“The following is an excerpt from Tim Snyder’s “Weekly Quick Facts” newsletter. Tim is an accomplished economist with a deep understanding of applied economics in energy. We encourage you to visit Matador Economics and learn more about Tim. While there, you can sign up for his completely free Daily Energy Briefs and Weekly Quick Facts newsletters.”

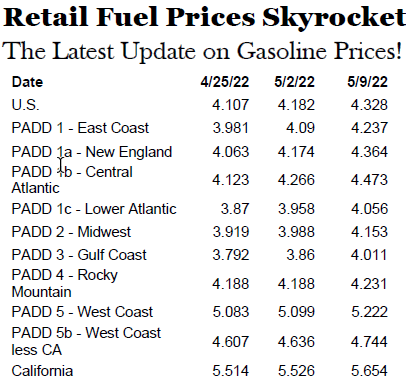

As we continue the gasoline discussion from last week, economists are fielding questions, from most of the conservative media, regarding just what needs to happen to change the trajectory of retail fuel prices in the U.S.

Last week, alone, I did 12 radio interviews and gave a lunch address to the Petroleum Engineers Club of Dallas. The subject for each one of those interviews was the same, "How high can prices go" and "How much longer with these record fuel prices hang on"?

To address these two questions, we must look at the remaining conditions, after the pandemic and the Biden administration. They are tight inventories for gasoline and diesel, drive season, and increased demand. I'm not even going to drift off into the fact that the Hurricane Season starts in 15 days.

We started the year at 232.8 million barrels, and As of 5-6-2022, gasoline inventories sat at 225 million barrels. As for the distillate inventories, they began the year at 126.8 million barrels and as of 5-6-2022 stood at 104 million barrels. Continue reading "Records Everywhere And Not A Drop To Spare"