum Engineers Club of Dallas. The subject for each one of those interviews was the same, "How high can prices go" and "How much longer with these record fuel prices hang on"?

To address these two questions, we must look at the remaining conditions, after the pandemic and the Biden administration. They are tight inventories for gasoline and diesel, drive season, and increased demand. I'm not even going to drift off into the fact that the Hurricane Season starts in 15 days.

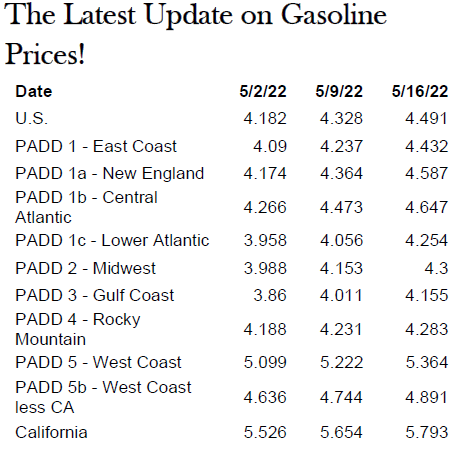

We started the year at 232.8 million barrels, and As of 5-6-2022, gasoline inventories sat at 225 million barrels. As for the distillate inventories, they began the year at 126.8 million barrels and as of 5-6-2022 stood at 104 million barrels.

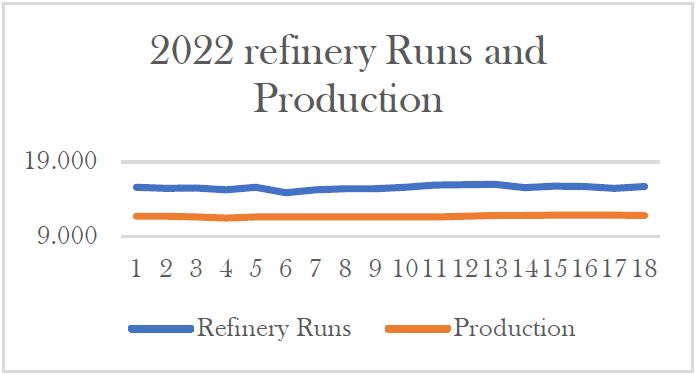

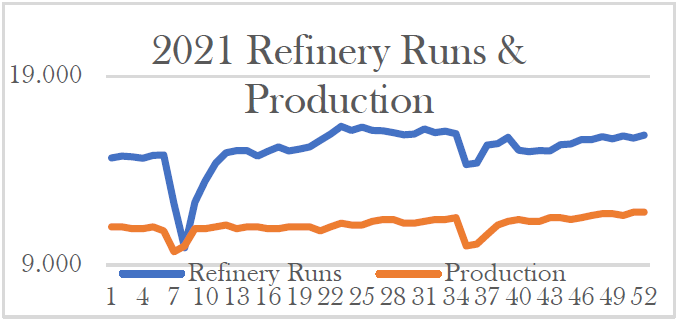

As for refinery demand, 2021 showed better than a million barrel increase from the beginning of the year until the end. On the other hand, 2022 refinery demand started at 15.573 million barrels per day but has fallen to 15.466 as of the end of April. Are we beginning to see a pattern?

Production is pretty much trending like refinery demand. Add in an embargo on Russian crude oil, and this scenario goes out of focus in a hurry. Then we just added the "Summer Blends" into the gasoline supply. Here we go again!

On Thursday, May 12, 2022, President Biden canceled offshore leases in Alaska and the Gulf of Mexico in light of record gasoline and diesel prices. So what happened to the pledge that was made to bring prices down; oh yeah, it's politics. So the answer is, it won't change until the politics change!

I keep watching to see when the price of gasoline and the distillates (diesel fuel, heating oil, kerosene, and jet fuel) attempt to make a break for the downside. But hey, keep running like the old "Energizer Bunny" with never change batteries.

We'll need to watch the refining operations as we head into the peak of the driving season. Statistics show that the highest demand period for gasoline is from Memorial Day to the Fourth of July. So we're in it, folks.

With refineries holding pretty close to flat, production is flat, to slowing ever so slightly. The chart below shows just 2022 Refinery Runs by week, and it shows demand for crude oil to make gasoline may be outpacing U.S. Production.

Looking back at the 2021 graph, production kept up with refinery demand.

Timothy S. Snyder, Economist

Matador Economics